Gregory (Scotland Yard detective): “Is there any other point to which you would wish to draw my attention?” Sherlock Holmes: “To the curious incident of the dog in the night-time.” Gregory: “The dog did nothing in the night-time.” Sherlock Holmes: “That was the curious incident.” From Silver Blaze by Arthur Conan Doyle, 1892 It is hard to determine sometimes what causes markets to move as they do. Take last Friday’s stock market selloff. The widely cited “reason” for the selloff was Jerome Powell’s speech at the Fed’s Jackson Hole Symposium. Frankly, I don’t think Powell said anything new, his message remarkably similar to his last post-FOMC press conference. But two passages drew attention as being sufficiently different to upset the market. First was this bit,

Topics:

Joseph Y. Calhoun considers the following as important: 5.) Alhambra Investments, Alhambra Portfolios, Alhambra Research, Apple, bonds, cfnai, China, commodities, corporate profits, currencies, economic growth, economy, emerging markets, Featured, Federal Reserve/Monetary Policy, inflation, Jerome Powell, Markets, Monetary Policy, newsletter, PMI, Real estate, stocks, US dollar

This could be interesting, too:

investrends.ch writes US-Gericht: Google muss Chrome und Android nicht verkaufen

investrends.ch writes Apple: Zölle kosten schon 900 Millionen Dollar

investrends.ch writes EU: Apple und Meta müssen 700 Millionen Euro Strafe zahlen

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Gregory (Scotland Yard detective): “Is there any other point to which you would wish to draw my attention?”

Sherlock Holmes: “To the curious incident of the dog in the night-time.”

Gregory: “The dog did nothing in the night-time.”

Sherlock Holmes: “That was the curious incident.”

From Silver Blaze by Arthur Conan Doyle, 1892

It is hard to determine sometimes what causes markets to move as they do. Take last Friday’s stock market selloff. The widely cited “reason” for the selloff was Jerome Powell’s speech at the Fed’s Jackson Hole Symposium. Frankly, I don’t think Powell said anything new, his message remarkably similar to his last post-FOMC press conference. But two passages drew attention as being sufficiently different to upset the market. First was this bit, where the key word was supposedly “pain”:

Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.

Again, I don’t find any of that surprising. Anyone who thought the Fed was going to kill inflation without some impact on the real economy is not living in the real world. Now, we could have a long discussion here about how growth doesn’t cause inflation but that probably isn’t the most efficient use of our time. Suffice it to say that higher interest rates – and more importantly the reaction to those higher rates – will have an impact on growth and the labor market. The right question isn’t whether there will be some pain, but rather how much?

The second part that drew attention was this reference to the time line:

That brings me to the third lesson, which is that we must keep at it until the job is done.

It was these two lines, according to most of the market commentators out there, that pushed the S&P 500 down 3.4% on Friday. As you might guess by now, I disagree. Vehemently. There was something significant in this speech but it had nothing to do with Powell’s vow of higher rates for longer (I guess “lower for longer” has been retired). The most significant paragraph was this one:

We are moving our policy stance purposefully to a level that will be sufficiently restrictive to return inflation to 2 percent. At our most recent meeting in July, the FOMC raised the target range for the federal funds rate to 2.25 to 2.5 percent, which is in the Summary of Economic Projection’s (SEP) range of estimates of where the federal funds rate is projected to settle in the longer run. In current circumstances, with inflation running far above 2 percent and the labor market extremely tight, estimates of longer-run neutral are not a place to stop or pause.

Remember after the last post-FOMC press conference when Mohamed El-Erian and bunch of other Fed watchers said Powell must have misspoken when he referred the current level of rates as “neutral”? I don’t remember if it was El-Erian but someone even characterized Powell’s neutral statement as embarrassing.

Well, if you didn’t hear him the first time, he just told you, in that paragraph above, that he didn’t misspeak, that the current policy rate is indeed what he believes to be neutral. So, when he says that the policy rate needs to rise above neutral all he’s saying is that it needs to rise from here. Based on listening to every Fed talking head all week at Jackson Hole, the consensus seems to be that rates need to rise to 3.5 – 3.75%.

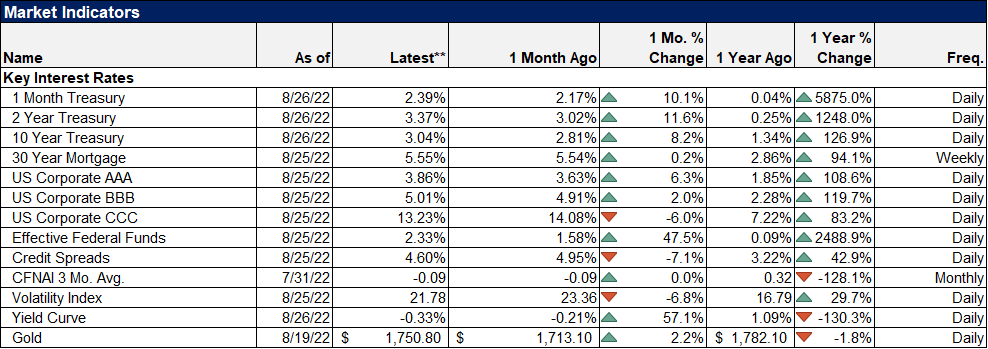

That is exactly what the market is expecting by the way. We can see that through a variety of futures markets including SOFR (secured overnight financing rate; the replacement for LIBOR), Eurodollars and Fed funds themselves. A model developed by the Atlanta Fed that uses Eurodollar futures options and SOFR swap spreads has Fed Funds peaking in March of 2023 at 3.76%. And that didn’t change before, during or after Powell’s speech. SOFR and Eurodollar futures were basically unchanged on Friday.

By the way, another indication that the market was already expecting the “higher for longer” narrative is that the peak and subsequent inversion of SOFR and Eurodollar futures has been moving further out the calendar recently. 6 weeks ago both expected rates to peak between January and March of 2023. After the last FOMC meeting the date of peak rates has been moving out and is now expected between March and June of 2023. And the difference between March and June is down to just about 5 basis points so if it keeps moving it will soon be moved out to between June and September. To simplify that, even if we assume that recession starts coincident with rates peaking, it is now a Q2 2023 event. That, in my opinion, is why stocks have been rising lately – the market no longer believes recession is imminent.

In fact, no matter where you look in the rates complex, Powell’s speech was a giant nothing. And so the question in my mind is, if the speech didn’t impact the bond and money markets did it really drive the DJIA down 1000 points? Well, there were other things going on Friday so let’s look somewhere else for an explanation.

The stock selloff in the morning may have been about Powell’s speech but there were two major new stories Friday that may have had a bigger impact. The first was this story by Politico that posted in the early afternoon:

Apple faces growing likelihood of DOJ antitrust suit

An antitrust lawsuit against Apple would be a dramatic escalation in the administration’s battle against the tech giants.

The second news story was this one that came out around 3PM:

3M Can’t Use Bankruptcy to Halt Lawsuits Over Combat Earplugs, Judge Rules

Both of those articles were unexpected and could have a large impact on corporate America. In the case of Apple, those of us old enough to remember can’t help but think back to the government’s pursuit of Microsoft in similar fashion at the turn of the century. The current administration is not exactly business friendly but in this case, the backlash against big tech is bipartisan. The outcome could be a big deal for Apple’s bottom line and more importantly could be a distraction for years to come.

The 3M news was also a bit of a shock. I think most people thought – after the ruling in the similar Johnson & Johnson baby powder case – that 3M’s liability would be confined to the subsidiary. So, now we have two judges in two different districts basically coming to polar opposite conclusions. It isn’t coincidence that J&J’s stock went straight down with 3M in the afternoon.

I think the potential impact on the markets from these cases is much greater than anything Jerome Powell said or might say or do. I can’t say for sure that it is why stocks sold off so hard Friday afternoon but it is a much more satisfying answer than Powell’s speech.

Don’t assume that the reasons for a market event are really what you see in the headlines. It is impossible on most days to figure out what caused investors to buy or sell. And more often than not, like the Sherlock Holmes story about the dog that didn’t bark, the answer to the mystery of why the market moved today is not the most obvious one. Sometimes the thing no one talked about is more important than the thing they talked about all day.

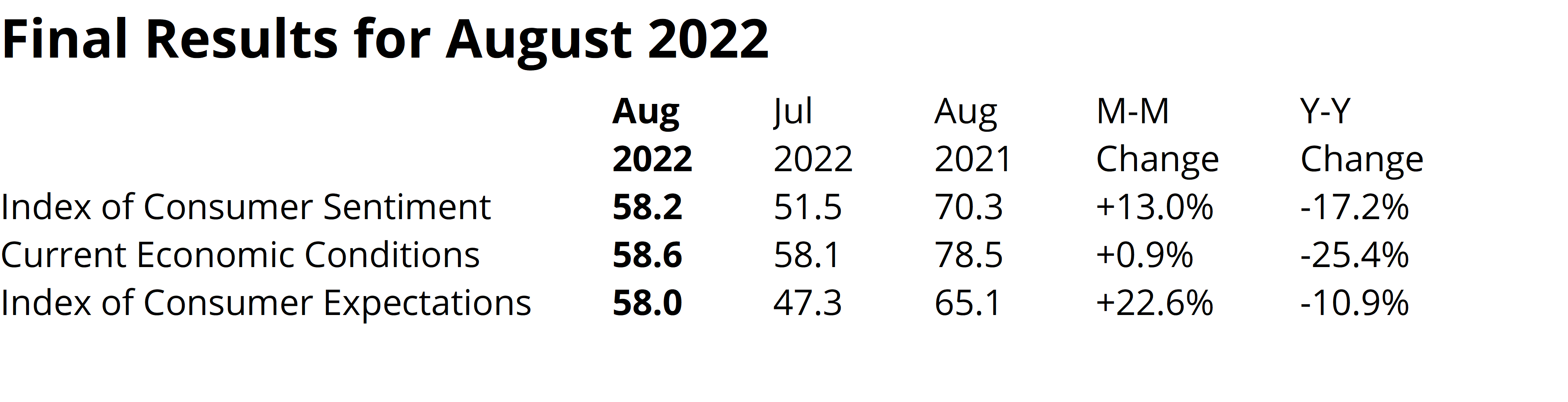

EconomyThe economic data last week was generally pretty positive but not great. There were some soft readings on some of the survey type data but actual hard data on the economy continued to present a picture of an economy slowing but still growing. One of the broadest indicators we follow, the Chicago Fed National Activity Index, showed an improvement in the economy in July. I wrote a short note about it last week: The Economy Improved in July That is probably why the University of Michigan consumer sentiment poll showed an improvement. I’ve said before I don’t put much emphasis on these surveys because of the political slant in the poll. It may be significant though if Republicans’ sentiment is improving: |

|

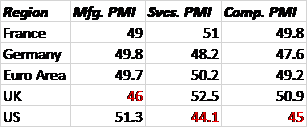

| I’m beginning to wonder if the same political effect is seeping into the S&P Global PMIs. Flash readings were released last week and the results are odd to say the least:

So, what do you think? Is the economy in Germany better than the US? Is the economy in the UK better than the US? How about the Euro Area as a whole? Yeah, I’m having some trouble putting much weight on this. The biggest difference in the S&P PMIs and the ISM PMIs is that S&P surveys smaller businesses. Draw what conclusion you might from that. Housing continues to be a problem area which showed up in new home sales: Rate Hikes Are Working |

|

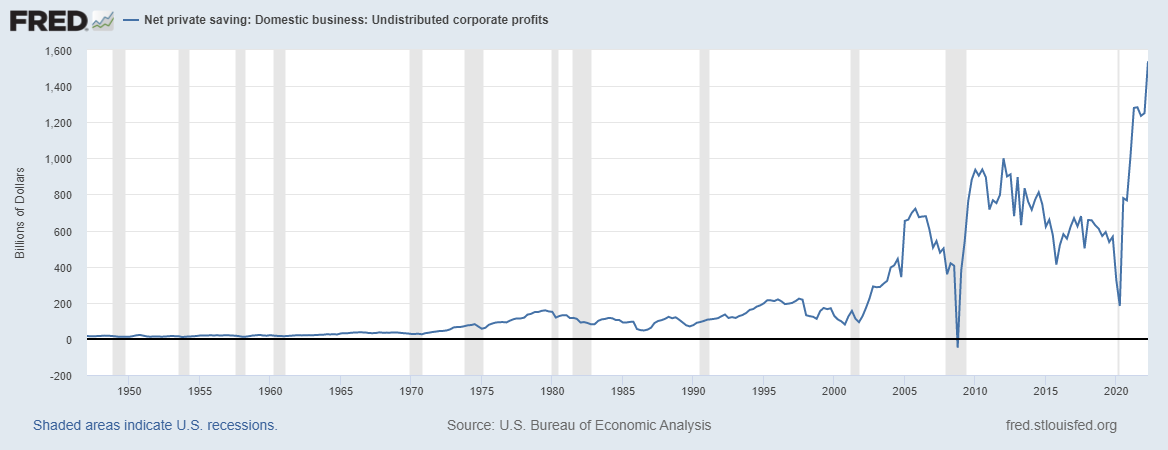

| But pending home sales were an upside surprise, falling just 1%. Durable goods orders were up ex-transportation and about as expected. Core capital goods orders were up again. The update of Q2 GDP included corporate profits which were up better than expected at +9.1% from Q1. And here’s one I haven’t looked at before but jumped out at me – undistributed corporate profits were up 23% in Q2. Balance sheets are in good shape and companies appear to be husbanding cash in anticipation of the slowdown.

Personal income and spending were both up but a little less than expected. On the other hand, the PCE price index was down which sounds like good news because it is. |

|

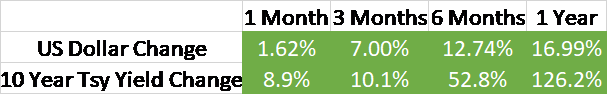

EnvironmentLike I said last week and I think the week before, rates and the dollar are still rising. You have to respect the trend until you get some indication that its changing and we just haven’t. I know everyone is worried about the rising dollar but it still doesn’t concern me much. By the way, I find it interesting that the large specs faded the move higher in the dollar. Watching the commitment of traders report is much more art than science and sometimes you have to respect that the traders actually do get some things right. Large specs have been net long the dollar since July of last year. In other words, a group that has been long and right about the dollar for over a year didn’t buy the move last week. Significant? Maybe, but interesting for sure. |

|

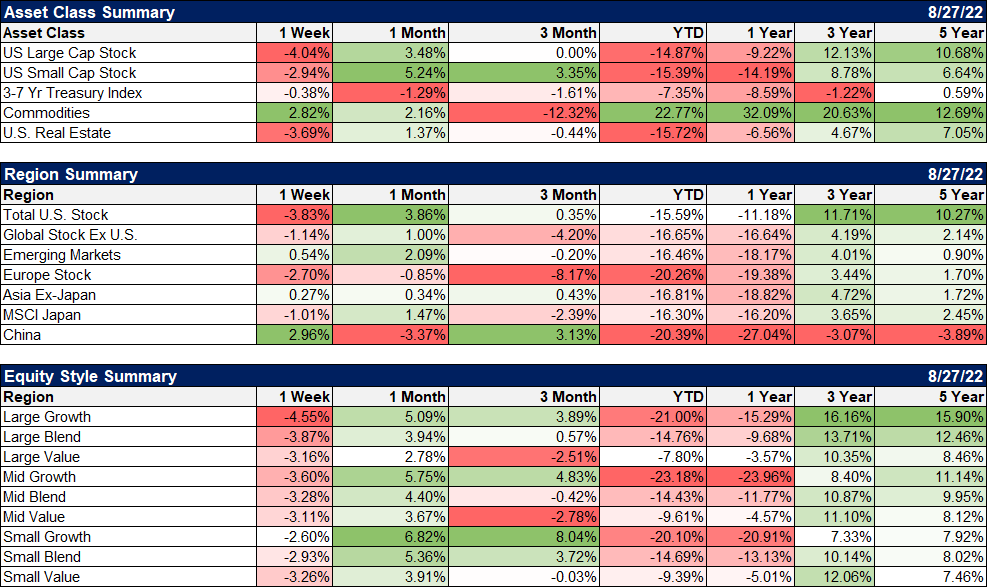

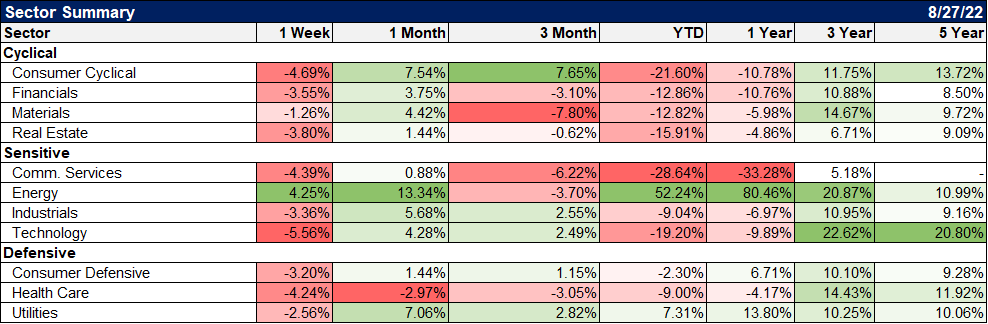

MarketsOf the major asset classes we follow, only commodities were higher last week. That was a broad based move by the way and did not include gold which tells you that economic growth isn’t the issue for stocks. Two notable things about last week was the outperformance of international stocks, specifically EM, and the outperformance of small caps vs large caps. The move in EM stocks is interesting because it comes with a rising dollar which is unusual. Part of the driver was that China and the US appear to be getting close to an agreement on the audit issue for US listed Chinese stocks. But it shouldn’t escape your notice that Latin American stocks were up last week too. The EM rally was pretty broad based too. The small cap outperformance is something I’ve remarked on several times recently and it does seem persistent. Small caps outperformed from the 2020 lows coming out of the COVID recession but gave back most of that move in 2021. Can they continue to outperform? That is something to really keep an eye on because small caps are cheap. They tend to outperform in weak dollar periods though so this move may need some help. If you lean toward the stagflation/1970s re-run camp, you probably know they outperformed back then too. |

|

| Energy stocks were the sole sector winners last week but crude oil is at a critical juncture technically. If it fails here at the 200 day MA that opens the door to a move to the low 70s but I think that is unlikely in the short term. More likely is a rally that tests to the old highs and that would likely mean new highs for the stocks. I do have my doubts about crude breaking out to a new high though. | |

| Credit spreads move a bit wider last week but are still well below the recent highs.

I think people worry too much sometimes about the whys. Why the market moves in whatever direction on any given day is hard to impossible to figure out. And it doesn’t really matter anyway. Try to shut out the noise of the why – and the commentary is all about the why – and concentrate on the what. What are markets doing? Interest rates are in an uptrend right now. The dollar is in an uptrend. Stocks are in a short term uptrend no matter why they sold off Friday. The S&P 500 is also in an intermediate term downtrend and a long term uptrend. Choose your time frame to fit your own and make tactical bets accordingly. But pay attention to the trend and try not to fight it. |

You also need to make sure you don’t let your emotions get the best of you when the market makes a big short term move. I told you a few weeks ago that you shouldn’t get too enthusiastic about this rally . And you shouldn’t get too worried about Friday’s selloff either. Many of the sentiment factors I’ve been citing the last couple of months are still in place; sentiment is still too negative in my opinion with large short positions in S&P and Russell 2000 futures. With the selloff last week, some of my short term worries about the rally off the lows – low put/call ratios for instance – were relieved. So keep an even keel and carry on with your strategic plan. Last week was a tad dramatic but it probably doesn’t have any deeper meaning than some traders took profits from a big short term rally.

Joe Calhoun

Tags: Alhambra Portfolios,Alhambra Research,Apple,Bonds,cfnai,China,commodities,corporate profits,currencies,economic growth,economy,Emerging Markets,Featured,Federal Reserve/Monetary Policy,inflation,Jerome Powell,Markets,Monetary Policy,newsletter,PMI,Real Estate,stocks,US dollar