© Alessandro Melis | Dreamstime.com Switzerland’s federal government has increased the amount of money earmarked for SARS-CoV-2 vaccines by CHF 100 million, bringing the total to CHF 400 million. The announcement came as preliminary trials of a vaccine developed by Pfizer and BioNTech found it to be more than 90% effective in preventing Covid-19 in participants without evidence of prior SARS-CoV-2 infection. Switzerland had already set aside money to buy 4.5 million...

Read More »Curt Carlson on Innovation Champions

Key Takeaways and Actionable Insights Austrian economics sees an economy in motion, perpetually renewing itself. Economic agents (firms, customers, investors) constantly change their actions and strategies in response to outcome they mutually create. This further changes the outcome, which requires them to adjust afresh. Entrepreneurs live in a world where their beliefs and strategies are constantly being “tested” for survival within an outcome these beliefs and...

Read More »“The Great Reset” Already Happened

Put another way: the elites have cannibalized the system so thoroughly that there’s nothing left to steal, exploit or cannibalize. The global elites’ techno-fantasy of a completely centralized future, The Great Reset, is addressed as a future project. Too bad it already happened in 2008-09. The lackeys and toadies tasked with spewing the PR are 12 years too late, and so are the critics listening to the PR with foreboding. Simply put, events outran our...

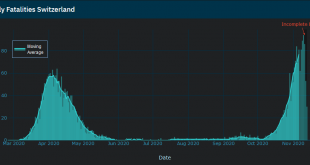

Read More »Covid, November 13: 553 deaths in Switzerland this week as infection rate slows

Deaths because of and with Covid19 Over the 7 days to 13 November 2020, Switzerland’s Federal Office of Public Health (FOPH) reported 553 deaths among laboratory-confirmed Covid-19 cases, bringing the death toll to 1,229 since summer and 2,960 since the beginning of the year. The 553 reported deaths this week represent 19% of the total so far, making the last 7 days the deadliest 7-day period since the virus arrived in Switzerland. There are currently 3,945 Covid-19...

Read More »FX Daily, November 13: Greenback Pares this Week’s Gains while the Turkish Lira Continues to Squeeze Higher

Swiss Franc The Euro has fallen by 0.02% to 1.0796 EUR/CHF and USD/CHF, November 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The largest bourses in the Asia Pacific region followed the US equity market lower, with the Nikkei posting its first loss in nine sessions. China, Hong Kong, and Australia moved lower as well. On the week, the MSCI Asia Pacific Index gained about 1% after rising 6.3% in the prior...

Read More »FINMA veröffentlicht Risikomonitor 2020

Die Eidgenössische Finanzmarktaufsicht FINMA veröffentlicht den Risikomonitor 2020. Sie gibt damit einen Überblick über die aus ihrer Sicht aktuell bedeutendsten Risiken für die Beaufsichtigten und beschreibt den daraus abgeleiteten Fokus der Aufsichtstätigkeit. Die FINMA identifizierte im Corona-Jahr sieben Hauptrisiken. Neu auf der Liste sieht die FINMA drohende Ausfälle oder Korrekturen bei Unternehmenskrediten und -anleihen im Ausland. Das Jahr 2020 war klar von...

Read More »Public worker absenteeism costs Geneva 285 million francs a year

© Lauvergnat Laurent | Dreamstime.com Public worker absenteeism in Geneva costs at least CHF 285 million, according to Heidi.news, which calculated the sum based on information contained in an internal document. According to the news service the cost of absenteeism, which continues to rise, is equivalent to 11% of the 2.54 billion spent public sector workers’ salaries in 2019 and 3% of the canton’s total public sector spending that year. This is the first time that...

Read More »Dollar Softens Ahead of CPI Data

Pressure on the dollar has resumed; October CPI data will be the US highlight; US bond market was closed yesterday but yields have eased a bit today Weekly jobless claims data will be reported; monthly budget statement for October will hold some interest; Mexico is expected to cut rates 25 bp to 4.0%; Peru is expected to keep rates steady at 0.25% UK Q3 GDP rebounded strongly but September data show a loss of momentum; Brexit talks remain unresolved; the domestic...

Read More »Prepare For ‘No-Deal Brexit’ – Own Physical Gold To Protect Your Wealth

The Brexit deadline of December 31st, the date beyond which the transition or implementation period cannot be extended, now looms large and the dreaded “No-Deal” Brexit outcome looks increasingly possible by the day. There is plenty of brinkmanship, rhetoric and passionately held views on the Brexit issue and recent days have seen this again. It is and will continue to be a highly partisan and divisive issue. It is important to tune out the political noise and...

Read More »FX Daily, November 12: Nervous Calm in the Capital Markets

Swiss Franc The Euro has fallen by 0.14% to 1.0788 EUR/CHF and USD/CHF, November 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There is a nervous calm in the capital markets today. The equity rally in the Asia Pacific region stalled to end an eight-day rally, though the Nikkei’s rally remains intact. The Dow Jones Stoxx 600 in Europe is consolidating near eight-month highs visited yesterday, and US shares...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org