Swiss Franc The Euro has risen by 0.04% at 1.1181 . FX Rates Overview: The weekend failed to break the grip of investor worries that is driving stocks and yields lower. The US Administration’s penchant for tariffs is not simply aimed at China, where there is some sympathy, but the move against Mexico, dropping special privileges for India, and apparently, had considered tariffs on Australia. At the same time, the...

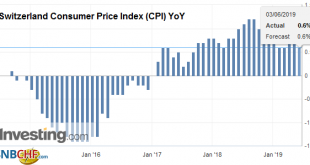

Read More »Swiss Consumer Price Index in May 2019: +0.6 percent YoY, +0.3 percent MoM

03.06.2019 – The consumer price index (CPI) increased by 0.3% in May 2019 compared with the previous month, reaching 102.7 points (December 2015 = 100). Inflation was 0.6% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). The 0.3% increase compared with the previous month can be explained by several factors including rising prices for fuel and for...

Read More »Switzerland world’s 4th most competitive nation, according to business school ranking

© Bogdan Lazar | Dreamstime.com Every year, Lausanne-based IMD business school publishes its global competitiveness ranking. Switzerland climbed from 5th last year to 4th behind Singapore, Hong Kong and the US. Venezuela (63rd) was last. The ranking, established in 1989, incorporates 235 indicators and takes into account a wide range of “hard” statistics such as unemployment, GDP and government spending on health and...

Read More »FX Weekly Preview: Curiouser and Curiouser

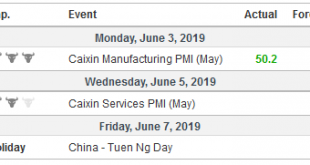

The first week of June features the Reserve Bank of Australia meeting, an ECB meeting, and the US employment data. The RBA is expected to deliver its first rate cut in three years. The market appears to have discounted not only a second cut in H2 but has priced nearly half of a third cut as well. A soft inflation reading after the seasonal bump in April and disappointing survey data, with Brexit and trade tensions,...

Read More »Fewer Swiss farms and dairy cows, more egg-layers and goats

There was a 3.1% jump in the number of goats in 2018, especially in mountain regions. (Keystone / Arno Balzarini) Last year 768 farmers in Switzerland called it quits, while others increased their livestock numbers and production of organic food. Figures released this week by the Swiss Federal Statistical Officeexternal link revealed a 1.5% drop in the number of farms, bringing the total down to 50,852. However, the...

Read More »Switzerland a top place for skilled foreign workers and students

Switzerland is ranked the most attractive destination for international students. Switzerland is one of the most attractive locations for highly qualified foreign workers, according to a new study by the Organisation for Economic Cooperation and Development (OECD). In a ranking of 35 countries presented on Wednesday, Switzerland comes third behind Australia and Sweden as an attractive destination for skilled workers...

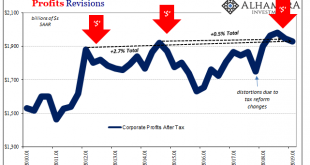

Read More »More What’s Behind Yield Curve: Now Two Straight Negative Quarters For Corporate Profit

The Bureau of Economic Analysis (BEA) piled on more bad news to the otherwise pleasing GDP headline for the first quarter. In its first revision to the preliminary estimate, the government agency said output advanced just a little less than first thought. This wasn’t actually the substance of their message. Accompanying this first revision was the first set of estimates for corporate profits. For the second straight...

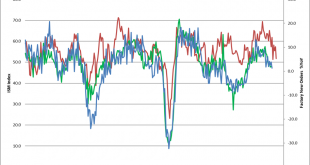

Read More »US Money Supply Growth and the Production Structure – Signs of an Aging Boom

Money Supply Growth Continues to Decelerate Here is a brief update of recent developments in US true money supply growth as well as the trend in the ratio of industrial production of capital goods versus consumer goods (we use the latter as a proxy for the effects of credit expansion on the economy’s production structure). First, a chart of the y/y growth rate of the broad US money supply TMS-2 vs. y/y growth in...

Read More »FX Daily, May 31: US Struggles to Build Physical Wall, Tries Tariff Wall on Mexico

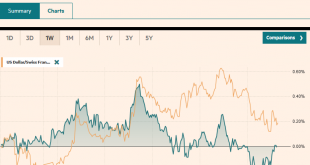

Swiss Franc The Euro has fallen by 0.01% at 1.1214 EUR/CHF and USD/CHF, May 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US announcement to lay a 5% tariff on all goods coming from Mexico (starting June 10) until it stops the flow of “illegal migrants” spurred sharp losses in the Mexican peso and general risk-off move that strengthened the yen. The...

Read More »Expansion of SNB statistics

New Focus Article series published on data portal The Swiss National Bank is expanding its offering in the field of statist ics. It is to start publishing articles on selected statistical subjects at irregular intervals. These articles will appear on the SNB data portal (data.snb.ch, Resources, International economic affairs, Focus articles) as so-called focus articles. The first focus article is out now and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org