Insolvency isn’t restricted to private enterprise; governments go broke, too. One reason the economy is so much more precarious than advertised is inflation has pushed households and small businesses to the edge–and one engine of that inflation is local government. This is not to dump on local government, which is facing essentially unlimited demands from the public for more services while mandated cost increases in...

Read More »FX Daily, June 26: Biggest Drop in the S&P 500 in June Weighs on Global Equities

Swiss Franc The Euro has risen by 0.06% at 1.109 EUR/CHF and USD/CHF, June 26(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 fell nearly one percent yesterday, its steepest fall this month and this was a weight on Asia Pacific and European activity. Most markets have eased, though not as much as the US did. Hong Kong, India, and Singapore were...

Read More »Swiss monetary policy – it’s (almost) all about the Swiss franc

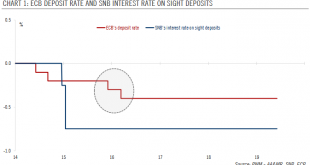

With the ECB and the Fed both signalling their readiness to provide further stimulus, the Swiss National Bank is unlikely to have smooth sailing over the coming months. How the Swiss National Bank (SNB) reacts to further stimulus by its US and European counterparts will be the key focus of the coming months for investors. We believe that the Swiss central bank will be reluctant to cut rates in direct response to the...

Read More »Gold boosted by dovish central banks

Bar a further major escalation in trade tensions, it is hard to see much more upside for gold in the short term. We remain more upbeat over the medium term. The gold price soared to a fresh five-year high on 20 June following a dovish Fed monetary policy meeting. Indeed, the dovish shift among major central banks (with the sole exception of the Norges Bank) and high global uncertainty have pushed global yields lower...

Read More »Federal fat cats see bonuses fall

There has been pressure to curb the earnings of top executives in Switzerland. The salaries of top managers at Swiss government-affiliated companies shrank last year due to smaller bonuses, according to a federal report published on Friday. Top state earner, Andreas Meyer, head of Swiss Federal Railways, saw his earnings fall below CHF1 million for the first time: down to CHF987,442 ($1 million) from CHF1,007,000 in...

Read More »Cool Video: Sketch of Bullish Case for Gold

I know some people who are always bullish gold. I am not. In fact, I often think I can find higher returning assets. However, I have recently have turned bullish gold, and while in Toronto on business, I was invited to the set of Bloomberg to discuss my change of heart. Many of the reasons the gold bugs cite would seem to justify owning gold bullion not paper claims on gold, like gold mining companies or gold ETFs. The...

Read More »FX Daily, June 25: Heightened Political Risks Weigh on Sentiment

Swiss Franc The Euro has risen by 0.10% at 1.1088 EUR/CHF and USD/CHF, June 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It is far from clear that the US sanctions against nine Iranian officials, with the foreign minister to be added later brings negotiations any closer. At the same time, US officials trying to keep expectations low for the weekend meeting...

Read More »What Gets Measures Gets Improved, Report 23 June

Let’s start with Frederic Bastiat’s 170-year old parable of the broken window. A shopkeeper has a broken window. The shopkeeper is, of course, upset at the loss of six francs (0.06oz gold, or about $75). Bastiat discusses a then-popular facile argument: the glass guy is making money (to which all we can say is, “plus ça change, plus c’est la même chose”). Bastiat says it is true, and this is the seen. The glazier does...

Read More »Swiss poised to retaliate against EU stock market access

The tit-for-tat strategies between Switzerland and the EU appear to take their course over access to each other’s stock exchanges and a framework agreement. The Swiss finance ministry has reaffirmed that it is ready to ban stock exchanges in the European Union from trading Swiss shares – in a worsening row with Brussels over the future of bilateral relations. “In the event of stock market equivalence not being extended,...

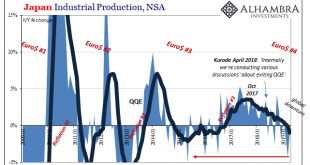

Read More »Japan’s Bellwether On Nasty #4

One reason why Japanese bond yields are approaching records like their German counterparts is the global economy indicated in Japan’s economic accounts. As in Germany, Japan is an outward facing system. It relies on the concept of global growth for marginal changes. Therefore, if the global economy is coming up short, we’d see it in Japan first and maybe best. I wrote in April last year how Japanese Industrial...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org