In einem Beitrag auf LinkedIn am 29. Dezember 2019 wirft Prof. Erwin Heri von der Universität Basel in die Runde, dass negative (Real-)Zinsen möglicherweise vernünftig sind. Sie wären das natürliche Ergebnis der Präferenzen der Wirtschaftssubjekte – und nicht primär das Ergebnis einer Manipulation von Zentralbanken.

Als Indizien werden angeführt:

die über Jahrhunderte stetig sinkende Tendez der Realzinsen

die Demographie

der materielle Wohlstand

Aus folgenden Ueberlegungen pflichte ich dem Gedankenexperiment von Prof. Heri bei:

anekdotische Evidenz für ein Ungleichgewicht zwischen grösserer Spar- und kleinerer Investitionsneigung: ich begegne viel mehr Leuten, die in 20 Jahren real geliefert haben möchten als solchen, die in 20 Jahren real liefern möchten

zur

Articles by wiesenda

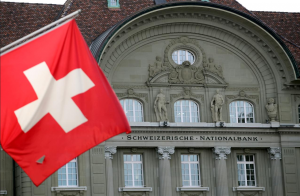

Is the SNB In Control of the Amount of Sight Deposits?

February 9, 2020The current monetary environment in Switzerland is as far from ordinary as can be imagined: negative interest rates (from -0.75% in the short term to -0.25% for 50Y govt bonds) and oceans of liquidity (M0 has grown to 50% of M3 from pre-crises levels of around 8%).

The Swiss National Bank faces criticism because it is seen as contributing to this state of affairs. Both the critique and the counter-arguments have many facets. Let us pick just one of them: is the SNB at all in control of the amount of sight deposits, or does it passively suffer them?

As is so often the case, the answer if both a Yes and a No. To understand why, it is useful to keep a mental picture of the following three aggregate balance sheets with both their assets and liabilities sides: i. the

The SNB Is a Passive Clearing House Rather Than an Active Currency Manipulator

September 26, 2019This post is a long excursion to make two simple points:

The SNB is IMHO just acting in a passive way as a clearing house for (massive) capital inflows. It is not actively managing the exchange rate.

A rate of increase of sight deposits of 2.5bn per week (100bn p.a.) is not extraordinary considering the need to recycle a current account surplus of 80bn p.a.

Observing SNB behaviour over time, it looks to me that what the media call “currency interventions” by the SNB are not activist interventions at all, but passive settlement operations in a sense. When Swiss entities stop reinvesting the proceeds of the current account surplus (the flow variable) abroad, or when Swiss entities choose to repatriate a part of the Swiss International Investment Position (the stock