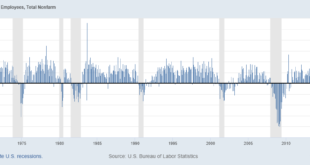

The Federal Reserve has been on a mission lately to make sure everyone knows they are serious about killing the inflation they created. Over the last two weeks, Federal Reserve officials delivered 37 speeches, all of the speakers competing to see who could be the most hawkish. Interest rates are going up they said, no matter how much it hurts, no matter how many people have to be put on the unemployment line, because that’s the only way to kill this inflation, to...

Read More »Weekly Market Pulse: Peak Pessimism?

Goodbye and good riddance to the third quarter of 2022. That was one of the wildest 3 months I’ve experienced in my 40 years of trading and investing. The quarter started off great with the S&P 500 rising 14% from July 1 to August 16 but ended with a 17% swan dive into the end of the quarter. And we closed on the low of the year. The 10-year Treasury yield rose from 2.97% to 4% just a few days before the end of the quarter. The 3-7 year Treasury index – our...

Read More »Weekly Market Pulse: The Dog That Didn’t Bark

Gregory (Scotland Yard detective): “Is there any other point to which you would wish to draw my attention?” Sherlock Holmes: “To the curious incident of the dog in the night-time.” Gregory: “The dog did nothing in the night-time.” Sherlock Holmes: “That was the curious incident.” From Silver Blaze by Arthur Conan Doyle, 1892 It is hard to determine sometimes what causes markets to move as they do. Take last Friday’s stock market selloff. The widely cited “reason”...

Read More »Weekly Market Pulse: Same As It Ever Was

History never repeats itself. Man always does. Voltaire Mark Twain is credited with a similar saying, that history doesn’t repeat but it rhymes. Of course, there is scant evidence that Clemens said anything of the sort just as Voltaire may or may not have penned the quote above. But both men were much wittier than I – than most – so I’ll take them both as being representative if not genuine. I have been a professional investor for now over 30 years and I have seen...

Read More »Will Silver Prices Go Up to $300?

This week’s guest is so bullish on silver that he’s even written a best-selling book ‘The Great Silver Bull’ where he takes an in-depth look at why silver will outperform gold once again and even go as high as $300 an ounce. Author and investments editor Peter Krauth joins Dave Russell on GoldCore TV to discuss the silver price, silver’s future and how industrial demand will continue to grow, outstripping supply. Silver’s a big theme for us at the moment, look out...

Read More »Weekly Market Pulse: Opposite George

It all became very clear to me sitting out there today, that every decision I’ve ever made, in my entire life, has been wrong. My life is the complete opposite of everything I want it to be. Every instinct I have, in every aspect of life, be it something to wear, something to eat… It’s all been wrong. Every one. – George Constanza If every instinct you have is wrong, then the opposite would have to be right. – Jerry Seinfeld From the Seinfeld episode “The Opposite” I...

Read More »Long Term Gold Price Prediction

What do the weather and the markets have in common? Quite a bit says this week’s guest! Kevin Wadsworth is a meteorologist-turned-chart analyst who has a lot of interesting insight and predictions into market movements and the price of gold. Kevin joins GoldCore TV host Dave Russell to discuss how he applies his 35 years of experience and methodology to financial markets. He takes us through the range of outcomes he sees for the economy, the US Dollar and precious...

Read More »Weekly Market Pulse: A Most Unusual Economy

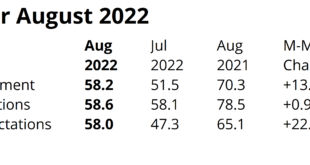

The employment report released last Friday was better than expected but the response by bulls and bears alike was exactly as expected. Both found things in the report to support their preconceived notions about the state of the economy. I do think the bulls had the better case on this particular report but there have been plenty of others recently to support the ursine side of the aisle too. My take is that everything about the economy right now, and really since...

Read More »Market Pulse: Mid-Year Update

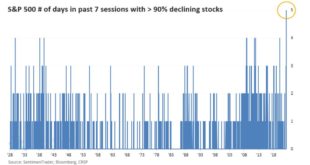

Note: This update is longer than usual but I felt a comprehensive review was necessary. The Federal Reserve panicked last week and spooked investors into the worst week for stocks since the onset of COVID in March 2020. The S&P 500 is now firmly in bear market territory but that is a fraction of the pain in stocks and other risky assets. Stocks are now down 10 of the last 11 weeks but the pain was concentrated in the last two weeks. 5 of the last 8 trading days...

Read More »How Long Will Inflation Last 2022

What if we told you that you could predict the future? For today’s guest, this is certainly the case when it comes to future market events. He hasn’t got a crystal ball, instead, he has nearly 300 years of historical analysis and models that have led him to the conclusion that markets operate in clear, predictable cycles. For Charles Nenner there is little point in trying to explain why something happened because it did happen and it will happen again. Charles Nenner...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org