The asymmetries are piling up and we’re cracking under the weight. Judging by the record-high stock market and the record-low unemployment rate, the “recovery” has reached new heights of prosperity. Academics and think-tankers viewing the global economy from 40,000 feet are brimming with policies to bring the remaining laggards into the booming economy. You can imagine them rubbing their hands with glee as they quote statistics such as: the 53 metropolitan areas in the U.S. with populations of 1 million or more accounted for two-thirds of the GDP growth and three-quarters of the job growth. A staggering 93% of the population growth in the U.S. in the past decade occurred in these urban centers. And this asymmetry is

Topics:

Charles Hugh Smith considers the following as important: 5) Global Macro, Featured, newsletter, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| The city’s solution–mandating a $15/hour minimum wage–doesn’t magically make healthcare or rent affordable; all it does is increase the burden on small businesses that are hanging on by a thread.

The writer doesn’t even mention the sky-high rent she paid for her restaurant space. Rent alone drove this small food service business into the ground: Via Gelato owner plans to close Ward store, file for bankruptcy. Working 100 hours a week couldn’t compensate for the crushing rent. Even the well-paid are burning out. Astronomical household incomes (say, $300,000 annually) aren’t enough to buy a decayed bungalow for $1.3 million and pay for childcare, private-school tuition, healthcare, an aging parent and all the services the overworked wage-earners don’t have the time or energy to do themselves. Oh, and don’t forget the taxes. You’re rich, people, so pay up. No wonder people who can afford to retire are bailing at 55 or 60, on the first day they qualify. Life’s too short to put up with the insane pressure and stress a day longer than you have to. |

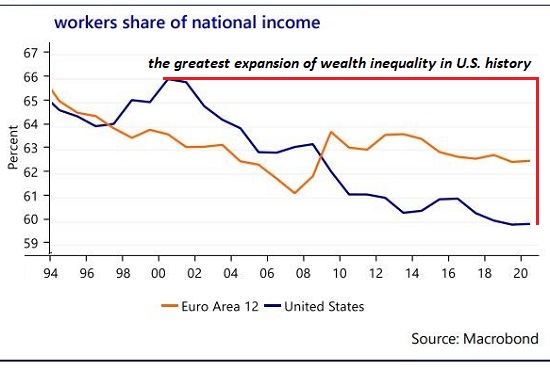

Workers Share of National Income, 1994-2020 |

| Not everybody feels it, of course. People who bought their modest house for $100,000 30 years ago can hug themselves silly that it’s now worth $1,000,000 (but with a still-modest property tax), and if they’re retired with a plump pension and gold-plated medical benefits, their biggest concern is finding ways to blow all the cash that’s piling up.

These lucky retirees wonder what all the fuss is about. “We worked hard for what we have,” etc. It’s easy to overlook being a lucky winner of the housing-bubble lottery and the equally bubblicious pension lottery, and easy not to ask yourself how you’d manage if you arrived in NYC, San Francisco, et al. now rather than 35 years ago. The asymmetries are piling up and we’re cracking under the weight. When do we recover from the “recovery”? The answer appears to be “never.” |

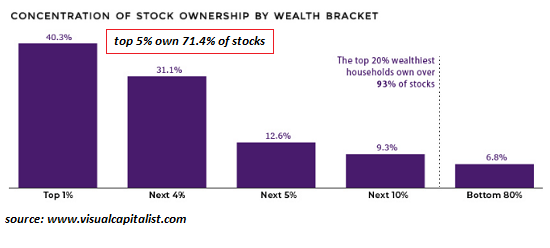

Concentration of Stock Ownership by Wealth Bracket |

Tags: Featured,newsletter