The Bureau of Economic Analysis (BEA) piled on more bad news to the otherwise pleasing GDP headline for the first quarter. In its first revision to the preliminary estimate, the government agency said output advanced just a little less than first thought. This wasn’t actually the substance of their message. Accompanying this first revision was the first set of estimates for corporate profits. For the second straight quarter, net incomes in the sector fell. This part of economic life can be noisy, a single quarter’s minus perhaps not all that meaningful. Two in a row, however, this reduces the chances of randomness and introduces a very likely real trend. It is but further confirmation of Euro$ #4’s handiwork in the

Topics:

Jeffrey P. Snider considers the following as important: 5) Global Macro, bonds, China, corporate profits, currencies, economy, Featured, Federal Reserve/Monetary Policy, GDP, Markets, newsletter, stocks, The United States, U.S. Treasuries, Yield Curve

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| The Bureau of Economic Analysis (BEA) piled on more bad news to the otherwise pleasing GDP headline for the first quarter. In its first revision to the preliminary estimate, the government agency said output advanced just a little less than first thought. This wasn’t actually the substance of their message.

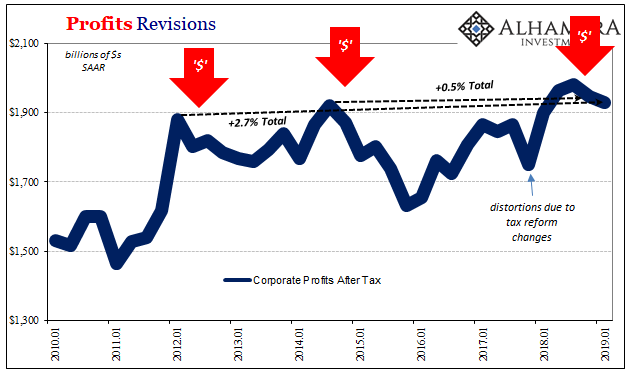

Accompanying this first revision was the first set of estimates for corporate profits. For the second straight quarter, net incomes in the sector fell. This part of economic life can be noisy, a single quarter’s minus perhaps not all that meaningful. Two in a row, however, this reduces the chances of randomness and introduces a very likely real trend. It is but further confirmation of Euro$ #4’s handiwork in the real economy. The last time profits had declined in consecutive quarters? In 2015 during Euro$ #3. |

Profits Revisions, 2010-2019 |

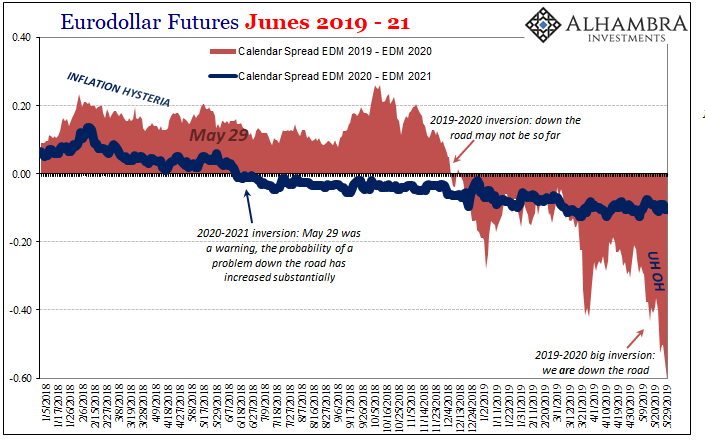

| The downward slope is not huge, but it is sustained. We can reasonably guess it continued at least this way into Q2 (if not accelerated on the downside). There is real economy information in things like the yield curve and eurodollar futures, financial participants whose business brings them in contract with real companies operating out in the world.

This profit downturn is another basis for the yield plunge and curve distortions, another piece of evidence for why fear is up and optimism has been almost entirely displaced throughout the vast networks of the “bond market.” |

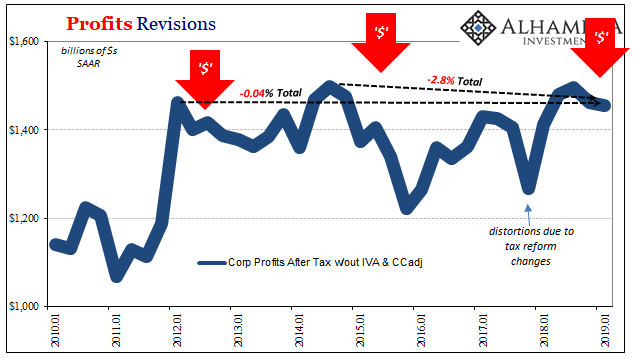

Profits Revisions, 2010-2019 |

| It points to rising risks beyond half a year of negative bottom line “growth.” Businesses are not going to be doing any of the things required of them in order to make for Jay Powell’s second half rebound. Instead, they are going to be scaling back even more than they might’ve already, anything to get net income growth back on the plus side.

This is exactly what the yield curve during Q2 increasingly points toward. The profit numbers fill in more of the details behind those intentions. There are risks in the real sector as well as for stock investors. In the former, businesses who like shareholders had been expecting Powell’s inflationary recovery scenario to pan out and who had been willing to cut him some slack (meaning time) for it to materialize are going to be very short of patience under these conditions. You can keep doing some of the things like capex and inventory, maybe even hiring a few new workers while profit growth is at least growth even if still lackluster as it has been for seven years. Once that turns to minus signs, all bets are off. Two quarters in a row? The chances for the real nasty response, the self-reinforcing stuff of recessions rise. Again, yield curve. |

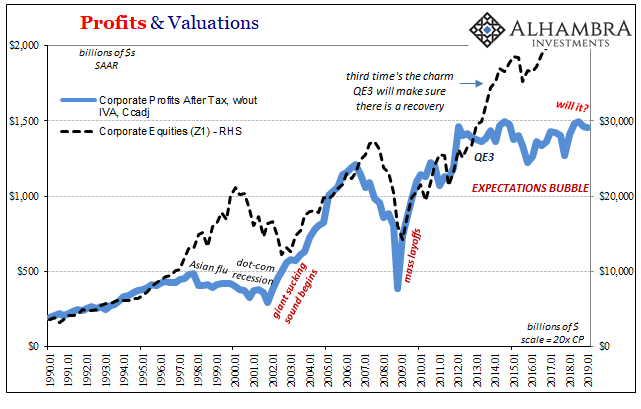

Profits & Valuations, 1990-2019 |

| For stock investors, it’s yet more evidence that the QE3 bet will never pay off. It’s not a monetary bubble in stocks, it has been an expectations bubble. Share prices had been rising sharply after 2012 taking Ben Bernanke at his word: this monetary policy puppet show would work if given enough time.

After years of subdued economic performance, meaning lack of true profit growth, everyone piled into the stock market before the recovery showed up. You get in early or you miss out. The danger, obviously, was that the recovery might never actually show up. This seemed minimal because, after all, four QE’s! Despite constant proclamations and exhortations from the official sector all over the world, especially in 2017, it never did happen. Corporate profits like bond yields told a much different story than the unemployment rate. Another setback in them is more compelling evidence the recovery is never happening. Not while the system remains the way it has been since August 2007. |

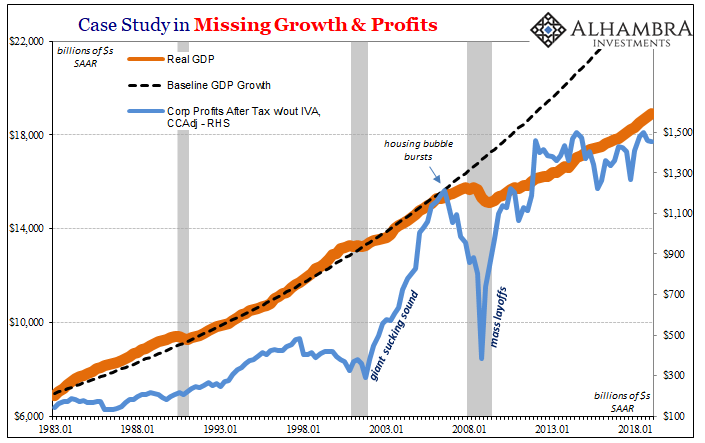

Case Study in Missing Growth & Profits, 1983-2018 |

| For the NYSE and DJIA, it instead became self-reinforcing rationalizations, even officially sanctioned. The stock market was up because the economy was on the road to recovery, and everyone knew the economy was on the road to recovery because the stock market was up. And still, corporate profits like bond yields never really budged. Profound and necessary skepticism. |

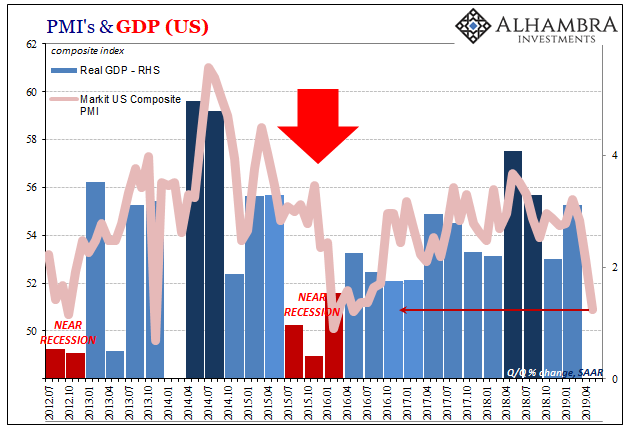

PMI's and GDP (US), 2012-2019 |

| This proved the real RINO, Recovery In Name Only. Which left us with RHINO, Rate Hikes In Name Only that are now being ruthlessly unwound in the same bond market which has the closest contact with corporate real economy business.

Economic softness is one thing. Combine that with serious profit pressures: rate cuts (plural) this year. |

Eurodollar Futures Junes 2019-21 |

Tags: Bonds,corporate profits,currencies,economy,Featured,Federal Reserve/Monetary Policy,GDP,Markets,newsletter,stocks,U.S. Treasuries,Yield Curve