The US repo market appears to finally be normalizing. The low pace of normalization is concerning and so a more permanent solution may be needed to head off similar problems at year-end. We do not think this issue has any implications for the economic outlook, which we continue to view as solid. RECENT DEVELOPMENTS The repo market provides an efficient, reliable, and predictable channel to raise short-term funding. It is but one part of a larger short-term funding...

Read More »FX Daily, October 1: Dollar Jumps to Start New Quarter

Swiss Franc The Euro has risen by 0.17% to 1.0893 EUR/CHF and USD/CHF, October 1(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is rising against nearly every currency today as global growth concerns deepen. Japan’s Tankan Survey showed large manufacturers confidence is a six-year low. The Reserve Bank of Australia cut 25 bp as widely expected and kept the door open for more. The final EMU PMI...

Read More »Swiss Retail Sales, August 2019: +1.3 percent Nominal and -1.4 percent Real

01.10.2019 – Turnover adjusted for sales days and holidays rose in the retail sector by 1.3% in nominal terms in August 2019 compared with the previous year. Seasonally adjusted, nominal turnover fell by 1.6% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover adjusted for sales days and holidays fell in the retail sector by 1.4% in August 2019 compared with the previous year. Real growth takes...

Read More »Could Pricey Urban Meccas become Crime-Ridden Ghost Towns?

As the exodus gathers momentum, all the reasons people clung so rabidly to urban meccas decay. If there is any trend that’s viewed as permanent, it’s the enduring attraction of coastal urban meccas: despite the insane rents and housing costs, that’s where the jobs, the opportunities and the desirable urban culture are. Nice, but like many other things the status quo considers permanent, this could reverse very quickly, and all those pricey urban meccas could become...

Read More »USD/CHF technical analysis: Another attempt to defy 2-month-old rising wedge resistance

USD/CHF again aims to break two-month long rising trend-line, part of a bearish technical formation. Bullish MACD can trigger an uptick to 61.8% Fibonacci retracement. Sustained trading above 0.9948/50 confluence again propels USD/CHF to confront near-term key resistance-line while taking the bids to 0.9988 amid Tuesday’s Asian session. A rising trend-line since August-start, coupled with another one connecting lows marked since August 13, portrays a short-term...

Read More »Swiss accident insurer to cut 170 jobs

Lucerne: The yellow building is SUVA’s head office. Between 2021 and 2027, the Swiss National Accident Insurance Fund (SUVA)external link plans to cut about 20% of its jobs in the claims management department. Currently, that department has more than 800 jobs, including agency clerks, district physicians, insurance physicians at the head office and lawyers for objections and court cases. The cuts would affect workers who handle administrative processes that can be...

Read More »The Purchasing Power of Capital, Report 29 Sep

We discuss capital consumption all the time, because it is the megatrend of our era. However, capital consumption is an abstract idea. So let’s consider some concrete examples, to help make it clearer. Flipping Homes, Consuming Capital First, let’s look at the case of Timothy Housetrader. Tim has a small two-bedroom house. Next door, his neighbor Ian Idjit, owns a four-bedroom house which is twice the size. For some reason, Ian offers to trade houses with Tim. Both...

Read More »FX Daily, September 30: A Busy Week Begins Quietly

Swiss Franc The Euro has risen by 0.24% to 1.0862 EUR/CHF and USD/CHF, September 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: As the quarter ends, the capital markets are mixed. Equities in Asia Pacific were heavier, except in Hong Kong and Australia, while shares were mixed, leaving the Dow Jones Stoxx 600 little changed through the European morning. US shares are trading firmer. Benchmark 10-year bond...

Read More »USD/CHF technical analysis: Positive above multi-week old rising trend-line, 200-bar SMA

USD/CHF clings to 23.6% Fibonacci retracement amid bearish MACD. The rising trend-line since mid-August, 200-bar SMA limits downside. The seven-day long falling trend-line restricts immediate advances. Despite being mostly around 23.6% Fibonacci retracement of August-September upside, USD/CHF stays above key support-confluence as it trades near 0.9910 while heading into the European open on Monday. While the bearish signal from 12-bar moving average convergence and...

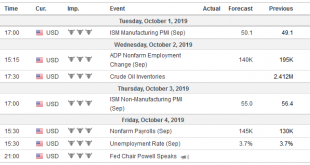

Read More »FX Weekly Preview: Forces of Movement at the Start of Q4 19

United States The world’s largest economy appears to have grown by about 2% in Q3 at an annualized pace, the same as in Q2, and in line with what many Fed officials understand to be trend growth. The strength of the US labor market underpins consumption, the powerful engine of the US economy. The latest readings of both the labor market and consumption will highlight the economic data in the week ahead. The strength of the recent housing data (starts and sales)...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org