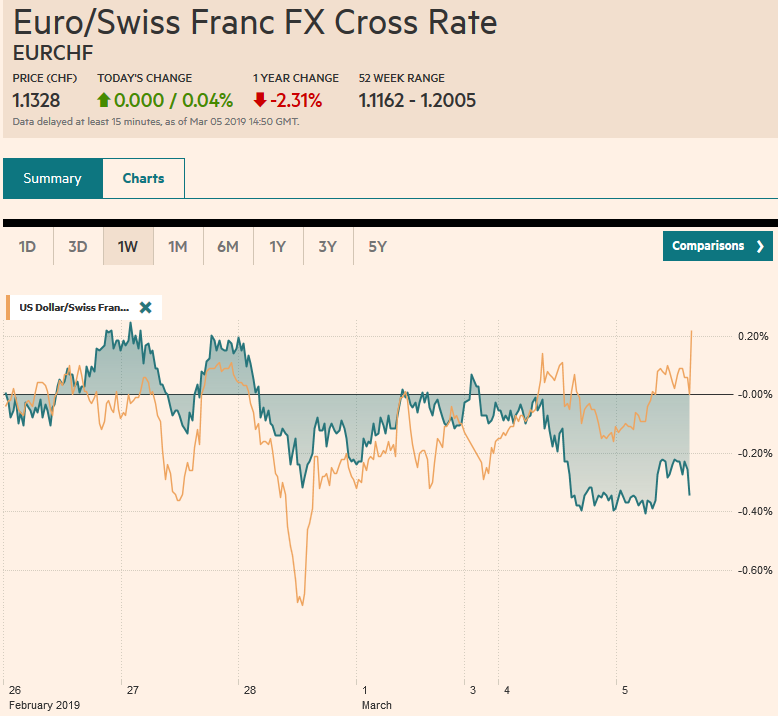

Swiss Franc The Euro has risen by 0.04% at 1.1328 EUR/CHF and USD/CHF, March 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It is an eventful day, but the capital markets are taking it in stride. Equity markets are mixed. Asia may have been weighed down by China’s shaving its growth target and announced around CNY2 trillion (~0 bln) in tax cuts to support the economy, though Chinese stocks edged higher. India was the other major market to rise in Asia and this despite the US giving 60-day notice that its preferential trade treatment would end due to the lack of sufficient reciprocity. Turkey is also going to have this privilege removed, but in its case,

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, CAD, EUR, Featured, GBP, JPY, MXN, newsletter, SPX, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.04% at 1.1328 |

EUR/CHF and USD/CHF, March 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: It is an eventful day, but the capital markets are taking it in stride. Equity markets are mixed. Asia may have been weighed down by China’s shaving its growth target and announced around CNY2 trillion (~$300 bln) in tax cuts to support the economy, though Chinese stocks edged higher. India was the other major market to rise in Asia and this despite the US giving 60-day notice that its preferential trade treatment would end due to the lack of sufficient reciprocity. Turkey is also going to have this privilege removed, but in its case, it is because of good behavior the sense that it no longer qualifies as a developing country for this assistance purpose and its stock market reacted less favorable. Europe equities are firm as the Dow Jones Stoxx 600 tries to extend its advance for a fourth session. The service PMIs generally surprised on the upside in Europe, with Spain the notable exception. Benchmark 10-year yields are mostly 1-2 basis points firmer with notable exceptions in Australia and New Zealand. The Reserve Bank of Australia remained on hold as nearly universally expected. The dollar is firmer against most currencies. Among the majors, the Swedish krona is the exception as the stronger than expected PMI follows last week’s Q4 GDP upside surprise underpins the currency. The Philippine’s peso is suffering its largest loss in several years following what is seen as a political appointment to head the central bank. |

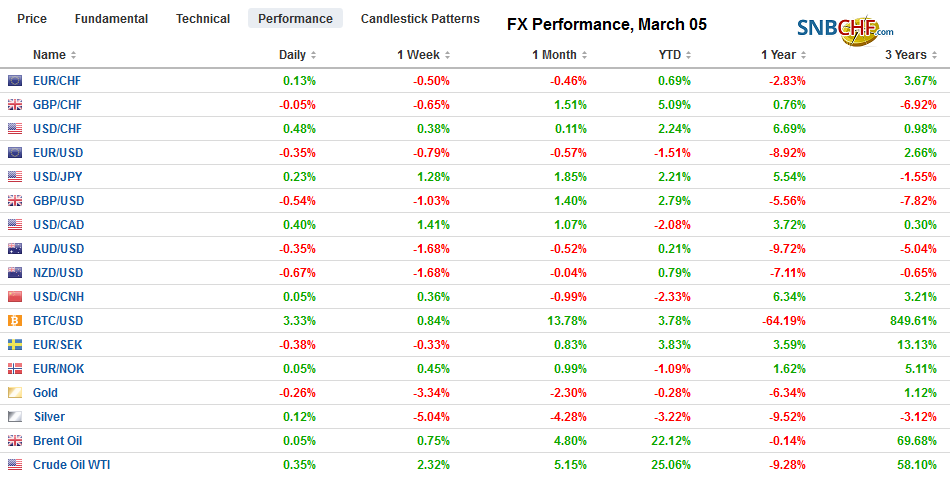

FX Performance, March 05 |

Asia Pacific

Economists raise questions about the veracity of Chinese economic data. Yet, we can glean much insight into the state of the economy by the measures proposed to address it. We have argued that officials have had their “Draghi moment” and will do whatever it takes to support the economy in the face of US tariffs and during the 70th anniversary of the Revolution. It is as if the CCP is renewing its pledge to the Chinese people to deliver better growth while tightening its grip on politics. The focus of China’s new measures is on tax cuts more than spending increases. Some initiatives, like the three percentage point cut in the highest of three VAT rates, are meant to discourage capital outflows. There will also be more targeted cuts in the required reserve ratio. The stimulus program is estimated to be around 1.25%-1.50% GDP. The GDP target was lowered to 6.0%-6.5% from about 6.5% last year. The budget deficit goal is 2.8% of GDP. Last year’s goal was 2.6%. The call for a stable yuan, apparently demanded the US trade negotiators, was repeated at this year’s National Party Congress. The disappointing Caixin service PMI (51.1. vs. 53.6 in January) was seen as old news in light of the economic stimulus announced.

Japan’s service PMI improved to 52.3 from 51.6, but because of the manufacturing slump, the composite PMI slipped to 50.7 from 50.9. Japan is expected to revise up its estimate for Q4 GDP from 1.4% at an annualized pace to 1.7%, at the end of the week. New Capex figures are behind the expectation. Japan is still going forward with the retail sales tax hike (from 8% to 10%) in October. The government is rolling out a number of different tax breaks to underpin consumption.

The Reserve Bank of Australia left the cash rate at 1.50%, surprising no one. Despite the RBA’s claims of neutrality, the market is gradually pricing in a greater chance of a cut in the second half. The composite PMI slid to 49.1 from 49.7 of the flash reading and 51.3 in January. Fourth quarter GDP will be reported tomorrow. There is a downside risk to the 0.3% median forecast, which would be the same as Q3 18. Today, Australia reported that net exports shrank 0.2% in Q4. After a 0.4% gain in Q3, economists expected a 0.1% contraction in Q4.

The dollar has been confined to about a quarter of a yen range below JPY112.00. There are nearly $3 bln in options struck between JPY111.90 and JPY112.00 that expire today. Above JPY112 that we may see after the options cut, the next target is near JPY112.60. The Australian dollar was sold to nearly $0.7065, its lowest level since February 12. Resistance is now seen in the $0.7090-$0.7100 area.

Europe

The EMU service and composite PMI was better than the flash reading. It supports our suspicion that the worst of the growth slowdown is behind it. The improvement was broad-based. Spain was the notable exception. Its economy has been among the strongest in the region. The minority-led Socialist government was unable to pass the budget last month and was forced to call elections for April. Its manufacturing PMI had previously disappointed, and today it announced the service PMI slipped to 54.5 from 54.7. The composite eased to 52.5 from 54.5. Italy’s service sector expanded (50.4) from its contraction (49.7), but this was not enough to lift the composite back above the 50 boom/bust level (49.6 vs. 48.8). Germany, not known for its service sector, showed improved to 55.3 from 55.1 of the flash. This lifted the composite reading to 52.8 from 52.7. It is the second monthly gain and is at its best level since last October. France, marred by the continuing Yellow Vest protests, the service sector rose to 50.2 from 49.8, and the composite poked back above 50 to 50.4 from 49.9 of the flash.

The UK PMI was better than expected. The services reading stands at 51.3 from 50.1 in January. The median forecast was for a tad below 50. The composite rose to 51.5 from 50.3. This is the best reading since October. However, the high-frequency economic data is being overwhelmed by Brexit. Today a delegation that includes Attorney General Cox is in Brussels to ostensibly hammer out some legally binding changes to the Irish backstop. We doubt the EU is prepared to re-open the Withdrawal Treaty but still may be willing to craft some words of comfort about intent. A recent Bloomberg poll found a little more than a third (37%) expect the Withdrawal Bill to be passed next week. Less than a tenth (9%) see no deal, while 54% anticipate a postponement.

The euro has been confined to about a quarter of a cent in the lower end of yesterday’s range. While it has not been below $1.1315, it has not been above $1.1340. The market retains a bearish bias ahead of Thursday’s ECB meeting, where growth forecasts are expected to be cut, and a commitment to a new loan facility (TLTRO) is anticipated. Sterling is lower for the fourth consecutive session, but the downside momentum eased after $1.3150 was tested. There is a nearly GBP300 mln option at $1.32 that expires today. It was capped near $1.3220 in North America yesterday.

America

We argue that many of the crosscurrents that Fed Chief Powell identified are likely to be lifted or resolved in the next few months. We are looking past what will likely be a poor Q1 performance, but already before the quarter ends, some signs of resilience are being seen. The labor market, which the February report at the end of the week should confirm, remain robust. Today the Markit composite PMI is expected to confirm the improvement to 55.8 from 54.4 in January. The non-manufacturing ISM is expected to improve as well. On the other hand, new home sales for December were likely poor. Separately, the US monthly budget position for January will be reported. A $12 bln surplus is expected, but do not be misled. This still represents significant fiscal deterioration. The surplus in January 2018 was $49.2 bln. The deficit in Q1 18 was $375 bln. The deficit in Q4 18 was $318 bln.

The Canadian economy is disappointing, and Trudeau’s politic problems are heating up. Another minister (Treasury Board’s Philpott) resigned over the government’s attempt to interfere with a judicial case. The Bank of Canada meets tomorrow. There is no chance of a change in policy, but last year’s three hikes may have been too much. The US hiked rates four times but had a large fiscal stimulus too. Canada did not have nearly the fiscal stimulus, plus bottleneck in the pipelines that also bogged things down. If the Bank of Canada is not going to ease, the market may do it (partially) for it through the exchange rate.

The US dollar is approaching the January high near CAD1.3375. The 50% retracement of this year’s decline is found a little below there (~CAD1.3355). The next retracement objective is seen near CAD1.3440. It appears the US dollar may have carved out a potential head and shoulders bottom that projects back to the end of 2018 high near CAD1.3665. The Mexican peso is little changed. The market rejected the MXN19.40 level yesterday. It may test support in the MXN19.15-MXN19.20 range today. The Dollar Index is firm. It is up against 96.80, which is a retracement objective of the decline from the middle of February. Initial support is seen near 96.60. The S&P 500 traded on both sides of last Friday’s range yesterday, but the close neutralized what could have been a negative technical development. The 20-day moving average (~2761) held yesterday. US shares are trading firmer in Europe and the early call is for a slightly higher opening. We remain cautious, suspecting more corrective pressures, which could come from a broad sideways movement rather than a serious decline.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,Featured,MXN,newsletter,SPX