The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the good years of the credit cycle now. Bad quarters like the one in Q4/2018 are rare now. Franc will rise again with crisis or inflation With a new financial crisis or a with a big rise of inflation, the run into the Swiss franc will start again. And this at an exchange rate that is not digestible for the SNB. We considered that after an inflationary

Topics:

Swiss National Bank considers the following as important: 1.) SNB Press Releases, 1) SNB and CHF, Featured, newsletter, SNB balance sheet, SNB equity holdings, SNB Gold Holdings, SNB profit, SNB results, SNB sight deposits, Swiss National Bank

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The increasing volatility of SNB EarningsAnnual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit CycleThis trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the good years of the credit cycle now. Bad quarters like the one in Q4/2018 are rare now. Franc will rise again with crisis or inflationWith a new financial crisis or a with a big rise of inflation, the run into the Swiss franc will start again. And this at an exchange rate that is not digestible for the SNB.

And this will lead to a massive SNB loss around 150 billion CHF. However, we are not there yet: Inflation is low and interest rates even lower. |

Some extracts from the official statement.

|

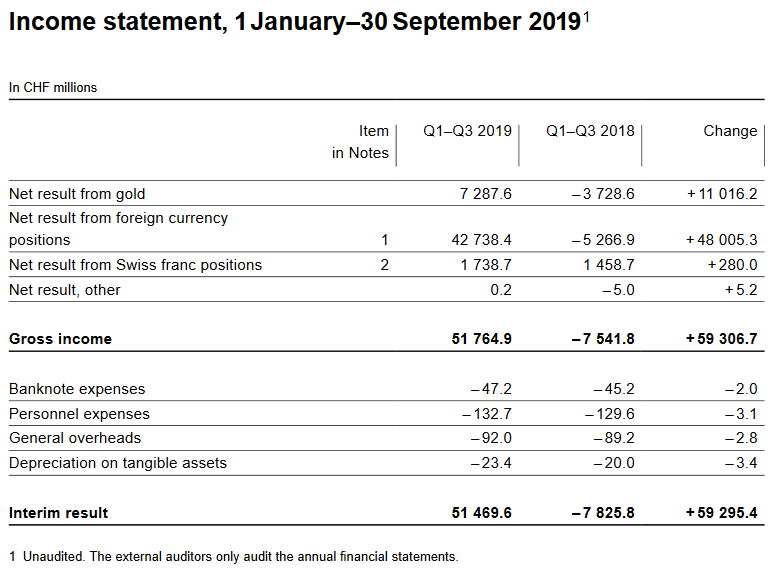

Income statement, 1 January–30 September 2019 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||||||

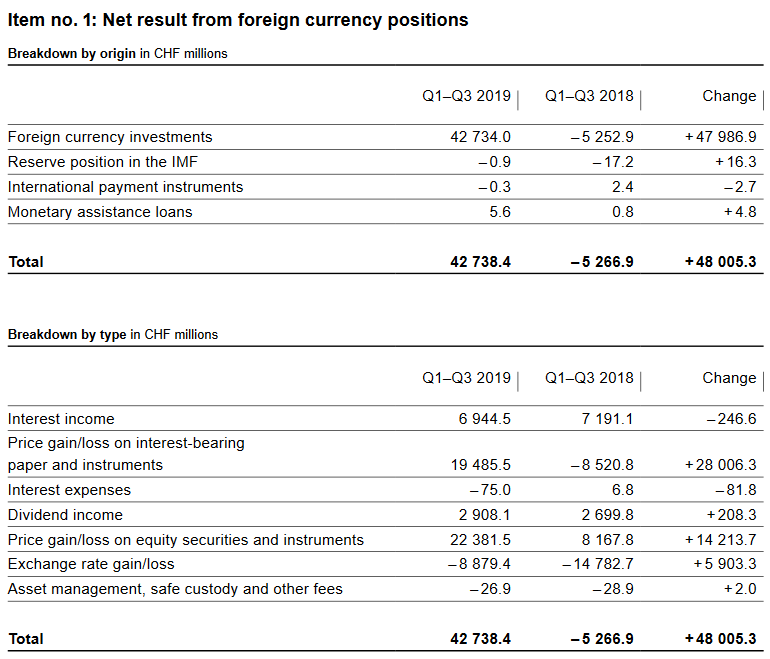

Profit on foreign currency positionIn a period of low interest rates, asset prices rise, last but not least because of margin debt. When the Fed raised rates in 2018, the SNB had a loss of 15 billion francs. Fortunately for the SNB, the Fed stopped raising rates in 2019, on the contrary U.S. rates went down. Rising asset prices implies that the SNB obtains a profit. The following numbers are in billion Swiss Francs.

|

SNB Profit on Foreign Currencies Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||||||

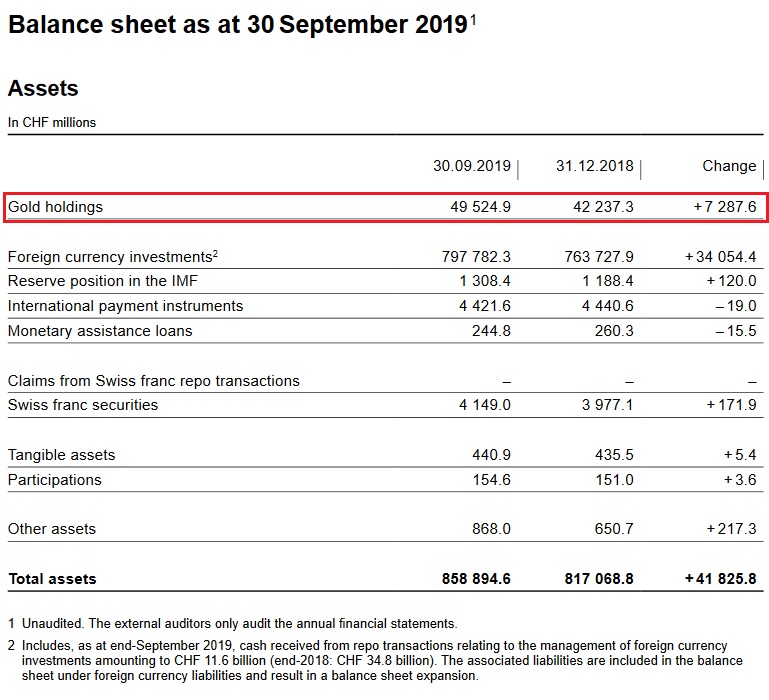

Valuation loss on gold holdings

Percentage of gold to balance sheetThe percentage of gold has risen to 5.76% thanks to higher prices.

Balance Sheet The balance sheet has expanded by over 46.1 bn. francs by 5.67%. Especially during summer there were bigger SNB interventions.

|

SNB Balance Sheet for Gold Holdings for Q3 2019 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||||||

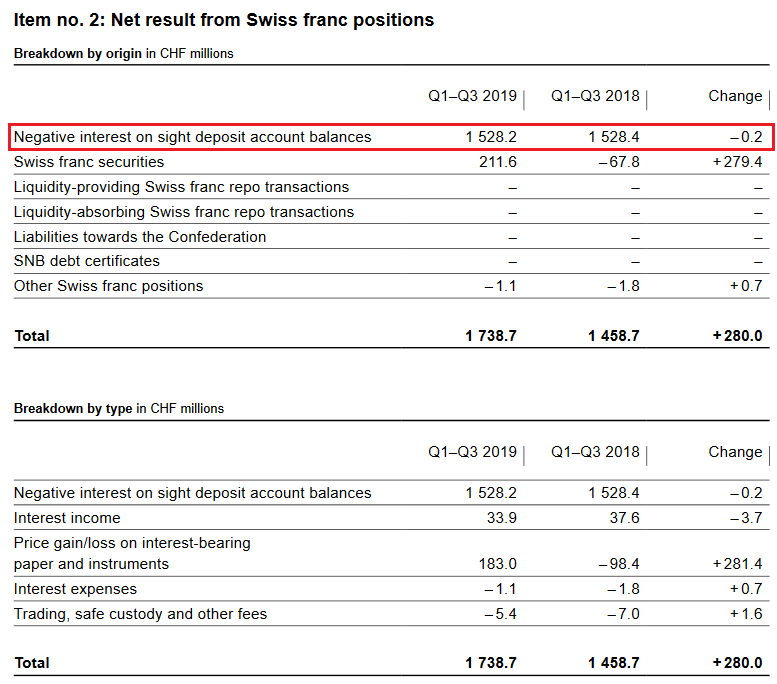

Profit on Swiss franc positionsThe SNB maintains its profitability, last but not least, thanks to the reduction of the profitability of banks. When too many funds arrive on their accounts, they must deposit them on their sight deposit account at the SNB.

Negative Interest ratesFurthermore, the SNB harms the Swiss economy, when it reduces the profits of Swiss banks by negative interest rates. But with this measure she maintains her own profitability. The SNB obtained slightly less money for negative rates, while sight deposits were slightly up (see below). The reason might that banks better use their exoneration from negative rates. Still, as compared to the FX profits or gains on equities, this number is relatively low.

|

SNB Result for Swiss Franc Positions for Q3 2019 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||||||

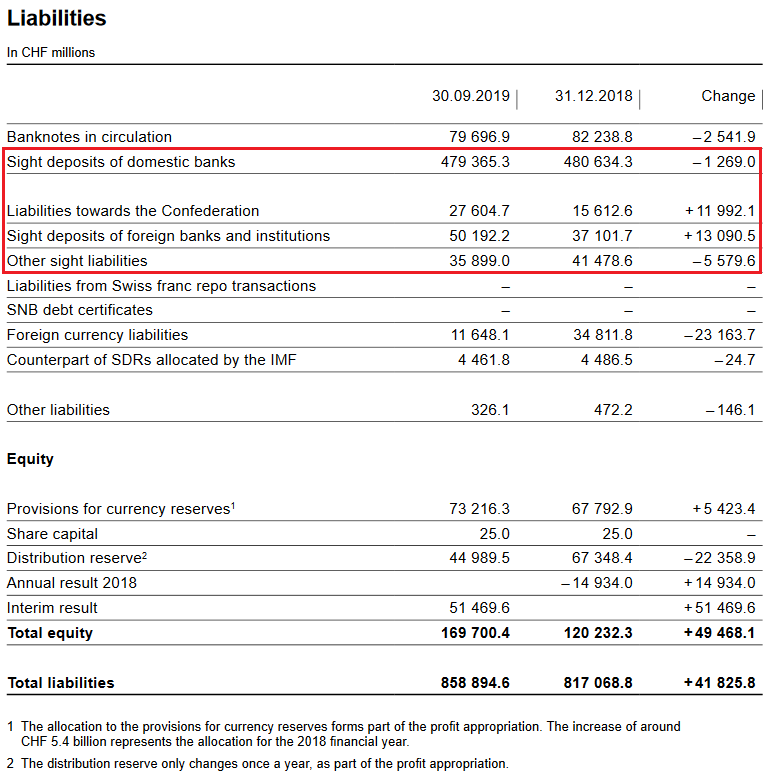

SNB LiabilitiesElectronic Money Printing: Sight Deposits Sight deposits is the biggest part of SNB interventions. In the third quarter, the SNB intervened again, increasing sight deposits and its debt towards the Swiss state.

Paper PrintingBanknotes in circulation: -2.54 bn francs to 79.7 bn. CHF This old form of a printing press, today a less important form of central bank interventions. It showed that safe-haven Swiss francs, e.g. 1000 franc bank notes are currently less in demand than previously. Provisions for currency reservesThe SNB seems to think that the price gains in bonds and in stocks are forever sure. Only about 10% of the paper gain is put into the provisions for potential bigger FX losses. |

SNB Liabilities and Sight Deposits for Q3 2019 Source: snb.ch - Click to enlarge |

Tags: Featured,newsletter,SNB balance sheet,SNB equity holdings,SNB Gold Holdings,SNB profit,SNB results,SNB sight deposits,Swiss National Bank