(Disclosure: Some of the links below may be affiliate links) Diversification is often called the only free lunch in investing. It is a great way to reduce the volatility of a portfolio and sometimes increase its returns. You want to avoid having all your eggs in one basket. So, instead, you are going to use many baskets. The idea of diversification is mostly to invest in many companies and many countries. But there are other forms of diversification that we are going to see in this article. And we are also going to discuss the limits of diversification. Diversification In essence, diversification is a risk management strategy. The main goal is to reduce the risks in your portfolio. In practice, we measure reduced risk by reduced volatility in a portfolio. The

Topics:

Mr. The Poor Swiss considers the following as important: 9) Personal Investment, 9) The Poor Swiss, Featured, Investing, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

(Disclosure: Some of the links below may be affiliate links)

Diversification is often called the only free lunch in investing. It is a great way to reduce the volatility of a portfolio and sometimes increase its returns. You want to avoid having all your eggs in one basket. So, instead, you are going to use many baskets.

The idea of diversification is mostly to invest in many companies and many countries. But there are other forms of diversification that we are going to see in this article. And we are also going to discuss the limits of diversification.

Diversification

In essence, diversification is a risk management strategy. The main goal is to reduce the risks in your portfolio. In practice, we measure reduced risk by reduced volatility in a portfolio.

The idea is the same as not putting all our eggs in the same basket. If one of your assets fails, you do not want your entire portfolio to fail. You want to spread your risk over several assets.

For instance, imagine the following scenario with two investors:

- Investor A invests 100K in one stock with a 2/3 chance of doubling its money and 1/3 of losing its money.

- Investor B invests 10K in 10 stocks with the same chances each.

For this scenario, both investors will have the same average positive returns. The difference is in the risk they are both taking. The risk of investor A losing all its money is 1/3, 33.33%. On the other hand, the risk of Investor B losing all its money is incredibly low, at 0.001%.

So, in this example, diversification reduces your risk without reducing your returns!

This example uses stocks, but it applies to other ways to diversify your entire portfolio. Indeed, there are several forms of diversification:

- Asset Class diversification

- Stock diversification

- Industry diversification

- International diversification

- Currency diversification

We are going to see most of these forms in detail in this article.

Limits of diversification

Before we delve into the different forms of diversification, we need to look at the limits of diversification.

Compared to our original stock scenario, adding more stocks does not necessarily reduce your risks. In practice, stocks are not entirely independent of each other. You need to add stocks that have a low correlation to each other. If you have two stocks that have a high correlation, you still have a high risk that both fail at the same time. But if you have two stocks that are negatively correlated, you will have avoided this risk.

In practice, there will be some level of correlation between most things. But it is essential to avoid investing in highly correlated assets. At least, you should not believe that two stocks are always better than one. The same stands true for each form of diversification.

If you only have one stock, adding an extra stock with a low correlation will dramatically reduce your volatility. Adding a third one will help a lot as well, but less so already. But once you have 50 stocks, there will be minimal benefits of adding more stocks. So, diversification has diminishing returns. Most theories agree that having about 30 to 50 stocks is enough to get the maximum diversification benefits. Advocates of the Modern Portfolio Theory generally use 30 stocks in their portfolio.

And not only that, but diversification cannot remove all the volatility from a portfolio. In the end, the systematic risk (or market risk) remains. So, a global market crash will still hurt you even if you are well diversified.

It is essential to know that even a very well-diversified portfolio has risks. It is impossible to eliminate all risks while keeping some returns.

Asset Class Diversification

The first form of diversification is to diversify over different asset classes:

- Cash

- Stocks

- Bonds

- Real Estate

- Commodities

- Precious Metals

- Alternative Investments

If you invest in different asset classes that have a low correlation, you are reducing your volatility. When your stocks are doing poorly, your cash should be stable enough to reduce your risks.

The issue is that the correlation between different asset classes changes over time. For instance, bonds were sometimes negatively correlated to stocks, but recently they are positively correlated, although it is still a small correlation, so there are still benefits.

Another issue is that by diversifying asset classes, you need to be aware of the average returns of each asset class. If you have only stocks and want to diversify in cash, you will lower your average returns. You will have the benefits of diversification, but you will have to weigh them down with the reduced returns.

I think that some amount of asset class diversification is good in your portfolio. But it is essential to consider the returns and risks of each class before you try to diversify too much.

Stock (or bond) diversification

Within an asset class, it is possible to diversify further. For instance, if you invest in stocks and bonds, you should not invest in a single stock or bond. You should diversify within all of your asset classes.

I will talk about stocks mostly, but the same information will apply to diversify other asset classes. Of course, it may be more challenging to diversify physical real estate than to diversify stocks, but the same principles are true.

As mentioned in the first example, having more stocks with independent returns will let you reduce risks without reducing your returns. But as we saw, there are some limits. Indeed the benefits of diversification are based on the correlation between the stocks. In practice, having between 30 and 50 stocks is enough to reap the benefits.

For me, the best way to diversify is to use an index fund or an Exchange Traded Fund (ETF) in a broad index.

For instance, if you want to invest in Swiss Stocks, you should invest in a Swiss Stock Market Index that represents as much as possible of the market. There are indexes for each country in the world. So, you should not have an issue finding a well-diversified index.

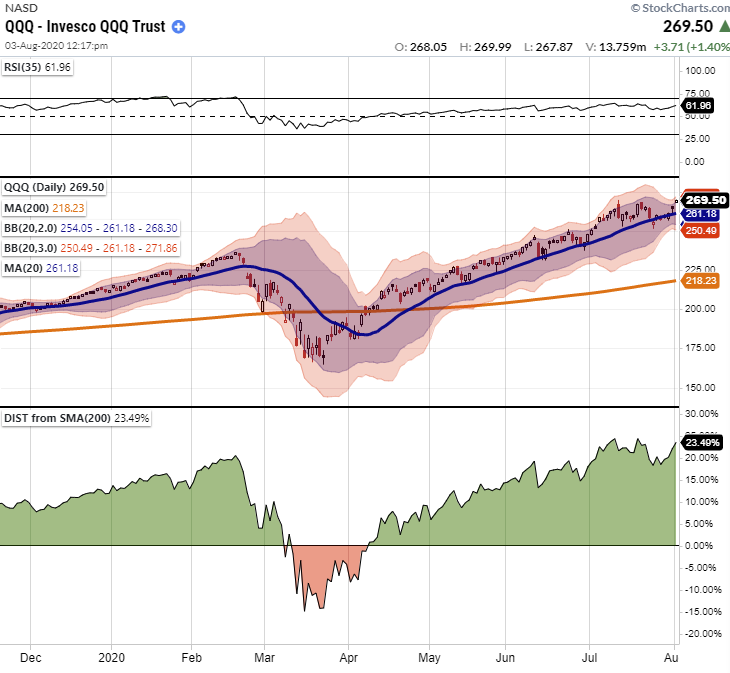

For instance, you could invest in the USA with the S&P500 index that contains 500 stocks.

Even though I said there are almost no benefits in going over 50 stocks, there are almost no disadvantages of having more stocks. Having more than 50 stocks will reduce the dispersion of possible outcomes. It will give you a higher probability of reaching the average returns.

Investing in many stocks will also give you industry diversification. Some people will invest only in Tech stocks because they have had high returns recently. But nothing tells us what the future has in store for them. So, investing in all industries will reduce your risk that a bad performance in a single sector hurts your overall performance too severely.

Therefore, I would recommend that you invest in an index that contains as many companies as possible. I have a guide if you need to choose a stock market index.

International Diversification

This form of diversification is incredibly important. Many people are very heavily invested in stocks (or bonds, or any other asset class) of one country. But international diversification has benefits.

Investors have a strong preference for stocks from their home country (domestic stocks). In some countries, investors have more than 80% of domestic stocks.

By adding international stocks to your portfolio, you will gain access to economies in other countries. In practice, a few percentages of global stocks are driving the returns of the stock market. So, you want to be invested in these stocks. But these stocks could be in any country. By diversifying globally, you will ensure that you are invested in those stocks and capture the returns of the stock market.

And there is something great with international diversification. It will decrease your risks (volatility), and it can also increase your returns. There are some exceptions, for instance, for the U.S. that has been shown to outperform global stocks historically. But even with that, we know nothing of the future. So, for a country with a small stock market, like Switzerland, it is essential to diversify internationally.

Now, it is true that globalization has reduced the benefits of international diversification. Indeed, now a lot of companies are doing business worldwide. And a situation in one country can easily impact the stocks of many other countries. But that does not negate the benefits of international diversification.

So, international diversification is critical, and there are easy ways to diversify internationally. The easiest to have many foreign stocks is to use a world ETF (or mutual fund). This fund will contain stocks of all the countries in the world. And each country will be weighted according to their market capitalization (the larger the market cap, the larger the allocation).

If you do not want to use a world index, you can also use several indexes for regions (America, Europe, Pacific, …). By doing this, you can generally reduce your fees since World ETFs are not the cheapest. But you will make it more complicated for you to invest. I am an advocate of the Keep It Simple and Stupid (KISS) principle, so I invest through a world ETF.

But regardless of the way to invest, do not overlook global diversification!

Currency diversification

Diversifying over different currencies also has some benefits.

Generally, by diversifying internationally, you will gain exposure to international currencies as well. If you invest globally, you may have exposure to Euros, Swiss Francs, and U.S. Dollars.

If your domestic currency loses a lot of value, you will be better off if you have exposure to other currencies. In that case, currency diversification protects you against severe domestic risks. But then, you are introducing currency risk in your portfolio.

Overall, I think it is good to have several different currencies in your portfolio. But for most investors, it will not matter too much since they will have several ETFs for their investment, and they should have several currencies.

It is essential to think about currency diversification when considering currency hedging. When you hedge ETFs to your local currency, you reduce the currency diversification of your portfolio and thus bypass its benefits. So, if you decide to hedge to your local currency, you should make sure not to hedge too much. A general rule of thumb is not to hedge more than 50% of your assets.

Should we stop home bias?

Many people, including me, have a home bias in their portfolio. It means that they allocate a part of their portfolio to stocks of their own country. So, the allocation to stocks of their own country is not in sync with the size of the local market.

For instance, I have 20% of Swiss Stocks in my portfolio, even though Switzerland only represents about 3% of the entire world stock market.

So, purely speaking, a home bias reduces your international diversification. But, there is a limit to diversification. Research has shown that the maximum benefits of diversification were experienced when adding about 60% of foreign stocks to a portfolio. Extra foreign stocks did not hurt the portfolio performance and volatility but did not improve it much either.

So, as long as you do not have a home bias that is too large, having a home bias will not hurt your diversification.

To learn more, I have an entire article about home bias and investing.

Consider your human capital

When you are considering the diversification of your portfolio, it is important to consider the entire picture. You want to consider your human capital as well when you plan your portfolio.

Your human capital is related to where you work and where you make your income from. It is the value of all future earnings during your lifetime. So, you should consider your human capital as a financial asset.

For instance, if you are heavily invested in the banking sector and work in banking, you may have too much risk in one sector. Many people never think of that when they invest.

That does not mean that you should avoid all tech investments because you work in Tech. You can still invest in the entire U.S. Stock Market that has a strong tilt towards Tech. But you should avoid investing in a Tech ETF if you are working in Tech.

The second thing you should also consider is if you make earnings based on the economy of a single country. If your employer only does business in one country, and this country goes through a recession, your human capital may be at risk. So think of that when you are planning your international diversification.

It is essential to consider your human capital when you are planning your investments.

The traps of false diversification

Many beginner investors try to use many ETFs to diversify their portfolios. But often, they end up having multiple funds covering the same thing.

For instance, if you invest in the S&P500 and the Russell 3000 index, there is no benefit compared to investing only in the Russell 3000 index. Indeed, the Russell 3000 already contains all the stocks in the S&P500 index. By doing that, you will increase the complexity of your portfolio and your fees while trading and rebalancing.

So, in general, you should try to avoid the false diversification in having multiple ETFs doing the same thing. Having your eggs in similar baskets is the same as having them in the same basket, except for the added complexity.

Diversification and value investors

Several of the most prominent value investors are against diversification. For instance, Warren Buffett said: “Diversification is protection against ignorance. It makes little sense if you know what you are doing.”. And another famous investor, Mark Cuban, had a strong view on the subject: “Diversification is for idiots”.

So are we idiots? No! As Warren Buffett says, if you know what you are doing, diversification makes little sense. And diversification is a protection against ignorance.

So, if you know how to analyze businesses, like Warren Buffett, you may not need diversification. But if you are a simple passive investor, like me, you do not know what the market is doing. And you do not have to spend hours researching companies that will do well in the future. And as passive investors, we accept our ignorance. It is not a bad thing. It is a good thing to recognize that we do not know enough. It is why we are investing passively.

Even Warren Buffett said there is nothing wrong with diversification if you aim for average returns. And it is what passive investing is all about. So, for passive investors, diversification not only makes sense but is incredibly important!

Conclusion

Diversification has benefits and has almost no cost. It is why diversification is known as the only free lunch in investing.

You can use several forms of diversification: over asset classes, over different companies, over countries, and even over currencies. If you want to limit your risks in the long-term with your portfolio, it is essential that you diversify!

I should have written this article a long time ago. I have received many questions about diversification, and I hope this article will help dispel these questions.

If you want to choose your ETF portfolio, I have a guide on choosing an index ETF portfolio for your needs.

What do you think about diversification?

Tags: Featured,Investing,newsletter