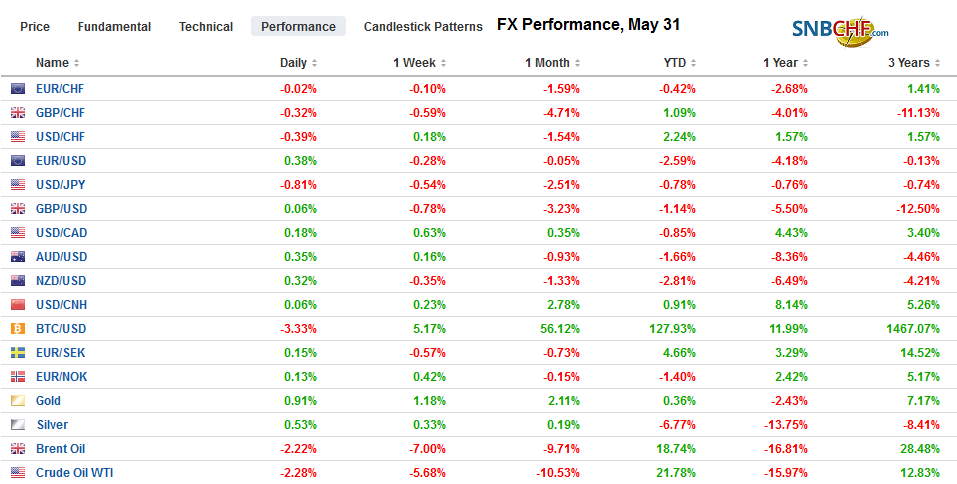

Swiss Franc The Euro has fallen by 0.01% at 1.1214 EUR/CHF and USD/CHF, May 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US announcement to lay a 5% tariff on all goods coming from Mexico (starting June 10) until it stops the flow of “illegal migrants” spurred sharp losses in the Mexican peso and general risk-off move that strengthened the yen. The tariffs are set to rise every month until reaching 25%. This is a significant surprise and especially given that the Trump Administration is preparing to formally submit the USMCA to Congress. The legislative ratification process has begun in both Canada and Mexico. The peso is off about 2.8%, the weakest in

Topics:

Marc Chandler considers the following as important: 4) FX Trends, China Manufacturing PMI, EUR/CHF, Featured, Japan Retail Sales, Japan Unemployment Rate, Mexico, MXN, newsletter, trade, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.01% at 1.1214 |

EUR/CHF and USD/CHF, May 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The US announcement to lay a 5% tariff on all goods coming from Mexico (starting June 10) until it stops the flow of “illegal migrants” spurred sharp losses in the Mexican peso and general risk-off move that strengthened the yen. The tariffs are set to rise every month until reaching 25%. This is a significant surprise and especially given that the Trump Administration is preparing to formally submit the USMCA to Congress. The legislative ratification process has begun in both Canada and Mexico. The peso is off about 2.8%, the weakest in the world today, while the Canadian dollar has weakened in sympathy. It is off about 0.25%, the most of the majors. The yen strengthened, and this coupled with the exposure of Japanese automakers, (Nissan, Mazda, Honda) which produce autos in Mexico and export to the US, weighed on Japanese shares. China’s shares edged lower, while South Korea and Taiwan advanced more than 1%. European markets are lower, and the Dow Jones Stoxx 600 is off nearly 1% to three-month lows. The S&P 500 failed to close the gap left from Wednesday’s sharply lower opening, leaving it vulnerable technical position before the action that seems to be a textbook example of cutting one’s nose to spite one’s face. It is trading nearly 1% lower. Our technical target is 2700-2720. The trade action spurred an extension in the bond market rallies. The US 10-year is near 2.15%, while the 2-year yield is threatening to go below 2%. The German 10-year Bund is at minus 20 bp. Australian and New Zealand benchmark yields are 5-7 bp lower to new record lower. European bond yields are off 2-3 bp mostly. Italy’s looming confrontation with the EU and political uncertainty sees the Italian bonds continue to trade as risk assets, and the yield is five basis points higher to push above 2.70%. |

FX Performance, May 31 |

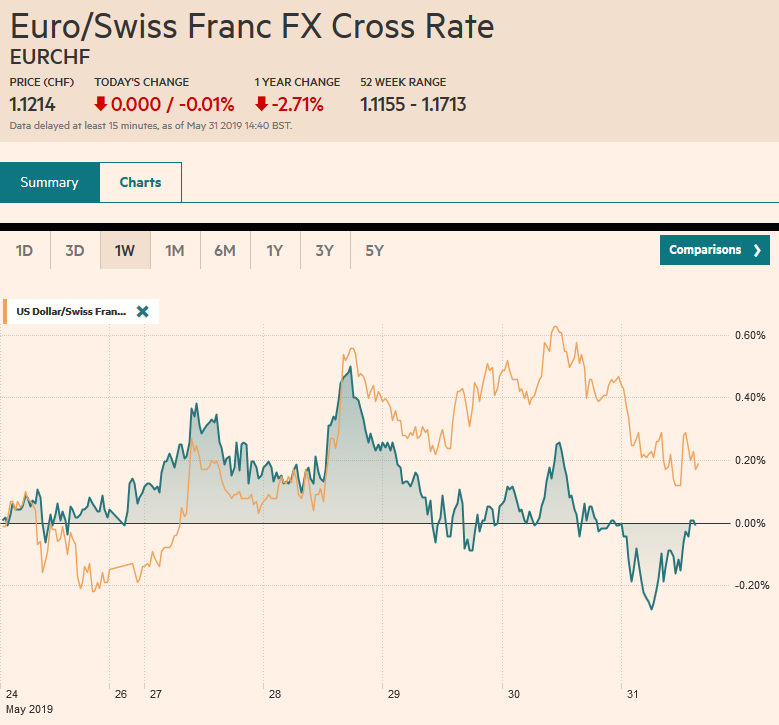

Asia PacificJapanese data reported today captures the challenge facing the economy. Unemployment unexpectedly eased last month to 2.4% from 2.5%. Industrial output was up more than expected. The 0.6% rise compares with a median forecast of 0.2% in the Bloomberg survey and a 0.6% fall in March. However, it does not appear to help boost consumption. |

Japan Unemployment Rate, April 2019(see more posts on Japan Unemployment Rate, ) Source: investing.com - Click to enlarge |

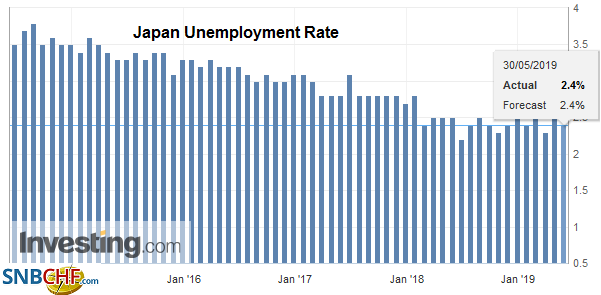

| Retail sales were flat in April. Economists surveyed by Bloomberg forecast a 0.6% increase. Separately, the slowdown in housing starts and construction spending (-5.7% and -19.9% year-over-year, respectively) follows a surge in March (10% and 66.7% respectively). The BOJ did not reduce the amount of bonds it intends to buy in June, but it did reduce the frequency (three days instead of four) for long bonds and widened the range for the 10-year-25-year purchases to JPY100-JPY300 bln up from JPY100-JPY250 bln last month. The net impact was marginal. |

Japan Retail Sales YoY, April 2019(see more posts on Japan Retail Sales, ) Source: investing.com - Click to enlarge |

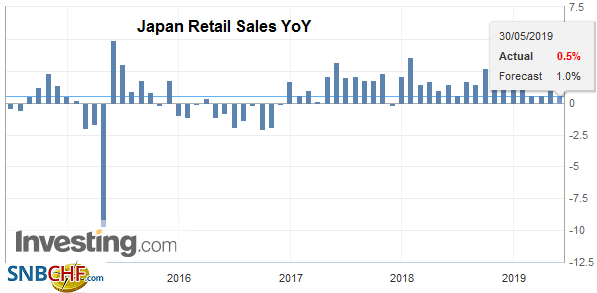

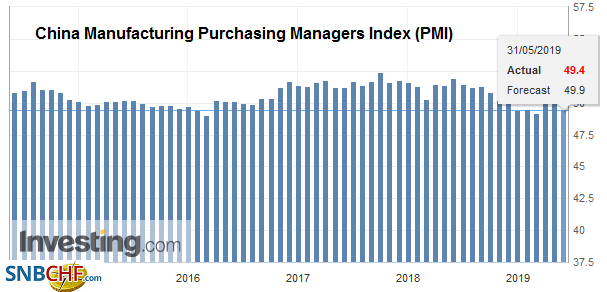

| Many, if not most, observers are suspicious of Chinese data unless they are weak. The May PMI showed the manufacturing sector slipping back into contraction, with a decline to 49.4 from 50.1 in April. It had recovered from the sub-50 reading in the December-February period. The non-manufacturing PMI was unchanged at 54.3. The composite slipped to 53.3 from 53.4. New orders for manufacturing slumped to 49.8 from 51.4, and new export orders fell to 46.5 from 49.2. In the non-manufacturing sector, new orders and new export orders also fell (50.3 from 50.8 and 47.9 from 49.2, respectively). The disappointing data, even before the full impact of the increase in US tariffs is felt, suggests officials will have a policy response. |

China Manufacturing Purchasing Managers Index (PMI), May 2019(see more posts on China Manufacturing PMI, ) Source: investing.com - Click to enlarge |

In emerging Asia, note that South Korea’s central bank kept rates steady. Earlier in reported a stronger than expected 1.6% rise in April industrial output and an upward revision in the March series to 2.1% from 1.4%. However, next week’s data will likely to confirm that exports fell for the sixth consecutive month on a year-over-year basis in May and that the economy contracted 0.3% in Q1. May’s CPI will also be reported, and as it stays below 1%, there is scope for a BOK rate cut in Q3. Separately, S&P upgraded Indonesia’s credit rating to BBB citing better growth prospects and stable policy environment with the re-election of Widodo as President. The rupiah is the strongest currency today, rising nearly 1% against the dollar. The local equity market advanced 1.7% for an almost 3% gain om the week.

The dollar has been sold through JPY109 for the first time since the end of January. In the next few hours, a battle will be waged between two expiring options. There is $1.4 bln at JPY108.50 and $1.5 bln at JPY109. The Australian dollar has been confined to a $0.6900-$0.6940 range this week. There is an option for nearly A$560 mln at $0.6900 that will be cut. The market appears to have discounted nearly a 95% chance of an RBA rate cut next week.

Europe

Germany reported disappointing April retail sales and Italy cut its estimate for Q1 growth, while the softer inflation readings are consistent with what was already reported by Spain and France. The aggregate CPI figures will be reported next week, ahead of the ECB meeting, and are expected to show that price pressures eased back after the seasonal rise in April. Headline CPI is expected to slip back to 1.4% from 1.7% and the core rate to 1.0% from 1.3%. German retail sales fell 2% to start Q2. The median forecast in the Bloomberg survey was for a 0.1% gain. The revision in the March series to flat from minus 0.2% is of little consolation. Italy’s Q1 GDP estimate was halved to 0.1%, and that is enough to push the year-over-year rate back below zero (-0.1%). The fact that Italy has still high levels of unemployment have seen many economists argue there is scope for fiscal stimulus in Italy. However, it is clear that even the suggestion of more fiscal stimulus risks being wholly offset by higher yields.

Turkey emerged from recession with a 1.3% expansion in Q1, which was in line with expectations. Even with today’s modest loss, the lira is the strongest emerging market currency this week with a 3.4% gain that has pushed the dollar back below TRY6.0. The dollar has approached chart support seen in the TRY5.82-TRY5.86 band. The lira has appreciated nearly 5.2% since bottoming on May 9. It’s 1.5% gain net-net on the month leads the emerging market currencies.

The euro is trying to end a four-day slide. It too seems to be trapped between expiring options. The $1.11 level continues to be defended by options. Today a 2.7 bln euro option struck there will be cut, but ahead of that is a 1.4 bln euro option at $1.1125. As North American dealers return to their posts, the 1.6 bln euros in options between $1.1145 and $1.1150 area that expire today are in play. There are 2.5 bln euro in options at $1.12 will also be cut. Sterling is succumbing to the pressure and is trading lower as it has for the past four sessions. It is pushing through $1.26, and the next immediate target is $1.25.

America

The US tariff on Mexican goods will have unintended but not unforeseeable consequences. It says that a free-trade agreement with the US does prevent such actions. It is a new variable in consideration of businesses considering relocating from China. Production has been frequently organized along continental lines and the complex system and widely geographically dispersed production functions, sometimes within the same company. In some industries, a good can cross the borders many times before it is a finished good. That means a product could be hit with the tariff several times. And when we say that production is organized across the continent, it is understood that it did not simply become this way, large companies, mostly American, but also many European and Japanese businesses have integrated the continent. While Canada and Mexico legislative ratification process had begun, the US move jeopardizes it just as the trade tensions with China are escalating. China’s retaliatory tariffs become effective tomorrow.

Reports in Chinese press warns that it has drawn up plans to weaponize rare earths. There should be no doubt that China has such contingency plans. It does not mean that it is imminent or inevitable. We continue to see challenges in making the threat effective. If China would embargo rare earth to the US, US companies would likely respond in two ways. First, seek alternatives from other producers, like Australia. This would likely push prices higher. Second, businesses would move offshore the manufacturing that required the rare earths. So, instead, of making super magnets, for example with the imported rare earths, the company, for example, would import the super magnets.

The US reports April personal income and consumption data. Income is expected to have risen from 0.1% in March, but consumption will slow from the heady 0.9% increase. The headline deflator, which is what the Fed targets (despite claims that it prefers the core measure) and the core measure are likely to be little changed around 1.6%. Canada reports Q1 GDP. It is expected to have accelerated to near 0.7% from 0.4% in Q4 18. The Canadian dollar has weakened in sympathy with the Mexican peso. It is at new lows since January 3 and appears poised to confirm the breakout from the narrow CAD1.34-CAD1.35 trading range in May. The next target is CAD1.36. The dollar has soared more than 3% against the Mexican peso. The high for the year was set on New Year’s Day near MXN19.77. The dollar approached that area in the European morning. Above there, is MXN20.00.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,China Manufacturing PMI,EUR/CHF,Featured,Japan Retail Sales,Japan Unemployment Rate,Mexico,MXN,newsletter,Trade,USD/CHF