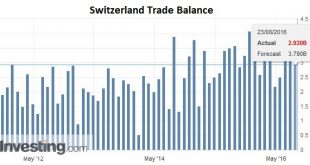

Swiss Franc Switzerland Trade Balance (See more posts for Switzerland Trade Balance) Click to enlarge. Source Investing.com FX Rates The US dollar is mostly little changed against the major, as befits a summer session. There are two exceptions. The first is the New Zealand dollar. Comments by the central bank’s governor played down the need for urgent monetary action and suggested that the bottom of cycle may be...

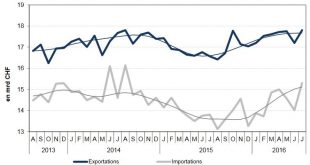

Read More »Swiss Exports + 7.9 percent YoY, Imports +11.8 percent. Trade Surplus +2.9 bn CHF.

Exports and Imports YoY Development In July 2016, Swiss exports declined due to two working days less. Adjusted for this difference, exports were up 7.9% YoY (in real terms: + 2.4%) and imports 11.8% YoY (in real terms: + 8.2%). Exports and Imports MoM Development Compared with June 2016, seasonally adjusted exports rose by 3.5% (in real terms: + 5.5%). Thus the positive trend that began in mid-2015 continues....

Read More »Swiss Sovereign Money Initiative: Reserves For Everyone

On a new website, Aleksander Berentsen rejects the Swiss Vollgeld initiative. As an alternative, he suggests the Swiss National Bank should offer transaction accounts for everybody, in line with proposals I have made earlier (see here (2016), here (2015), here (2015)). In the Handelszeitung (here and here), Simon Schmid reports....

Read More »FX Daily, August 22: Fischer Joins Dudley; Waiting for Yellen

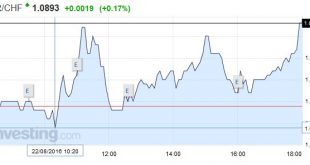

Swiss Franc As usual, when discussions about rate hikes go on, then both the dollar and the euro gain against the Swiss Franc. Click to enlarge. Federal Reserve Last week, some market participants were giving more credence to what seemed like dovish FOMC minutes than to NY Fed President Dudley’s remarks that accused investors of complacency over the outlook for rates. Yesterday, Vice-Chairman of the Federal Reserve...

Read More »FX Weekly Preview: Yellen at Jackson Hole

Lastly, a brief word about next week. I will not post my usual piece on macro considerations on Sunday. Here, though, is a brief thumbnail sketch of the top five things I will be watching: 1. Yellen at Jackson Hole at the end of next week: To the extent that she shares her assessment of the economy, I would expect to largely echo the broad sentiment expressed by NY Fed President Dudley. Click to enlarge. 2....

Read More »Swiss Labour Force Survey in 2nd quarter 2016: labour supply: 1.6percent increase in number of employed persons; unemployment rate based on ILO definition rises slightly to 4.3percent

18.08.2016 09:15 – FSO, Labour Force (0353-1607-60) Swiss Labour Force Survey in 2nd quarter 2016: labour supply 1.6% increase in number of employed persons; unemployment rate based on ILO definition rises slightly to 4.3% Neuchâtel, 18.08.2016 (FSO) – The number of employed persons in Switzerland rose by 1.6% between the 2nd quarter 2015 and the 2nd quarter 2016. During the same period, the unemployment rate as...

Read More »The Deep State’s Catch-22

What happens if the Deep State pursues the usual pathological path of increasing repression? The system it feeds on decays and collapses. Catch-22 (from the 1961 novel set in World War II Catch-22) has several shades of meaning (bureaucratic absurdity, for example), but at heart it is a self-referential paradox: you must be insane to be excused from flying your mission, but requesting to be excused by reason of...

Read More »Emerging Markets: Preview of the Week Ahead

EM ended last week on a soft note. Fed tightening expectations were buffeted first by hawkish Dudley comments and then by the more balanced FOMC minutes. On net, the markets adjusted the odds for tightening by year-end a little higher from the previous week, and stand at the highest odds since the Brexit vote. Yet despite the strong jobs data in June and July, odds of a move on September 21 or November 2 are...

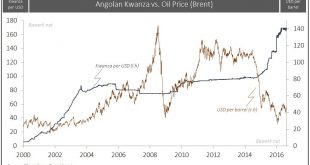

Read More »The Dos Santos Succession Saga

Arguably one of the easier calls for us to make after 37 years in power was that President dos Santos would find ways of affording himself another 5 years in. Like any ‘effective’ leader, Mr. Santos made sure the final deal to do just that was stitched up long before the Party Congress formally convenes in Luanda, with a lower level MPLA ‘Central Committee’ already rubber stamping his name in mid-August. That also...

Read More »FX Daily, August 19: Dollar Recovers into the Weekend

Swiss Franc: In the real effective exchange rate calculation, the PPI plays an important role. The Swiss producer price index fell by 0.8% YoY, while the German one is down 2.0%. Thismeans that in 2016 the CHF overvaluation is rising, when compared to the major Swiss trading partner Germany. The values for 2015 were -6% for the Swiss and -2.5% for Germany, the CHF overvaluation was reduced. Click to enlarge. Source...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org