Inflationism is that policy which by increasing the quantity of money or credit seeks to raise money prices and money wages or seeks to counteract a decline of money prices and money wages which threatens as the result of an increase in the supply of consumers’ goods. In order to understand the economic significance of inflationism we have to refer to a fundamental law of monetary theory. This law says: The service which money renders to the economic community is...

Read More »‘Switzerland failing to tackle money laundering’: Thelesklaf

The public examines some of the 25 luxury cars seized by canton Geneva during a money laundering probe into Teodoro Obiang, the son of Equatorial Guinea’s President – but such seizures are rare, according to Thelesklaf. Keystone / Laurent Gillieron The former head of Switzerland’s anti-money laundering office says the country is failing to pull its weight in the fight against large scale corruption. Daniel Thelesklaf is convinced that billions of dollars are still...

Read More »Dollar Gains from Risk-Off Trading Unlikely to Persist

Markets are starting the week in risk-off mode; the dollar is firm on some safe haven flows but this is likely to prove temporary US politics is coming in to focus as the election nears; we fear that the likely horse-trading and arm-twisting will take away any residual desire to get another stimulus package done The trend towards more restrictive measures continues with London in focus; between the virus numbers and Brexit risks, sterling remains under pressure China...

Read More »The Fed Is Planning Another Ultralong Period of Ultralow Rates

The Fed plans to keep interest rates near zero, while monetizing debt, financing zombie companies, and pouring new dollars into the market. But that may not be enough. This Audio Mises Wire is generously sponsored by Christopher Condon. Narrated by Michael Stack. Original Article: “The Fed Is Planning Another Ultralong Period of Ultralow Rates“. You Might Also Like Walter Berns and the Cult of “Patriotic”...

Read More »The Saving Problem in America: Alternatives and Reforms

Savings are the foundation for a productive and advanced economy. Unfortunately, governments insist on policies that make it harder for ordinary people to save. This Audio Mises Wire is generously sponsored by Christopher Condon. Narrated by Millian Quinteros. Original Article: “The Saving Problem in America: Alternatives and Reforms“. You Might Also Like What Germany Must Do for a Speedy Recovery On June...

Read More »FX Daily, September 21: Risk Appetites Join Tokyo on Vacation

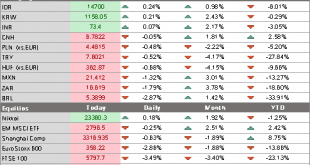

Swiss Franc The Euro has fallen by 0.45% to 1.0751 EUR/CHF and USD/CHF, September 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equity markets are off to a poor start to the week, and the dollar appears to be enjoying a safe-haven bid. Tokyo markets are closed until Wednesday, while Asia-Pacific stocks tumbled, and the regional index is unwinding last week’s gains. The Dow Jones Stoxx 600 is off...

Read More »Confidence in vaccine safety remains low in Switzerland

© Jesada Wongsa | Dreamstime.com Compared to much of the world, confidence in the safety of vaccines is low in Switzerland, according to a recently published study. In 2015, only 30% of Swiss questioned strongly agreed that vaccines were safe, ranking it 133rd out of 149 nations in terms of confidence in vaccine safety. This compared to 89% in Argentina and 86% in both Liberia and Bangladesh. At the same time only 3% in Switzerland strongly disagreed with them being...

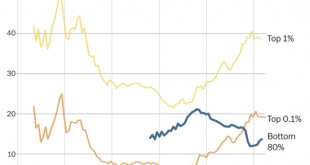

Read More »“Inflation” and America’s Accelerating Class War

Those who don’t see the fragmentation, the scarcities and the battlelines being drawn will be surprised by the acceleration of the unraveling. I recently came across the idea that inflation is a two-factor optimization problem: inflation is necessary for the macro-economy (or so we’re told) and so the trick for policy makers (and their statisticians who measure the economy) is to maximize inflation in the economy but only to the point that it doesn’t snuff out...

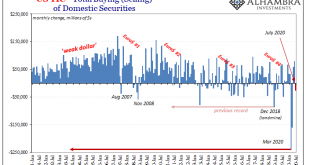

Read More »If Dollar Is Fixed By Jay’s Flood, Why So Many TIC-ked At Corporates in July?

When the eurodollar system worked, or at least appeared to, not only did the overflow of real effective (if virtual and confusing) currency “weaken” the US dollar’s exchange value, its enormous excess showed up as more and more foreign holdings of US$ assets. Mostly US Treasuries, especially in official hands, but not entirely those. That much is perfectly clear; you can actually see the difference on every chart despite all the QE’s and trillions in bank reserves...

Read More »Turning to Keynes in this Crisis Will Only Make Things Worse

In the New York Times on September 8, 2020, Paul Krugman wrote that The CARES Act, enacted in March, gave the unemployed an extra $600 a week in benefits. This supplement played a crucial role in limiting extreme hardship; poverty may even have gone down. For Krugman and many economic commentators, it is the duty of the government to support the economy whenever it falls into an economic slump. Following in the footsteps of John Maynard Keynes, most economists hold...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org