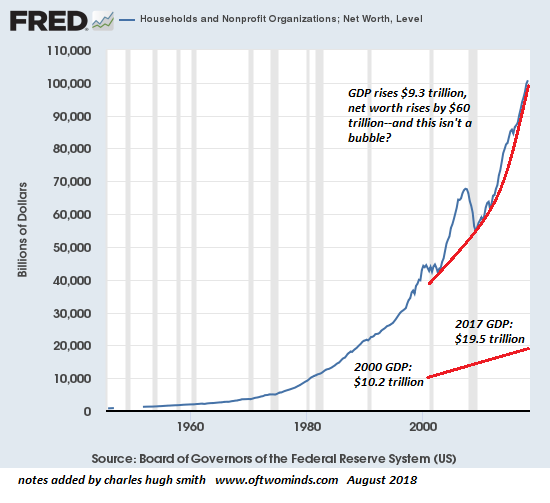

The Fed is the mortal enemy of the young generations, and thus of the nation itself. “The wealth effect” generated by rising stock and housing prices has long been a core goal of the Federal Reserve and other central banks. As Lance Roberts noted in his recent commentary So, The Fed Doesn’t Target The Market, Eh?(Zero Hedge), Ben Bernanke added a “third mandate” to the Fed – the creation of the “wealth effect”–in 2010, the reasoning being that higher asset prices “will boost consumer wealth and help increase confidence” which will then lead to higher spending and all the wonderfulness of endless economic expansion. But as Chris Hamilton explains in his recent essay Economic Doom Loop Well Underway, “the wealth

Topics:

Charles Hugh Smith considers the following as important: 5) Global Macro, Featured, newsletter, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| The nation is losing an entire generation as a result of the Fed’s cargo-cult like obsession with boosting the wealth of the haves. The wealth effect is the most generationally lopsided policy possible, the equivalent of a “tax on youth.

“Sure, a few lucky folks got a down payment from the parents to buy a home in bubblicious areas like Seattle, Portland or Brooklyn in the narrow window between 2009 and 2012, but what percentage of Millennials managed to buy in this brief window before the Fed inflated Housing Bubble #2? Not many. How many Millennials cobbled together a stock portfolio (or secured stock options) before the S&P 500 shot up from 700 to 2,800? Not many. |

Households and Nonprofit Organizations 1960-2018 |

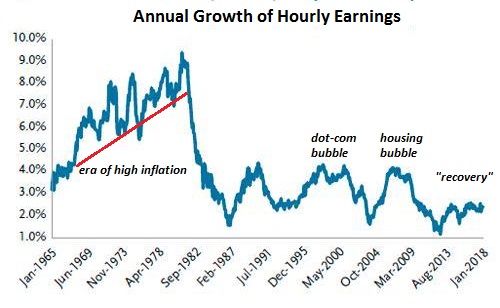

| How many Millennials have seen their earned income match or exceed the sharp increases in rent, college tuition and healthcare? Not many. |

Annual Growth of Hourly Earnings 1965-2018 |

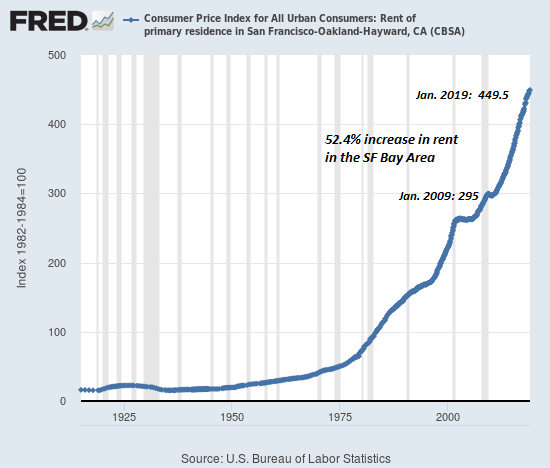

| Rent has climbed by between 30% and 50% since 2009: |

Consumer Price Index for All Urban Consumers 1925-2018 |

Tags: Featured,newsletter