(Disclosure: Some of the links below may be affiliate links) Diversification is often called the only free lunch in investing. It is a great way to reduce the volatility of a portfolio and sometimes increase its returns. You want to avoid having all your eggs in one basket. So, instead, you are going to use many baskets. The idea of diversification is mostly to invest in many companies and many countries. But there are other forms of diversification that we are...

Read More »FX Daily, November 10: Markets Remain Unsettled

Swiss Franc The Euro has risen by 0.18% to 1.0806 EUR/CHF and USD/CHF, November 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Performance Overview: Pfizer’s vaccine announcement eclipsed the US election as the key market driver. It spurred the unwinding of Covid trades in terms of sectors and yields. Emerging market currencies and the majors that benefit from world growth outperformed the perceived safe-havens, like the...

Read More »House View, November 2020

Macroeconomy The upsurge in covid-19 cases will likely hurt global economic prospects in the current quarter. With a Democrat ‘blue wave’ failing materialise in the US elections, hopes of a substantial spending bill have faded and there is risk that US household incomes suffer as existing support measures fade. In the meantime, covid-19 infections continue surge in the US. The Chinese recovery continues, supported by strong exports and solid improvement in fixed...

Read More »Swiss investors still leaning heavily on fossil fuels

Despite concerns about global warning, coal is still being mined and burned all over the world. Keystone / Sascha Steinbach The Swiss financial market invests too much in oil and coal production, according to a review of nearly 200 financial institutions. Some 80% of the banks and asset management firms surveyed by the report have coal mining companies in their investment portfolios. “On average, the Swiss financial centre thus supports additional expansion of...

Read More »How Much Taxes Will Retirees Owe on Their Retirement Income

Planning for retirement. We spend most of our working career preparing for it, saving for it, covering every contingency. When you finally wave goodbye to the company, you’re ready for all that planning to take over. But does your planning take into account the taxes you’ll have to pay on your retirement income? It’s one of the biggest retirement planning mistakes people make. Anqui Chen and Alicia H. Munnell at the Center for Retirement Research at Boston College...

Read More »No Wonder the Super-Rich Love Inflation

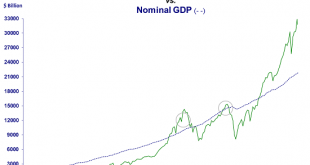

Asset inflation benefits the super-rich more than anyone else because they own the vast majority of these assets. With the reflation euphoria running full blast, maybe central banks will finally get all that inflation they’ve been pining for. So let’s ask cui bono–who will benefit from inflation? The Super-Rich love inflation and the money-printing that generates it. Longtime correspondent Michael M. explains the dynamic behind billionaires’ adoration of...

Read More »Election 2020: Choking on the Political Red and Blue Pills

Presidential election 2020 is the same as every other, except in the ways it isn’t. Allow me to expand on this. What is the same? The purpose of all elections is to allow a band of people called the state to legitimize their claim of control over everyone and everything within a given jurisdiction. In his book The Rise and Fall of Society, the Old Right libertarian Frank Chodorov defines the state as “a number of people who, having somehow got hold of it,” use “the...

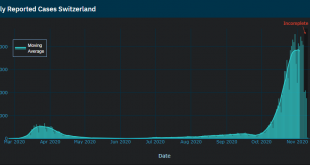

Read More »Covid, November 10: no time to relax, says minister as 3-day Swiss case number returns to 17,000

New Infections On 9 November 2020, Switzerland’s Federal Office of Public Health (FOPH) reported 17,309 new laboratory-confirmed Covid-19 cases over 72 hours, bringing the total to 229,222. The 24-hour average number of new cases of 5,770 recorded over the weekend is lower than the previous weekend when it was 7,309 (21,926 over 72 hours). However, Alain Berset, the minister in charge of health care in Switzerland, told an audience in Jura that now is not the time...

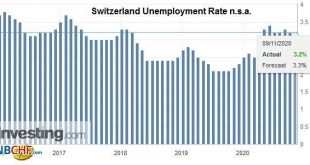

Read More »Switzerland Unemployment in October 2020: remained at 3.2percent, seasonally adjusted fallen to 3.3percent

Unemployment Rate (not seasonally adjusted) Registered unemployment in October 2020 – According to surveys by the State Secretariat for Economic Affairs (SECO), 149,118 unemployed people were registered with the regional employment centers (RAV) at the end of October 2020, 558 more than in the previous month. The unemployment rate remained at 3.2% in the month under review. Compared to the same month last year, unemployment increased by 47,434 people (+ 46.6%)....

Read More »FX Daily, November 9: Markets are not Waiting for Official Closure in the US

Swiss Franc The Euro has risen by 0.84% to 1.0782 EUR/CHF and USD/CHF, November 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge Overview: The new week has begun with robust risk appetites, driving stocks and stocks higher and sending the dollar broadly lower. Nearly all the equity markets in the Asia Pacific region gained more than 1%, except Malaysia and Indonesia. The Nikkei, which posted its highest close before the weekend in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org