Swissinfo, December 14, 2020. HTML, podcast. We talk about CBDC, the Swiss National Bank, whether CBDC would render it easier to implement helicopter drops, and how central bank profits should be distributed.

Read More »“CBDC: State of Play, Practical Challenges, Open Issues,” SUERF Webinar, 2020

SUERF Webinar “CBDC: State of play, practical challenges, open issues” with Ulrich Bindseil (ECB) and Morten Bech (BIS). Moderated by Dirk Niepelt. December 4, 2020, 2 pm. Webinar website. Presentation by Morten Bech. Presentation by Ulrich Bindseil. CBDC = MM0GA.

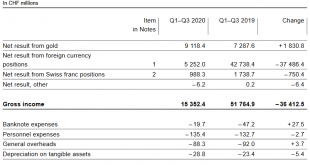

Read More »SNB Profit in Q1 to Q3 2020: CHF 15.1 billion Despite Covid19

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Low Inflation, Crashes and Central Bank Money Printing The crisis caused by the Covid19 virus,is a typical crisis with low inflation (at least for now). During such a crisis, central bank money...

Read More »Swiss National Bank intervenes heavily to weaken Swiss franc

Official data recently released by the Swiss National Bank (SNB) show it sold 51.5 billion Swiss francs while acquiring US dollar and euro-denominated assets in a bid to weaken the franc over the first quarter of 2020. © Michael Müller | Dreamstime.comThe data followed comments by SNB President Thomas Jordan signalling that even larger interventions may be on the cards in the future. Switzerland’s long-running battle with its overvalued currency has drawn criticism from the US. In...

Read More »“Unabhängigkeit der Nationalbank (Independence of the SNB),” FuW, 2020

Finanz und Wirtschaft, July 25, 2020. PDF. The Swiss National Bank—yes, the Swiss one—feels it must remind politicians of its independence. Parliamentarians from left to right (!) voice demands. To shrink the SNB’s balance sheet? No, for more central bank profits to be distributed sooner rather than later. I discuss misconceptions, possible motivations, and a constructive response. «The best way to defend the independence of a central bank is never to exercise it.»

Read More »“Monetäre Staatsfinanzierung mit Folgen (Monetary Financing of Government),” Die Volkswirtschaft, 2020

Die Volkswirtschaft, 24 July 2020. PDF. Clarifying the connections between outright monetary financing, QE, the distribution of seignorage profits, the relationship between fiscal and monetary policy, and central bank independence. Abstract: Wenn Parlamentarier höhere Gewinnausschüttungen der Nationalbank fordern, Kritiker im Euroraum mehr «Quantitative Easing» oder Helikoptergeld verlangen und andere Stimmen monetäre Staatsfinanzierung monieren, dann steht die Beziehung zwischen...

Read More »Willkommen in einer Zukunft ohne Zins

Die SNB, die EZB und andere Zentralbanken erwarten auch langfristig keine Zinswende – und machen Nullzinsen zur Regel. Eine Übersicht der Prognosen. Hält sich die Option offen, die Leitzinsen noch tiefer ins Minus zu senken: Die EZB in Frankfurt. Foto: Keystone Diese Woche ist die Welt einer Zukunft ohne positive Zinssätze ein Stückchen näher gerückt. Schwedens Notenbank erneuerte ihren Zinspfad. Erstmals geht sie davon aus, dass sie den Leitzins mindestens bis...

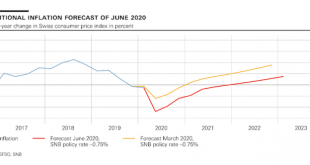

Read More »Swiss National Bank forecasts deflation until 2022

On 18 June 2020, the Swiss National Bank (SNB) said it would maintain its negative rate of interest (-0.75%) and remains willing to intervene more strongly in the foreign exchange market. © Marekusz | Dreamstime.comThe coronavirus pandemic has led to a severe downturn in economic activity and a decline in inflation both in Switzerland and abroad. The bank presented a new lower inflation forecast than the one it issued in March 2020. The red line in the chart above shows deflation...

Read More »“Wenn die Notenbank den Staat finanziert (When the Central Bank Finances the State),” FAS, 2020

FAS, 31 May 2020. PDF. Monetary deficit financing is the norm—after all, central banks distribute their profits. Monetary financing occurs in the context of regular open market operations and QE and, hyper charged, with helicopter drops. The question is not whether monetary policy should finance the government, but why it does so, and to what extent. Fiscal and monetary policy are inherently connected; what constitutes monetary policy is defined by objectives....

Read More »“Wenn die Notenbank den Staat finanziert (When the Central Bank Finances the State),” FAS, 2020

FAS, 31 May 2020. PDF. Monetary deficit financing is the norm—after all, central banks distribute their profits. Monetary financing occurs in the context of regular open market operations and QE and, hyper charged, with helicopter drops. The question is not whether monetary policy should finance the government, but why it does so, and to what extent. Fiscal and monetary policy are inherently connected; what constitutes monetary policy is defined by objectives.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org