Around one in seven Swiss say they have been hacked at some time or another. (Keystone / Sascha Steinbach) Hackers successfully attacked the website of the Swiss Consumer Protection Foundation last month, placing links to fake stores within the agency’s online shopping pages. The hack was detected within two hours and the malicious links were removed, said the foundationexternal link, which regularly warns consumers about online fraud. The agency said it was unlikely...

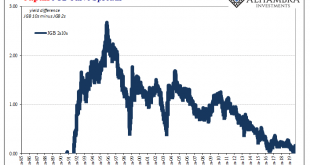

Read More »Why The Japanese Are Suddenly Messing With YCC

While the world’s attention was fixated on US$ repo for once, the Bank of Japan held a policy meeting and turned in an even more “dovish” performance. Likely the global central bank plan had been to combine the Fed’s second rate cut with what amounted to a simultaneous Japanese pledge for more “stimulus” in October. Both of those followed closely an ECB which got itself back in the QE business once more. But all that likely coordinated “accommodation” was spoiled...

Read More »EU to remove Switzerland from tax haven lists

Canton Obwalden’s low tax rates attract companies and millionaires (Keystone) European Union finance ministers are set to remove Switzerland and the United Arab Emirates (UAE) from the bloc’s lists of countries deemed to act as tax havens, an EU document said. On October 10 they are expected to remove Switzerland from the grey list that includes countries that have committed to change their tax rules to make them compliant with EU standards. Switzerland has delivered...

Read More »Novartis and Microsoft to develop drugs using AI

Joint research activities will be carried out at the Novartis Campus in Basel, Switzerland, at the Novartis Global Service Center in Dublin, Ireland, and at Microsoft Research Lab in Cambridge, Britain. (© Keystone / Georgios Kefalas) Swiss pharmaceutical firm Novartis and computer giant Microsoft have signed a five-year partnership deal aimed at transforming the Basel-based pharma’s business – from finance to manufacturing – using artificial intelligence. The new...

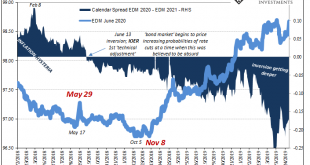

Read More »ISM Spoils The Bond Rout!!! Again

For the second time this week, the ISM managed to burst the bond bear bubble about there being a bond bubble. Who in their right mind would buy especially UST’s at such low yields when the fiscal situation is already a nightmare and becoming more so? Some will even reference falling bid-to-cover ratios which supposedly suggests an increasing dearth of buyers. Bid-to-cover, however, is irrelevant. That only tells you about one part of the buying equation, the number...

Read More »Blockchain for Good faces familiar blockages

Is blockchain being used as a gimmick in achieving sustainable development goals? (Keystone / Un Photo/loey Felipe Handout) Our regular analysis of developments in the world of fintech and Crypto Nation. All eyes were on Libra at the Blockchain 4 Impact summit in Geneva last week. But the Facebook stablecoin project was only one part of a two-day event asking the question: Can blockchain help meet Sustainable Development Goalsexternal link? The question of blockchain...

Read More »FX Daily, October 4: The US Jobs Data to Close a Sobering Week

Swiss Franc The Euro has fallen by 0.37% to 1.0913 EUR/CHF and USD/CHF, October 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The recovery of US shares yesterday signaled today’s fragile stability. Gains in Japan, Australia, and Taiwan blunted the losses elsewhere in the region, including a 1% slide in Hong Kong. The MSCI Asia Pacific Index fell for the third week. China’s markets have been closed since...

Read More »AUD/CHF Technical Analysis: Bears seeking a break to channel bottoms, below 61.8 percent Fibo

Bulls target risk back to the top of the channel and recent highs of 0.6750. Bears seek a break of trendline support and a resumption of the downside within the bearish channel. AUD/CHF has been resilient against the odds, considering the risk-off tone in markets were otherwise, the CHF usually performs. The Swiss Nation Bank has evidently been intervening in recent weeks, protecting its currency against strength vs the euro, although, on a technical basis, vs the...

Read More »Fête des Vignerons seeks millions to fill financial hole

While this year’s festival was seen as an artistic success, the event has left a huge hole in the organisers’ finances (© Keystone / Valentin Flauraud) The organisers of the Fête des Vignerons – a traditional winegrowers’ festival in the Swiss lakeside town of Vevey – is scrambling to cover its multi-million-franc deficit for 2019. The local winegrowers’ guild behind the once-in-a-generation private festival, which started in the 17th century, reported a CHF15...

Read More »USD/CHF capped again by 1.0025, retreats below parity

Swiss Franc flat versus US Dollar, down against its European rivals. Another weak economic report from the US keeps the Greenback and markets under pressure. The USD/CHF pair again was capped by the 1.0025/30 area and pulled back. Near the end of the session it is hovering around 0.9980/85 after falling to 0.9950. The Greenback weakened after US data and then recovered ground modestly. Despite rising against the US dollar, the Swiss Franc was the worst during the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org