© Georgejmclittle | Dreamstime.com The National Council, Switzerland’s parliament, rejected a motion to force Swiss mobile phone operators to remove EU roaming charges. 99 voted against, 78 for and 14 abstained, according to the newspaper 20 Minutes. In 2017, the European Union (EU) forced EU operators to stop charging their customers extra for calls made outside their home country but within the EU. This left Swiss...

Read More »A Surprise Move in Gold

Traders and Analysts Caught Wrong-Footed Over the past week gold and gold stocks have been on a tear. It is probably fair to say that most market participants were surprised by this development. Although sentiment on gold was not extremely bearish and several observers expected a bounce, to our knowledge no-one expected this: Back in April the so-called “managed money” category in the disaggregated commitments of...

Read More »FX Daily, June 7: Jobs Data and Tariffs Dominate

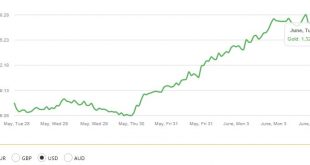

Swiss Franc The Euro has risen by 0.11% at 1.1186 EUR/CHF and USD/CHF, June 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities continue to recover from the recent slide. Chinese and Hong Kong markets were on holiday today, but the MSCI Asia Pacific Index eked out a minor gain and ensured that its four-week slide ended. Europe’s Dow Jones Stoxx 600...

Read More »Is the Tech Bubble Bursting?

There are two other trends that don’t attract quite the media attention that soaring profits do. Is the decade-long tech bubble finally popping? Tech bulls are overlooking the fundamental reality that the drivers of Big tech’s phenomenal growth–financialization and expansion into mobile telephony– are both losing momentum. A third dynamic–Big Tech monetizing privately owned assets such as vehicles and homes– has also...

Read More »Swiss regulator fines banks over improper forex trading

Ten currencies, including the Japanese yen, were traded in the banks’ foreign exchange spot markets. (Keystone) The Swiss Competition Commission (COMCO) has fined five international banks for their involvement in the formation of cartels that manipulated the foreign exchange market. COMCO fined Barclays, Citigroup, JPMorgan, the Royal Bank of Scotland (RBS) and the MUFG Bank a total of CHF90 million ($90.6 million) for...

Read More »Gold Hits 10 Week High At $1,328/oz as Trade Wars Spur Safe Haven Demand

Gold has consolidated on yesterday’s gains and is marginally higher as risk aversion creeps back into markets. Gold rose 1.5% yesterday to its highest level in more than three months. Concerns that trade wars look set to escalate globally and fears that President Trump’s threat of tariffs on Mexico will hurt the global economy are spurring safe haven demand. Gold had a fourth straight session gain yesterday, settling at...

Read More »FX Daily, June 6: US Tariff Threats on Mexico Compete with ECB for Attention

Swiss Franc The Euro has risen by 0.18% at 1.1178 EUR/CHF and USD/CHF, June 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The implications of President Trump’s assessment that there has not been “nearly enough” progress in negotiations with Mexico that would avert the tariff on June 10 competing for investors’ attention, which had been squarely today’s ECB...

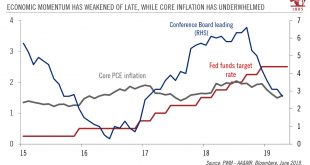

Read More »Why has euro inflation stayed so low?

Weak inflation data pose a conundrum, both in terms of the growth outlook and the ECB’s policy stance. We believe the ECB will stay on hold in 2020. The euro area headline flash Harmonised Index of Consumer Prices (HICP) dropped to 1.2% year on year in May from 1.7% the previous month. Core inflation fell by 50bp to 0.8% y-o-y. While this reflects volatility stemming from the date of Easter this year, one can...

Read More »A dovish Fed could become even more so

Trade, inflation expectations and economic data could well spark ‘insurance’ rate cuts by the Fed in the coming months. We now believe that the Federal Reserve (Fed) could deliver two ‘insurance’ rate cuts of 25bps in coming months (up to now, we expected rates to be on hold in 2019-2020). We see three drivers that could dictate the exact timing of these cuts: 1) a continuation of President Trump’s pro-tariff stance...

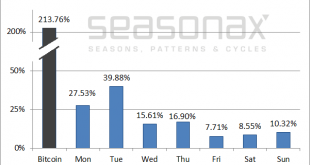

Read More »Bitcoin: What is the Best Day of the Week to Buy?

Shifting Patterns In the last issue of Seasonal Insights I have discussed Bitcoin’s seasonal pattern in the course of a year. In this issue I will show an analysis of the returns of bitcoin on individual days of the week. It seems to me that Bitcoin is particularly interesting for this type of study: it exhibits spectacular price gains, it is a very new instrument and it is unregulated. Moreover, it trades around the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org