Some countries like India have made rapid antigen tests a key part of their strategy for containing the coronavirus. Keystone / Str Swiss pharmaceutical company Roche plans to launch a test that can detect the coronavirus in 15 minutes. Could tests like this become the norm? With no vaccine in sight for at least a few months, testing is becoming a more important part of containing the coronavirus. Antigen tests, which detect the presence of a specific viral antigen...

Read More »“The U.S. economy felt like a balloon in search of a needle” – Part II

Interview with Robert Mark: Claudio Grass (CG): In this surreal policy environment, how has the role and the investment process of the value investor evolved, especially over the last decade? How can one still identify value in a world of subsidized binge borrowing, extreme indebtedness, and stock buybacks? Robert Mark (RM): The patriarch of value investing, Ben Graham, once said, “In the short run the market is a voting machine, but in the long run it is a...

Read More »Dollar Firm as Markets Digest Rising Virus Numbers

Markets are digesting the rising infection rates across Europe; the dollar is taking another stab at the upside Speculation is picking up that a compromise on a stimulus package could be reached; reports suggest House Democrats are working on a new $2.4 trln package as a basis for these negotiations Reports suggest Fed Governor Lael Brainard is a top candidate for Treasury Secretary if Biden were to win; today is a quiet day in the US Colombia is expected to cut...

Read More »Zak vs Neon: Best Swiss digital bank account in 2020?

(Disclosure: Some of the links below may be affiliate links) Zak and Neon are two good Swiss Digital bank accounts. They are both entirely digital and accessible through mobile applications. The great thing about these bank accounts is that they are significantly cheaper than conventional bank accounts. Their low prices are what make their success. And they have some attractive features. But which one should you choose? Which of Zak vs Neon is better for you? Let’s...

Read More »FX Daily, September 25: Sentiment Remains Fragile Ahead of the Weekend

Swiss Franc The Euro has fallen by 0.13% to 1.0801 EUR/CHF and USD/CHF, September 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dramatic week is finishing on a quieter note. The modest gains in US equities yesterday helped the Asia Pacific performance today. Most markets but China and Hong Kong pared the weekly losses, and easing regulations in Australia spurred a rally in financials that saw its stock...

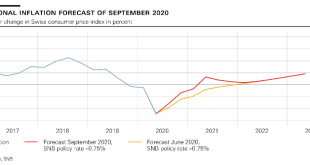

Read More »Monetary policy assessment of 24 September 2020

Swiss National Bank maintains expansionary monetary policy The coronavirus pandemic continues to exert a strong influence on economic developments. The SNB is therefore maintaining its expansionary monetary policy. In so doing, it aims to cushion the negative impact of the pandemic on economic activity and inflation. The SNB is keepingthe SNB policy rate and interest on sight deposits at the SNB at −0.75%.In view of the fact that the Swiss franc is still highly...

Read More »2500 students quarantined at Lausanne’s hotel school

EHL – source Wikipedia Around three quarters of the students at the hotel school of Lausanne (EHL) have been placed in quarantine after a number of students tested positive for SARS-CoV-2, reported RTS. The 2,500 students affected will be isolated until 28 September 2020 to stop the spread of the virus. The Swiss canton of Vaud, where recorded infections recently reached 213 per 100,000 over 14 days, is currently Switzerland’s Covid-19 hotspot. Eleven students spread...

Read More »Switzerland and UK balance sovereignty with EU market access

Britain’s controversial Internal Market Bill has prompted Switzerland’s former chief negotiator with the EU, Michael Ambühl, to examine the thorny issue of sovereignty in EU talks. The issue of balancing access to the EU market in exchange for a degree of EU regulatory intrusion on home turf has come to the fore during the ongoing Brexit negotiations. The British government is trying to enact new legislation, the Internal Market Bill, that could limit the ability of...

Read More »And Silver Crashes Some More! 24 Sept

A few days ago, we wrote about a big silver crash. The price dropped around 7.5%. And the basis dropped from around 2% to 0.6%. At the end, we said: “The key question is: what is the follow-through? If the price stays down and the basis goes back up, that will be a bearish signal. If the basis stays down, that means the silver market is markedly tighter at $24.50 than it was at $26.75.” Which this brings us to yesterday’s silver dive. Here’s the graph of the day’s...

Read More »Carter vs. Reagan: The Last Semi-Intelligent Presidential Race

Carter vs. Reagan Presidential campaigns in the United States tend to be discouraging affairs, even if one is not a libertarian who has zero expectations that anything good can come from American elections. The old saw that insanity consists of doing the same thing repeatedly and somehow expecting different results applies to presidential campaigns as well as to anything else. For whatever reason, Americans (and especially the American media) seem to believe that the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org