The important events take place in the second half of the week ahead: the ECB meeting and the US employment report. A dovish hold by the ECB is the most likely outcome. US jobs growth is bound to slow from the heady 304k gain in January, but there won’t be anything in it that lends credence to ideas that the world’s largest economy is on the precipice of a recession. The Brexit drama could be moving into its homestretch. In the coming days, though it is still not clear exactly when the UK and the EU may agree on a statement of intent that the Withdrawal Bill can be wrapped in to help ease concerns over the Irish backstop. Then sometime around March 12, the House of Commons will again vote on the Withdrawal

Topics:

Marc Chandler considers the following as important: $CAD $GBP, $CNY, 4) FX Trends, AUD, Brexit, EUR, Featured, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The important events take place in the second half of the week ahead: the ECB meeting and the US employment report. A dovish hold by the ECB is the most likely outcome. US jobs growth is bound to slow from the heady 304k gain in January, but there won’t be anything in it that lends credence to ideas that the world’s largest economy is on the precipice of a recession.

The Brexit drama could be moving into its homestretch. In the coming days, though it is still not clear exactly when the UK and the EU may agree on a statement of intent that the Withdrawal Bill can be wrapped in to help ease concerns over the Irish backstop. Then sometime around March 12, the House of Commons will again vote on the Withdrawal Bill and with the wrapper, and lo and behold, many who voted against it before will vote in favor of it.

Why? Prime Minister May has a new doomsday scenario that the Withdrawal Bill is the only alternative. The Labour Party has played its part by forcing Corbyn to honor a party position of supporting a second referendum, which is then the stealth cover for those who want to Remain. If the Withdrawal Bill does not secure a majority, there will be a vote the following day on leaving with no deal. Assuming that is not supported by a majority, there would be a vote the next day seeking an extension. A no-deal exit may be the worst thing, but what some might not appreciate is the total mess (yes, worse than a dog’s breakfast) if that too did not get majority backing.

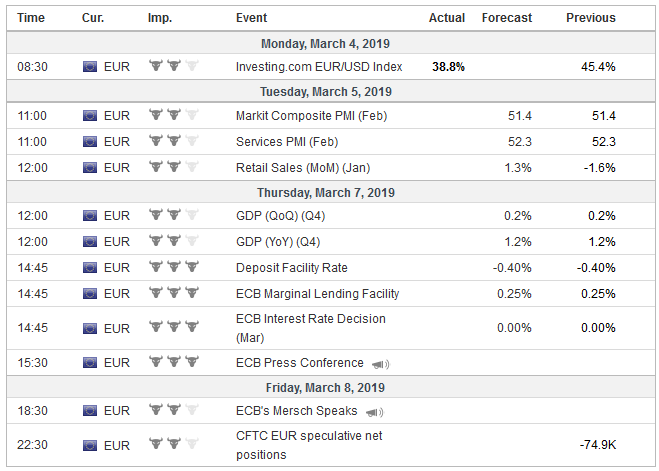

EurozoneThis week’s ECB meeting is key. Two outcomes are likely, and although no change in rates can be expected, both will support the characterization of a dovish hold. First, the ECB will likely commit itself to a new long-term lending facility. A targeted long-term refinancing operation (TLTRO) would allow banks to refinance before the old operation complicates their management of short-term liquidity ratios. This is no economic or financial panacea. It simply avoids a potential strain. The ECB may not provide much detail about the new facility, but the announcement effect could produce favorable price action. Second, the ECB’s staff will update its forecasts and recall, that at the last meeting, the ECB did to deem it necessary to wait for the update before changing the risk assessment. The growth forecast will be shaved and the flash February inflation was disappointing. The core rate unexpectedly slipped to 1.0% from 1.1%. The headline rate did tick up to 1.5% from 1.4%. Price pressures for goods have been tame for some time, what is new is that service price growth slowed to 1.3% from 1.6%. Some economists strip other items out of the core that do not appear particularly sensitive to monetary policy like package holidays (e.g., Bloomberg), which have risen for several months through January. It is interesting, but the difference between the core and the super core may not be sufficiently significant for policymakers. The sobering forecasts will require a policy response. It could come in the form of an adjustment to its forward guidance. Currently, the position is that rates will not be raised before the end of summer. The economic weakness and sub-par price pressures suggest a hike is unlikely this year. The issue is how far out doe the ECB want to pre-commit, especially given the change at the helm with Draghi’s term ending in October. Two different criticisms that are being levied against the ECB. One camp says that the ECB missed the opportunity to hike rates. Ostensibly, the ECB could have hiked rates in 2017 when the economy expanded by 0.7% each quarter. While headline CPI did rise to 2.0%, the core rate never got about 1.3%. The ECB could not repeat the policy error under Trichet, who engineered two rate hikes in the face of oil prices that were rallying toward $160 a barrel. Another source of criticism is that negative interest rates are counter-productive. This is not new and many, especially from the creditor countries and classes, have abhorred the negative interest rates from day one. Negative interest rates was a European innovation that later Japan adopted too. The US never did. The critics often do not appear to have thought through how once negative interest rates are in place, they can be exited. A hike in the deposit rate from the current -40 bp would likely spur a sharp tightening of financial conditions in the face of sluggish growth and soft price pressures. We suspect that a less disruptive way would suggest beginning from the other direction. Don’t raise rates, simply narrow the range of deposits that are subject to the punitive negative rate. |

Economic Events: Eurozone, Week March 04 |

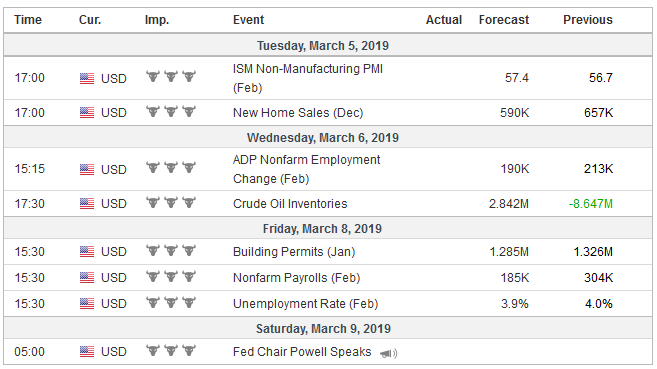

United StatesThe US employment data remains arguably the single more important high-frequency economic report. Its credibility appears to have risen as there have not been claims that it is rigged since the 2016 election. It is unreasonable to expect that the US economy generated more than 300k jobs two-months in a row. It has not done that since 2015. Since then, there is usually payback after a 300k+ month. The median forecast is coming in around 180k, which strikes us as on the high side. Job growth closer to 150k would not surprise us. Weekly jobless claims were higher. The ISM employment component softened. Judging from the data surprise model performances, even though Q4 GDP was better than expected, economists still do not appear to have sufficiently adjusted to the downshift in growth. We would not judge not necessarily judge a 150k rise as a weak, especially if the unemployment rate slips below 4%. Perhaps most importantly, hourly earnings could return to their cyclical high of 3.3% (year-over-year). The US debt ceiling is back in force after being suspended for the past year. The reason it does not matter yet to most investors is that they have been down this road before, and so has the Treasury. They know how to maneuver around it for a few months. So the effective cap is not at hand. The crunch time is projected to be in September or October when the Treasury exhausts its work around. To protect themselves from disruption, investors appear to be somewhat less interested in the six-month bills that would be settled around then. |

Economic Events: United States, Week March 04 |

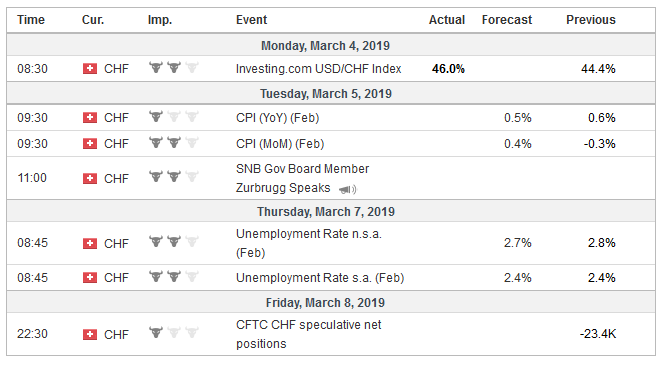

Switzerland |

Economic Events: Switzerland, Week March 04 |

The Reserve Bank of Australia and the Bank of Canada hold policy meetings in coming days. The RBA claims it is neutral, but the market leans toward a rate cut in the second half of the year. The Bank of Canada says it is no hurry to raise rates, but eventually it will have to return to a neutral setting. However, the GDP figures that were released before the weekend may soften Governor Poloz tone.

The Canadian economy grew at an annualized pace of 0.4% in Q4 18. The economy contracted by 0.1% in November and December. The year-over-year pace of 1.1% is the lowest since August 2016. Consumption was its weakest in almost four years. Housing fell the most in a decade. The two-year interest rate differential between the US and Canada rose close to 80 bp, the most since 2006. The Canadian dollar was sold-off in response to the disappointment and the nearly one percent decline was the largest since November 20.

China’s data are always interesting even though the accuracy is widely questioned. It will be important to see if investors look through any economic weakness on ideas that the stimulus is in the pipeline. We suspect this is the case. China officials have the ability and will to create the conditions that favor stronger growth. Chinese reserve figures are closely scrutinized, but in February they were probably little changed. The trade figures will be skewed by the Lunar New Year and disruptions by the US tariffs. However, exports may have been softer while imports likely rose, though this may reflect prices rather than quantities. Overall the trade surplus looks to have narrowed. China may also publish its February CPI and PPI. Disinflation pressures are consistent with economic weakness. If we are right and the low point has passed, then PPI should begin stabilizing.

Tags: #USD,$AUD,$CAD $GBP,$CNY,$EUR,Brexit,Featured,newsletter