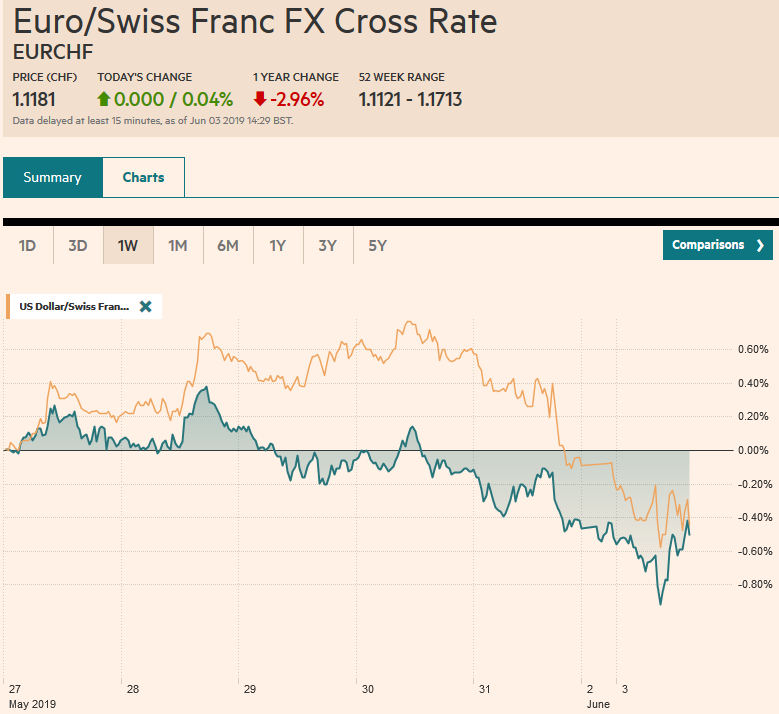

Swiss Franc The Euro has risen by 0.04% at 1.1181 . FX Rates Overview: The weekend failed to break the grip of investor worries that is driving stocks and yields lower. The US Administration’s penchant for tariffs is not simply aimed at China, where there is some sympathy, but the move against Mexico, dropping special privileges for India, and apparently, had considered tariffs on Australia. At the same time, the threat of 25% tariff on auto imports. Meanwhile, the recent data, including today’s PMI readings, show a world economy struggling even before the escalation. Equities have continued to surrender gains seen in the January to April period. The Nikkei gapped lower to levels not seen mid-January. Taiwan,

Topics:

Marc Chandler considers the following as important: 4) FX Trends, China Caixin Manufacturing Purchasing Managers Index, Eurozone Manufacturing Purchasing Managers Index, Featured, Germany Manufacturing Purchasing Managers Index, India, Japan Manufacturing Purchasing Managers Index, newsletter, South Korea, trade, U.K. Manufacturing Purchasing Managers Index, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.04% at 1.1181 |

|

FX RatesOverview: The weekend failed to break the grip of investor worries that is driving stocks and yields lower. The US Administration’s penchant for tariffs is not simply aimed at China, where there is some sympathy, but the move against Mexico, dropping special privileges for India, and apparently, had considered tariffs on Australia. At the same time, the threat of 25% tariff on auto imports. Meanwhile, the recent data, including today’s PMI readings, show a world economy struggling even before the escalation. Equities have continued to surrender gains seen in the January to April period. The Nikkei gapped lower to levels not seen mid-January. Taiwan, India, and South Korean markets advanced. Foreign investors bought South Korean shares for the second consecutive session. Previously there were two other sessions since the end of the tariff truce between the US and China that foreigners bought Korean shares. Europe’s Dow Jones Stoxx 600 is around 0.7% lower in the morning to return to levels seen in mid-February. US shares are trading lower in Europe, and the S&P 500 is set to gap lower again, and our 2700-2720 target is coming into view. Bond yields in Asia-Pacific rose, but European yields on falling, led by a six basis point decline in Italy, but it not doing much for Italian banks shares, which are holding just above the year’s low set before the weekend. The US 10-year yield is off four basis points to2.08%. The dollar is sporting a slightly heavier profile against most of the major currencies, led by the Swiss franc and the New Zealand dollar. Among emerging markets, the greenback is mixed. Asian currencies are mostly firmer. The Turkish lira is off 0.5% and is set to end a seven-day advance. The Mexican peso is softer but above the pre-weekend low. The Chinese yuan slipped less than 0.1% for the second consecutive session. |

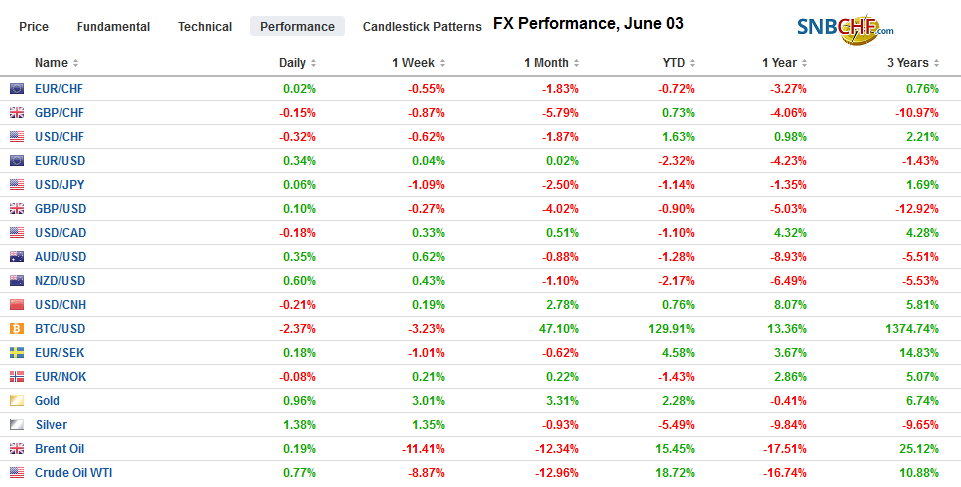

FX Performance, June 03 |

Asia PacificInvestors continue to anticipate more retaliation by China. Its investigation into FedEx for mis-delivering two packages to Huawei seems like low-hanging fruit but typical of China’s modus operandi. Many participants continue to hold on to hope that a meeting between Trump and Xi at the end of June on the sidelines of the G20 meeting could do repeat what happened in December and re-start negotiations. However, our sense that this is unlikely to happen continues to be underpinned by the fact that there has been no date set to resume negotiations and the escalation of rhetoric. Over the weekend, South Korea reported an unexpectedly large drop in exports. The 9.4% decline compares with a median estimate in a Reuters survey for a 5.6% decline after a 2.0% decline in April. It is the sixth consecutive contraction. It illustrates the ongoing challenge for the region. It is partly the slowdown in China, where exports fell by a fifth year-over-year, and something industry-specific with memory chips and semiconductors. South Korea’s memory chip exports fell by a little more than 30% year-over-year. The May PMI manufacturing PMI eased to 48.4 from 50.2. The central bank shaved its growth forecast last week (2.5% vs. 2.6%), but a deeper cut is likely next month. The split decision to keep rates will also be re-evaluated, and a rate cut in Q3 looks likely. |

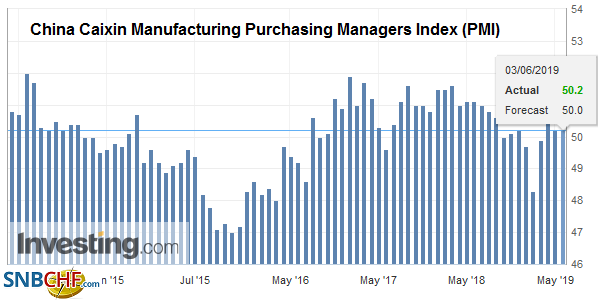

China Caixin Manufacturing Purchasing Managers Index (PMI), May 2019(see more posts on China Caixin Manufacturing Purchasing Managers Index, ) Source: investing.com - Click to enlarge |

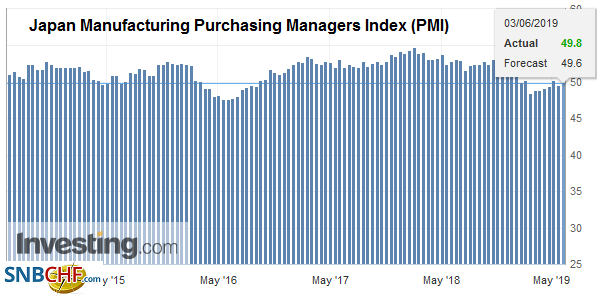

| Other manufacturing PMI readings in Asia were mixed. Japan’s May manufacturing PMI stands at 49.8, which is better than the 49.6 flash reading, but it is still off from moving back into expansion territory in April at 50.2. Taiwan’s improved to 48.4 from 48.2 but has not been above 50 since last September. Malaysia’s manufacturing PMI slipped to 48.4 from 49.4, though separately the government reported an unexpected increase in exports in April, the first increase since January. Australia’s AiG manufacturing PMI eased to 52.7 from 54.8. China’s Caixin manufacturing PMI was unchanged at 50.2, whereas official one had fallen to 49.4 from 50.1.

The dollar initially saw its recent losses extended against the yen, but buyers appeared ahead of JPY108. There are nearly a billion dollars in options struck between JPY108.00 and JPY108.15 that expire today and a $1.2 bln option at JPY108.50 that will also be cut. The Australian dollar is edging higher after closing above the 20-day moving average before the weekend for the first time since April 22. The Reserve Bank of Australia is widely expected to cut the cash rate tomorrow, but the market is pricing a very aggressive easing trajectory, and some shorts are content to lock in profits, especially given the fact that the downside momentum stalled. There is an A$500 mln option that expires today, struck at $0.6955 that is very much in play. |

Japan Manufacturing Purchasing Managers Index (PMI), May 2019(see more posts on Japan Manufacturing Purchasing Managers Index, ) Source: investing.com - Click to enlarge |

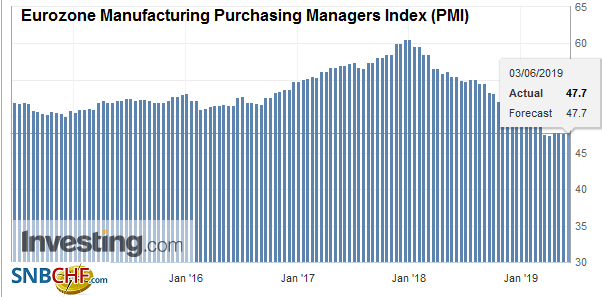

EuropeThe eurozone manufacturing PMI was unchanged from the 47.7 flash reading, which was down slightly from the 47.9 reading in April and a little above the 47.5 low in March. The ECB, which meets later this week, cannot be pleased. |

Eurozone Manufacturing Purchasing Managers Index (PMI), May 2019(see more posts on Eurozone Manufacturing Purchasing Managers Index, ) Source: investing.com - Click to enlarge |

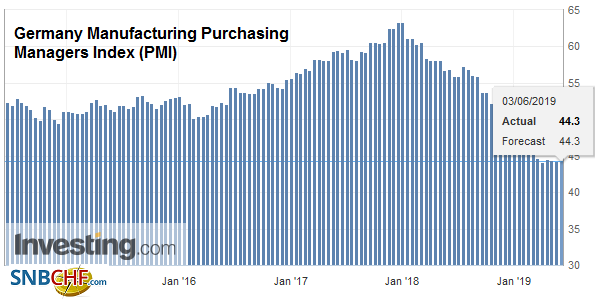

| German and French readings were unchanged from the flash. Italy had an upside surprise and Spain surprised on the downside. Italy’s manufacturing PMI edged up to 49.7 from 49.1 in April and the lowly 47.4 reading in March. Spain’s PMI fell to 50.1 from 51.8. It had bottomed in February just below 50. |

Germany Manufacturing Purchasing Managers Index (PMI), May 2019(see more posts on Germany Manufacturing Purchasing Managers Index, ) Source: investing.com - Click to enlarge |

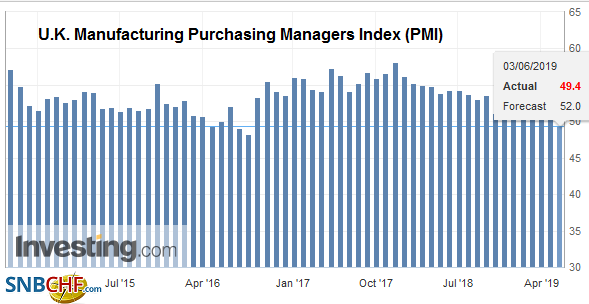

| Separately, the UK manufacturing PMI slumped to 49.4 from 53.1. It was much weaker than expected and has not seen this level since immediately following the June 2016 referendum. |

U.K. Manufacturing Purchasing Managers Index (PMI), May 2019(see more posts on U.K. Manufacturing Purchasing Managers Index, ) Source: investing,com - Click to enlarge |

Added to the poor PMI showing, the ECB will likely receive confirmation that price pressured eased in May. The headline rate is expected to pull back from 1.7% in April to something closer to 1.3%, if not a little lower, and the core rate may slip to 0.9% from 1.3%. Recall the core rate bottomed in the euro area at 0.6% in 2015. The ECB’s updated forecasts and details about the TLTRO (generous?) are the main focus at this week’s meeting.

Separately, European politics are emerging as another issue for investors. The head of the SPD in Germany resigned. There is some talk that the wing of the party that wants to leave the coalition is moving into ascendency, but given the recent electoral results, including the EU Parliament elections, the SPD would likely see substantial losses. Meanwhile, Merkel is said to be reconsidering AKK as her successor in the CDU. Italy’s Prime Minister Conte is threatening that if the dueling deputy Prime Ministers cannot resolve their infighting, he will resign. Many thought it possible that League leader Salvini would engineer a political crisis to force an early election, which may be his best chance to become Prime Minister of a center-right government. Lastly, we note that a Finnish coalition government appears to have been forged and this will allow it to nominate a successor to Draghi, which is thought to be a compromise candidate between the French and German contenders.

The euro rose to $1.1190 in Asia and has not managed to see it again in the European morning. Initial support is seen in the $1.1150-$1.1160 area. The $1.1100 continues to be supported by optionality. There is a billion euro option there that expires today and a 1.7 bln euro option that will be cut tomorrow. With a dovish ECB expected, it is challenging to envision strong gains now. Sterling managed to extend its pre=weekend recovery but stalled near $1.2660. Resistance is cited in the $1.2680-$1.2700 band.

America

The surprise action against Mexico has angered some Republican Senators on both substantive grounds (hurts US companies exporting from Mexico to the US, taxes American consumers, and makes it more difficult to approve NAFTA 2.0) and procedural grounds (invoking emergency powers in a way that had not been used before and mixing trade and migration issues). It is too early to know whether the frustration is enough to begin official efforts to claw back authority that had been deferred to the executive on trade issues. Mexican and US officials will meet over the next few days and Mexican President AMLO has suggested he is prepared to make some concessions. The 5% tariff is supposed to be effective at the start of next week. It is not clear that Mexican concessions will be enough. The Trump Administration may want to see results first. But even if they are not put into place, the mere threat may be enough to give investors and companies a pause and rethink their strategies.

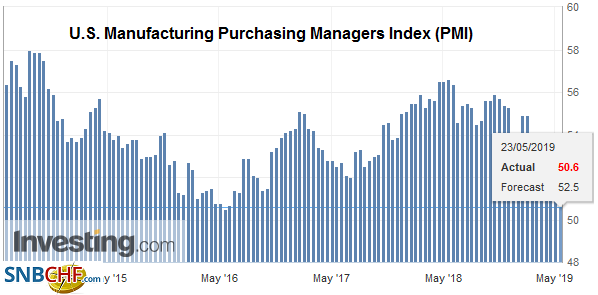

| The US reports both the PMI and ISM manufacturing data. They look mixed. Construction spending is expected to recover after falling 0.9% in March. The wild card maybe auto sales. The median from the Bloomberg survey calls for a recovery to 16.9 mln units (seasonally adjusted annual pace) from 16.4 mln. Disappointment would have knock-on effects on retail sales forecasts, but also possibly manufacturing output and inventories. Canada reports its May manufacturing PMI. It has fallen without interruption since last December and broke the 50 boom/bust level in April (49.7). Mexico’s manufacturing PMI was at 50.1 in April, and the May data will also be reported today. |

U.S. Manufacturing Purchasing Managers Index (PMI), May 2019(see more posts on U.S. Manufacturing Purchasing Managers Index, ) Source: investing.com - Click to enlarge |

The US dollar is straddling the CAD1.35 area now as investors await from the local market to open. There is a $700 mln option struck at CAD1.35 that expires today. Support is seen near CAD1.3480, and a break of that would help improve the Canadian dollar’s technical tone. The Mexican peso is trading sideways in a tight range. Dollar support is seen near MXN19.50, previous resistance. Some of the strength in the Brazilian real seen at the end of last week may have partly reflected the unwinding of long peso short real position that had been built.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,China Caixin Manufacturing Purchasing Managers Index,Eurozone Manufacturing Purchasing Managers Index,Featured,Germany Manufacturing Purchasing Managers Index,India,Japan Manufacturing Purchasing Managers Index,newsletter,South Korea,Trade,U.K. Manufacturing Purchasing Managers Index