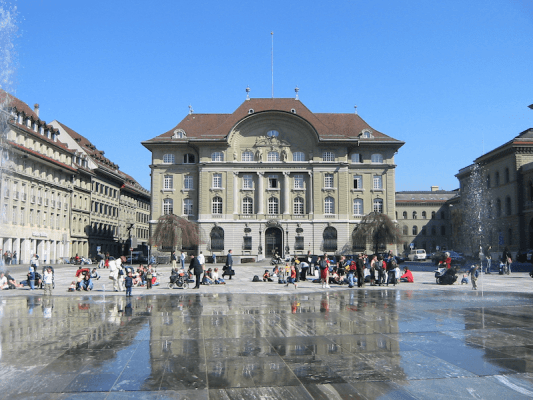

According to provisional calculations, the Swiss National Bank (SNB) expects to make a profit of around CHF 49 billion in 2019. SNB building in BernMost of this comes from the rising value of the SNB’s foreign currency positions (+CHF 40 billion) and a valuation gain on gold holdings (+CHF 6.9 billion). After adjusting reserves, the SNB will have CHF 88 billion available for distribution. Since the announcement SNB shares have risen 2% to CHF 5,600. The central bank plans to pay a dividend of CHF 15 per share, a total payment of CHF 1.5 million, representing a yield of 0.3%. CHF 15 per share is the maximum dividend payment the central bank can legally make. In addition, it will pay CHF 2 billion to the federal government and cantons. The federal government will receive one

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, Personal finance, SNB, Swiss National Bank, Swiss National Bank profit, Swiss National Bank profit 2019

This could be interesting, too:

Investec writes Swiss inflation falls further in January

Investec writes Catching ski pass cheats – reactions, fines and worse

Investec writes Swiss milk producers demand 1 franc a litre

Investec writes Swiss income taxes at highest level since 2008

According to provisional calculations, the Swiss National Bank (SNB) expects to make a profit of around CHF 49 billion in 2019.

Most of this comes from the rising value of the SNB’s foreign currency positions (+CHF 40 billion) and a valuation gain on gold holdings (+CHF 6.9 billion).

After adjusting reserves, the SNB will have CHF 88 billion available for distribution.

Since the announcement SNB shares have risen 2% to CHF 5,600.

The central bank plans to pay a dividend of CHF 15 per share, a total payment of CHF 1.5 million, representing a yield of 0.3%. CHF 15 per share is the maximum dividend payment the central bank can legally make.

In addition, it will pay CHF 2 billion to the federal government and cantons. The federal government will receive one third of this sum and the cantons the remaining two thirds. This sum was increased from CHF 1 billion in 2015.

Cantons holding shares in the SNB will receive small dividends payments on top of these payments. Cantons with the largest shareholdings include Bern (6,630), Zurich (5,200), Vaud (3,401) and St. Gallen (3,002). Bern will receive a CHF 99,450 dividend payment.

It’s worth remembering that the SNB doesn’t always make a profit. In the first half of 2015 it lost CHF 50 billion.

More on this:

SNB press release (in French) – Take a 5 minute French test now

For more stories like this on Switzerland follow us on Facebook and Twitter.