© Andrii Yalanskyi | Dreamstime.com One idea for containing rising healthcare costs was to remove the possibility of changing health insurance deductibles every year, making it possible only every three years. If people are able to switch from high to low deductibles annually then they can save money by opting for a high deductible one year, while postponing visits to the doctor until the following year when they opt...

Read More »Swiss gold refinery turns back on artisanal miners

Metalor is one of the world’s biggest gold refineries. Swiss gold refinery Metalor Technologies has announced it will no longer deal with artisanal mining operations. The company cites the increasing cost of ensuring that gold is being produced by small mines in compliance with human rights and environmental standards. Metalorexternal link has come under repeated fire for doing business with gold mines in South America...

Read More »FX Daily, June 18: Draghi Ends Calm Ahead of FOMC, Sending the Euro and Yields Down

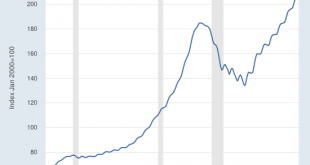

Swiss Franc The Euro has fallen by 0.08% at 1.1196 EUR/CHF and USD/CHF, June 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: ECB President Draghi underscoring the likely need for more stimulus broke the subdued tone as market participants took a “wait and see” stance ahead of tomorrow’s FOMC decision. Draghi’s comments sent the euro through $1.12 for the first...

Read More »Das Einmaleins des neuen Leitzinses

Wie schon beim Libor teilt die Nationalbank mit dem Leitzins mit, wo sie die Kurzfristzinssätze haben will: SNB-Präsident Thomas Jordan. Foto: Anthony Anex (Keystone) Die Schweizerische Nationalbank (SNB) führt neu einen Leitzins ein. Hatte sie denn bis jetzt gar keinen? Doch, hatte sie, aber der hiess anders. Nutzen wir doch die Gelegenheit, um zu klären, was eigentlich ein Leitzins ist. Und was sich nun geändert hat....

Read More »How Much of Your “Wealth” Is Hostage to Bubbles and Impossible Promises?

All asset “wealth” in credit-asset bubble dependent economies is contingent and ephemeral. A funny thing happens to “wealth” in a bubble economy: it only remains “wealth” if the owner sells at the top of the bubble and invests the proceeds in an asset which isn’t losing purchasing power. Transferring “wealth” to another asset bubble that is also deflating doesn’t preserve the “wealth” from evaporation. All the ironclad...

Read More »Raiffeisen bank announces CHF1 million executive pay cap

An activist impersonating former Raiffeisen CEO Pierin Vincenz who faced accusations of enriching himself thanks to poor board governance. Switzerland’s third largest bank will limit the annual remuneration of top management to CHF1 million (around $1million) from July 1. The announcement was made at the bank’s general meeting on Saturday in Crans-Montana. CEO Heinz Huber’s compensation has already been adjusted when he...

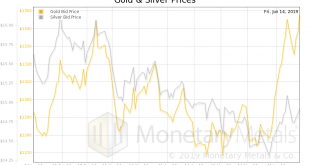

Read More »The Elephant in the Gold Room, Report 16 June

We will start this off with a pet peeve. Too often, one is reading something about gold. It starts off well enough, discussing problems with the dollar or the bond market or a real estate bubble… and them bam! Buy gold because the dollar is gonna be worthless! That number again is 1-800-BUY-GOLD or we have another 1-800-GOT-GOLD in case the lines on the first number are busy! Whether the writer is a bullion dealer, or...

Read More »FX Daily, June 17: Quiet Start to Big Week

Swiss Franc The Euro has risen by 0.09% at 1.1209 EUR/CHF and USD/CHF, June 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are off to a subdued start to what promises to be a busy week, featuring the FOMC, BOE, BOJ meetings, and the flash June PMIs. Investors also expect some signal whether Presidents Trump and Xi will at the G20...

Read More »Swiss healthcare costs expected to rise well above inflation

The high price of drugs in Switzerland has been partially blamed for driving up medical insurance costs. (© Keystone / Gaetan Bally) The cost of health insurance in Switzerland is expected to rise 3% both this year and next, warns the umbrella group for health insurers, Santésuisse. This is way above the forecast rise in consumer goods prices of 0.9% for 2019. On Monday, Santésuisseexternal link outlined the main...

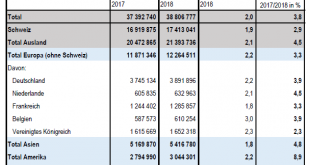

Read More »Supplementary accommodation recorded more than 16 million overnight stays in 2018

17.06.2019 – In 2018, supplementary accommodation posted a total of 16.6 million overnight stays, i.e. an increase of 4.2% compared with 2017. With 11.2 million units, Swiss visitors represented more than two-thirds of demand (67.4%), i.e. a rise of 2.9%. Foreign visitors registered a 6.9% increase with 5.4 million units. With 4.5 million units (+6.7%), European visitors generated the most overnight stays by foreigners....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org