But the potential for fiscal stimulus and ongoing Fed tightening are factors that support USD appreciation in 2017 at least.Our core scenario foresees risk appetite remaining robust as President Trump adopts a more moderate stance on protectionism than his past rhetoric would suggest. The USD should appreciate most against low-yielding currencies. But while we acknowledge that fundamental drivers also justify further USD strength, we believe that the long-term trend of USD appreciation is...

Read More »FX Daily, October 18: Dollar Slips Broadly but not Deeply

Swiss Franc and Sterling (Tom Holian) According to Bank of England deputy governor Ben Broadbent the drop in the value of Sterling has helped to stop the UK economy from falling further since the shock of the Brexit vote. He went on to say ‘in the shape of the referendum, we’ve had exactly one of those shocks’ and added that the Bank of England would not interfere with monetary policy to boost the Pound’s value....

Read More »Environment is supportive of US dollar

Macroview While near-term Fed rate hike has been priced in, other factors favour the greenback in the medium term. Alternatives like the Swiss franc and Australian dollar look less attractive. With a December rate hike already largely priced in, further dollar support from Fed tightening could be fairly limited in the next few months, especially as the Fed is likely to lower its rate forecasts for the coming years to take into account increasing concerns about the decline in ‘neutral’ real...

Read More »The dollar still has limited potential, while yuan could be source of volatility

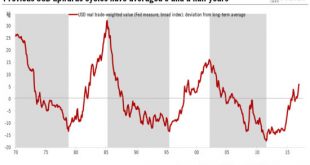

Just one rate hike this year will limit the greenback’s gains, but Asian currencies will be worth watching The US dollar has been in a long-term upward cycle, at least since July 2011. But the dollar stuttered in April after the release of some poor economic data, and again at the beginning of June, when poor nonfarm payrolls data was released, leading some to believe that we are at the end of this cycle. But we think this is not necessarily the case for at least two reasons. First, the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org