By EconMatters In this Video, we discuss the fact that Central Banks have basically morphed into Hedge Funds with similar risky investing strategies, except they buy without any regard to the underlying fundamentals of the assets they are buying. When did the Swiss Citizens say it was the proper role for the Swiss National Bank to be buying US Stocks? How is this stimulating the Swiss Economy? Central Banks have really...

Read More »What Will Trump Do About The Central-Bank Cartel?

Submitted by Thorstein Polleit via The Mises Institute, The US is by far the biggest economy in the world. Its financial markets — be it equity, bonds or derivatives markets — are the largest and most liquid. The Greenback is the most important transaction currency. Many currencies in the world — be it the euro, the Chinese renminbi, the British pound or the Swiss franc — have actually been built upon the US dollar. The...

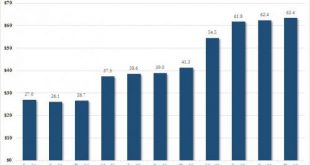

Read More »Swiss National Bank’s U.S. Stock Holdings Hit A Record $63.4 Billion

Being able to print your own money and buy stocks at any price sure can be fun. Just as the SNB which unlike many other (if ever fewer) central banks admits to doing just that. In its latest 13F filing, the Swiss National Bank reported that the value of its portfolio of US stocks rose again in the fourth quarter, increasing by 1.6% from $62.4 billion as of Sept. 30 to a record high $63.4 billion at the end of the year....

Read More »Largest Retail FX Broker FXCM Banned By CFTC, Fined $7 Million For Taking Positions Against Clients

The CFTC on Monday fined Forex Capital Markets, parent FXCM Holdings LLC and founding partners Dror Niv and William Ahdout to pay $7 million to settle charges it defrauded retail foreign exchange customers and engaging in false and misleading solicitations. As part of the settlement, FXCM agreed to withdraw its registration and never seek to register with the CFTC again, effectively banning it from operating in the...

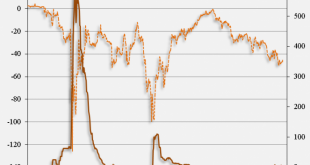

Read More »The VIX Will Be Over 100 due to Central Bank Created Tail Risk

By EconMatters We discuss the manner in which Central Banks have destroyed financial markets, and have the stage for what I label as the Red Swan Event in this video. When the Swiss National Bank holds risky Tech stocks in its portfolio, we are in unchartered territory! We had the Financial Crisis of 2008, and instead of learning from the mistakes of incentivizing excessive risk taking, the Central Banks were allowed to...

Read More »Vollgeld, the Blockchain, and the Future of the Monetary System

Presentation at the Liechtenstein Institute about the Vollgeld initiative, the blockchain revolution, and their possible effects on banks and the monetary system. Report in Liechtensteiner Vaterland, February 1, 2017. HTML. Interview in Wirtschaft Regional, February 4, 2017. PDF.

Read More »Who Owns the Public Gold: States or Central Banks?

It’s a common misconception that the world’s major central banks and monetary authorities own large quantities of gold bars. Most of them do not. Instead, this gold is owned by the sovereign states that have entrusted it to the respective nation’s central bank, and the central banks are merely acting as guardians of the gold. Tracing the ownership question a step further, what are sovereign states? A sovereign state is...

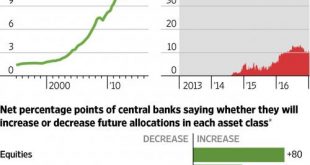

Read More »80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded “fake news” by the established financial “kommentariat.” What a difference eight years makes, because today none...

Read More »Jewish Trust Sues Deutsche Bank For $3 Billion

Just when it seemed that no more lawsuits are possible for Germany's largest lender, which over the past two years has settled or otherwise paid billions to set aside a barrage of allegations of wrongdoing leading to the bank's suspension of bonuses for most senior bankers, today we learn that Deutsche Bank was sued by a Jewish charitable trust in Florida, alleging that the bank wrongly withheld as much as $3 billion from the heirs to a wealthy German family. According to Bloomberg, the...

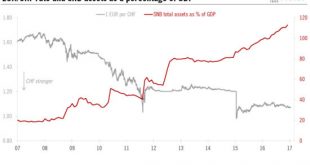

Read More »The ‘Frankenshock’, two years on

The Swiss economy has proved more resilient than expected to the sudden appreciation of the Swiss franc in January 2015, but negative deposit rates could remain in place through 2017.On 15 January 2015, the Swiss National Bank (SNB) decided to discontinue the minimum exchange rate of CHF1.20 per euro introduced in September 2011. The SNB’s announcement came as a shock for the Swiss economy, and resulted in a sharp appreciation of the Swiss franc. But two years later, the Swiss economy has...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org