There is a 1:252 pay gap ratio between the lowest and highest paid staff at the Swiss bank UBS Large wage gaps continue by gender and within Switzerland’s largest 26 firms, according to two new surveys. According to the Federal Office for Statisticsexternal link, the median gross salary of male full-time employees in Switzerland stood at CHF85,200 ($87,276) last year, while for full-time female employees it was...

Read More »FX Daily, June 28: The World may Look Different Come Monday

Swiss Franc The Euro has risen by 0.05% at 1.1106 EUR/CHF and USD/CHF, June 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Quarter-end positioning seems to dominate today’s activity. The outcome of bilateral talks at the G20 gathering partly reflects the influence of the US President who eschews multilateral efforts as a hindrance to its sovereignty. Equities...

Read More »Banks in Switzerland 2018

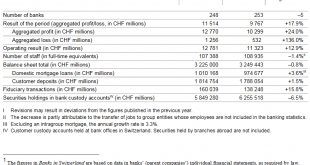

The Swiss National Bank has today published its report Banks in Switzerland 2018 and the corresponding data for its annual banking statistics.1 The most significant events are summarised below. Overview As at the end of 2018, there were 248 banks in Switzerland. Of this number, 216 reported a profit with an aggregated total of CHF 12.8 billion. Losses amounting to CHF 1.3 billion were recorded by 32 banks. The...

Read More »No, Autos Are Not “Cheaper Now”

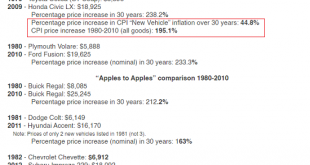

According to the BLS, inflation in the category of “New Vehicles” has been practically non-existent the past 21 years. Longtime readers know I’ve long turned a skeptical gaze at official calculations of inflation, offering real-world analyses such as The Burrito Index: Consumer Prices Have Soared 160% Since 2001 (August 1, 2016) and Burrito Index Update: Burrito Cost Triples, Official Inflation Up 43% from 2001 (May 31,...

Read More »Swiss pensioners most likely age group to be overweight

Dancing, the federal health office says, is a good way to keep off the weight. Swiss seniors are much more likely to be overweight that other age categories, new statistics from the Federal Office for Public Health (FOPH) show. Some 53% of over-65-year-olds have a body mass index judged to be too high (over 25 on the BMI scale), according to the statistics released on Tuesday by the FOPHexternal link. Older men are more...

Read More »Big Tech, Big Banks Push for “Cashless Society”

The War on Cash isn’t a conspiracy theory. It’s an open agenda. It’s being driven by an alignment of interests among bankers, central bankers, politicians, and Silicon Valley moguls who stand to benefit from an all-digital economy. Last week, Facebook – in partnership with major banks, payment processors, and e-commerce companies – launched a digital currency called Libra. Unlike decentralized, free-floating...

Read More »FX Daily, June 27: Ready. Set. Wait.

Swiss Franc The Euro has fallen by 0.07% at 1.111 EUR/CHF and USD/CHF, June 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The approaching month/quarter-end and the G20 meeting dominate considerations. Although the S&P 500 closed on its lows for the third consecutive session yesterday, Asia Pacific equities liked the apparent increase in the prospect of a...

Read More »Swiss central bank asked to issue stock exchange digital currency

The Swiss central bank produces paper money for general use, but will only contemplate digital currencies for specific industry use cases. The Swiss stock exchange wants the country’s central bank to issue a form of cryptocurrency to settle payments on its new digital securities trading platform. If the Swiss National Bank (SNB) agrees, it would represent a departure from its cautious policy on digital currencies. Stock...

Read More »‘Mature’ Swiss crypto industry demands banking access

A Korean delegation visited Switzerland’s Crypto Valley last autumn. Representatives from Switzerland’s growing cryptocurrency and blockchain sector say it has matured into a viable and respectable industry that demands to be taken seriously by banks. “The hype, nonsense and scams have gone away,” says Daniel Haudenschild, President of the Crypto Valley Associationexternal link (CVA), referring to a “wild west” phase...

Read More »Complaint filed against Federer and other Instagram influencers

The Swiss Foundation for Consumer Protection accuses Swiss influencers of not correctly labelling certain Instagram posts as advertising. A Swiss consumer protection organisation has filed a complaint against Swiss tennis star Roger Federer and several other celebrity “influencers”, accusing them of “stealth advertising” on Instagram and other social media sites. The Swiss Foundation for Consumer Protectionexternal link...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org