Goodbye and good riddance to the third quarter of 2022. That was one of the wildest 3 months I’ve experienced in my 40 years of trading and investing. The quarter started off great with the S&P 500 rising 14% from July 1 to August 16 but ended with a 17% swan dive into the end of the quarter. And we closed on the low of the year. The 10-year Treasury yield rose from 2.97% to 4% just a few days before the end of the quarter. The 3-7 year Treasury index – our benchmark for bonds – was down 3.9% for the quarter, only slightly less bad than the S&P 500’s -4.9%. YTD, the S&P 500 is now down 24% while bonds have their own double-digit losses. Our bond benchmark is down 10.5% for the year and that actually isn’t so bad. The Aggregate index – “the bond market” – is down

Topics:

Joseph Y. Calhoun considers the following as important: 5.) Alhambra Investments, Bear Market, bonds, commodities, currencies, Featured, Federal Reserve, Gold, Market Sentiment, Markets, Monetary Policy, newsletter, real interest rates, REITs, Russia, S&P 500, S&P 500, small cap stocks, stocks, TIPS, Ukraine, US dollar, valuations, value stocks

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

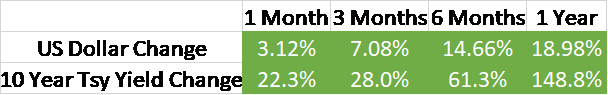

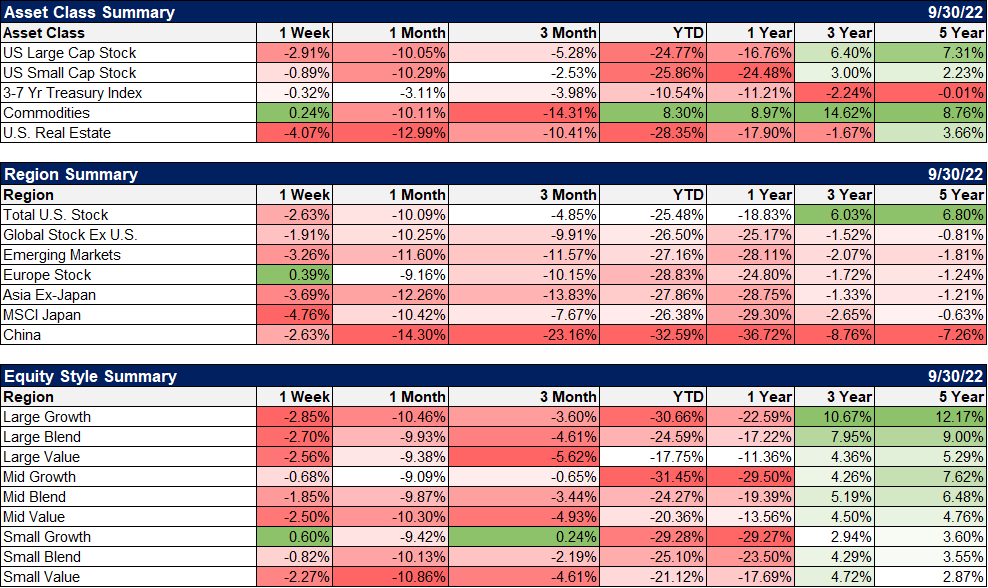

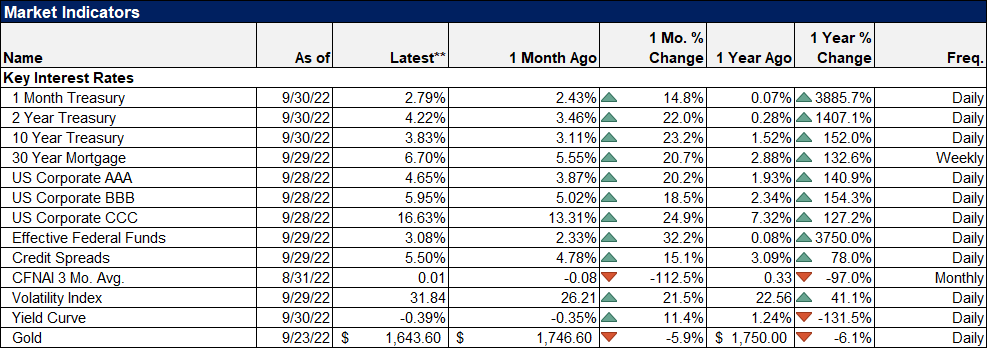

Goodbye and good riddance to the third quarter of 2022. That was one of the wildest 3 months I’ve experienced in my 40 years of trading and investing. The quarter started off great with the S&P 500 rising 14% from July 1 to August 16 but ended with a 17% swan dive into the end of the quarter. And we closed on the low of the year. The 10-year Treasury yield rose from 2.97% to 4% just a few days before the end of the quarter. The 3-7 year Treasury index – our benchmark for bonds – was down 3.9% for the quarter, only slightly less bad than the S&P 500’s -4.9%.

YTD, the S&P 500 is now down 24% while bonds have their own double-digit losses. Our bond benchmark is down 10.5% for the year and that actually isn’t so bad. The Aggregate index – “the bond market” – is down 14.4%, one of the worst performances in history. REITs, down 28.6%, have managed to underperform stocks in an inflationary environment, quite contrary to history but there it is. Non-US stocks (-26.5%) are also underperforming their US cousins, not surprisingly given that the dollar index is up over 17% YTD.

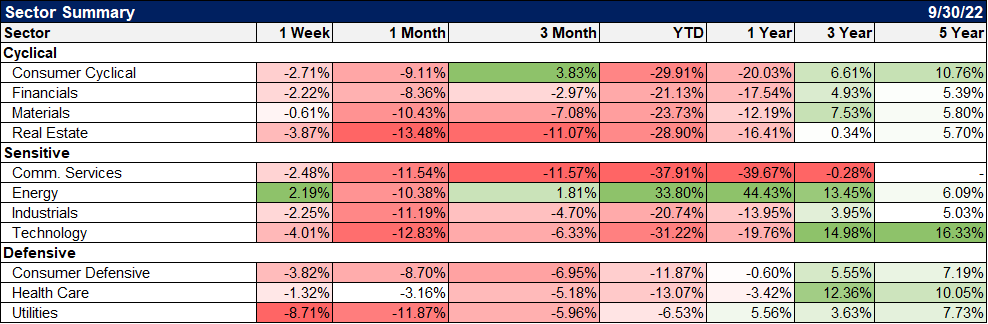

There have been some positive surprises too. Latin American stocks, of all things, are not only beating the S&P 500 but also posting an actual positive return. That may be due to commodities being one of the few major asset classes to post a gain (+15.7%) this year. Gold is down on the year but has managed to beat stocks by almost 15%. Value stocks have strongly outperformed this year; S&P 500 value has outperformed growth by nearly 13%. Even international value has managed to outperform the S&P by 1.3%. Dividend stocks (depending on which index you use) have outperformed by over 12%. As a firm, we have managed to own quite a few of the outperformers (int’l value, dividend, value, gold, commodities, 3-7 year Treasuries, arbitrage) but we’ve also owned a couple of underperformers (REITs, Japanese stocks).

So, it has not been a good year, to say the least. We have outperformed versus our 60/40 benchmark by a good margin and it feels awful. Bear markets are, of course, always like this and the hardest part of surviving a bear market is staying positive and sticking to your strategy. I struggle every day with the former but I have no problem with the latter. I’ve been using our strategy for 20+ years and I know it has always worked. The fact that we’re in one of its worst drawdowns right now doesn’t change that. Not the worst by the way, but not pleasant by any stretch of the imagination.

Needless to say, sentiment is about as bad as I’ve ever seen it. Whether we look at market-based indicators or polls, seemingly everyone is negative and a bunch of folks are betting that it will stay that way or get worse. Put volumes and premiums are setting records (people betting on a continued fall), portfolio manager cash levels are at their highest level since 2001, the American Association of Individual Investors poll just printed a second straight week with bears over 60%, the National Association of Active Investment Managers equity exposure just dropped to 12.6 (just above the March 25, 2020 low of 10.7) and speculators are holding near record short positions in the S&P 500, the Russell 2000 and the 10 and 30-year Treasury futures. Could it get more negative? Yes, but if you’re looking a year out, readings like this have almost always generated very favorable results.

There is, of course, plenty to be worried about. The Federal Reserve seems hell-bent on correcting their very large mistake of last year by committing another, maybe bigger one this year. I won’t spend any more space on that one except to say that the market will decide how the Fed proceeds, not the other way around. The hawkish Fed – and world events – have also pushed the dollar higher. A higher dollar isn’t really a problem in the short term but, as in most things financial, the rate of change matters more than the level. It isn’t however, generally good for profits going forward (although that is mostly a large-cap problem) so a moderation would certainly be welcome.

The situation in Europe is also cause for concern but in general, the US is fairly well insulated from direct problems. It is hard – impossible? – to see how the continent can avoid a deep recession from the energy crisis but governments will take some of the hit rather than just letting consumers take it all. Years of budget surpluses in Germany are about to come in handy. And obviously, Ukraine represents more, potentially, than a mere economic issue. Vladimir Putin is losing the war and has repeatedly threatened to use nuclear weapons. I have my doubts about that because I don’t think he’d survive it but who knows his mental state? I don’t even want to contemplate the consequences of that.

Bear markets and negative sentiment are, however, exactly what a long-term investor should hope for. It is during such times that the best opportunities for long-term investments present themselves. Warren Buffett says we should be greedy when everyone else is fearful and if fearful doesn’t describe today I don’t know what does. I have been writing since June that investors need to be looking for those opportunities and doing some selective buying. I’ve also said repeatedly that doesn’t mean going all in at once but if your investing time horizon is long term (at least 3 years), it makes a lot more sense to look for reasons to buy rather than reasons to sell.

I am still not much interested in the S&P 500 as a whole at 17 times next year’s earnings which might not happen. But that doesn’t mean that all the stocks in the index are expensive and you can shop outside that 500 stock universe too. Small and mid-cap stocks trade at historically low prices relative to sales and earnings. We may be seeing the beginning of some discrimination too as small and mid-cap stocks outperformed strongly in Q3. Small-cap growth stocks actually managed a gain in the quarter.

Non-US stocks may represent the best opportunity of all because of the dollar rally this year. My mentor when I got in this business years ago had a list of rules he had developed over a 50-year career. One of those was “always buy stocks in countries that just devalued their currency” – which includes most of the world right now. I once asked him why and he looked at me strangely and said “because it works”. Larry wasn’t much for theory but he was right. Stocks in countries with the most undervalued currencies do outperform strongly.

Like stock valuations, currency valuations (based on purchasing power parity) aren’t great timing tools but over a 3-year period after becoming undervalued, the outperformance is strong. The degree of outperformance is affected by whether the undervalued currency subsequently rises but it isn’t just a currency effect. Earnings also respond to over and undervalued currencies. If you want direct and recent evidence of that I’d suggest taking a look at last quarter’s earnings reports from some of the big US multinationals. The strong dollar shaved nearly $500 million off Microsoft’s revenue last quarter and they weren’t the only ones. That’s another reason to be looking at small and midcap stocks by the way; they don’t have as much exposure to non-dollar earnings.

The average bear market since 1929 has lost 35% (S&P 500) over a 10-month period. Of course, that includes some outliers like the 1929-1932 bear market that fell over 80% so the average minus that one is a bit less. But we’re down 25% now and October will be the 10th month of this bear market (longer if you look at small caps or NASDAQ which peaked in November of 2021) so we’re closing in on average. Things can always get worse and it is hard to see any silver linings right now. But that was true at the bottom of every other bear market too.

I don’t know if this is peak pessimism. It is always hard to invest during a bear market. I’ve been through six of them as an investor and each was different – and exactly alike. The conditions, the causes, of the bear markets were different each time but the investor reaction was the same. At bottoms, it feels like things will never get better, everyone is bearish and investors just give up hope. You can’t really quantify that into any definitive market indicator but that is exactly how last month felt.

EnvironmentThe rising dollar/rising rate environment is intact but both hit a peak in the middle of last week that may be the exhaustion of this move. The trend for both is still up but I am expecting a pullback in each now. Short-term overbought conditions can be corrected while the long-term trend remains intact and this may be just that but the rising rate, bullish dollar bandwagon is quite full at the moment. It would likely take a change in Fed policy or some hint that it may be coming to end the uptrend altogether. We will be getting a lot of economic data next week – and some of it will likely show some economic slowing – but none of it is actual inflation data. For that, we’ll have to wait for the following week when we’ll get PPI and CPI for September. There is an opportunity coming in both rates and the dollar but there is no way to know in advance what will reverse the trend. But when it does, the opportunity seems likely to be large. Short positions in bonds, stocks, and the dollar are large. It is interesting though that we are already seeing large speculators start to cover their short dollar positions. Large specs in the dollar are trend followers and usually only start to move after the underlying does. In this case, they are already fading the recent move higher. |

|

MarketsBonds were down slightly last week but rallied from midweek after the 10-year touched 4%. Commodities ended the week higher in a fairly broad-based rally. Palladium, which unlike stocks is still well above its June low, rose 5%. Copper was also up (+2.1%) as were a variety of the ag commodities while crude was up about 1%. Natural gas was lower again and has now corrected to a level that looks a lot more interesting. Commodities have outperformed stocks all year but since mid-August that has been by virtue of falling less rather than actually going up. That may be set for a change as a lot of individual commodities look like they are trying to make some kind of low. Small and mid-cap stocks outperformed last week too with the growth versions basically flat. That was true for the quarter as a whole too with small cap growth actually posting a gain. I still think value is the better place to be longer term but mid and small-cap stocks are sufficiently cheap now that it may not matter much. Perhaps more interesting is that European stocks finished the week higher. They’ve underperformed all year – for obvious reasons – but if the dollar reverses that could change quickly. The Euro was up a bit over 1% last week so European stocks actually fell but in dollar terms that turned into a gain. |

|

| It was utilities turn last week to get taken to the woodshed and that hit the dividend indexes pretty hard. They are still outperforming by a wide margin YTD and are up year-over-year. Consumer defensive stocks were also down hard last week. Energy was up last week and materials were only down slightly, responding to the strong commodity markets. The big losses were in real estate and technology (which was mostly Apple). | |

| Credit spreads widened last week but are still well below levels we associate with recession. Gold was also up last week despite the continued rise in real rates. 10-year TIPS yields hit a 13-year high last week but there is no indication that will be the high. You probably won’t see a peak in the dollar or a durable low in gold until real rates stop rising.

Investing isn’t easy. If it was everyone would be Warren Buffett and I’d be out of a job. It is hard to buck the crowd, to be the optimist when everyone is pessimistic. But superior investment results cannot be had by doing what everyone else is doing. We are considering several tactical moves in our portfolios right now as some trends are starting to shift. But our strategy is sound and we are sticking to it. We are still holding a cash position but that could change at any time. |

It is easy to be bearish right now. Everybody knows about the bad stuff. Yes, things could still get worse from here. But investors have to think long term and once the S&P 500 drops 25% the forward returns start to look pretty darn good. Since 1961, once the market hits down 25%, the average forward one-year return is over 21%. The only negative outcome was the 2008 financial crisis when the return was -6.9%. 3,5 and 10-year returns are all positive. If your time horizon is less than a year you shouldn’t be in risk assets at all. But if you are an investor, this is when you get tested, when you have to remember that lower prices today mean higher returns tomorrow. And that tomorrow always comes.

Joe Calhoun

Tags: Bear Market,Bonds,commodities,currencies,Featured,federal-reserve,Gold,Market Sentiment,Markets,Monetary Policy,newsletter,real interest rates,REITs,Russia,S&P 500,small cap stocks,stocks,TIPS,Ukraine,US dollar,valuations,value stocks