Summary:

Lastly, a brief word about next week. I will not post my usual piece on macro considerations on Sunday. Here, though, is a brief thumbnail sketch of the top five things I will be watching: 1. Yellen at Jackson Hole at the end of next week: To the extent that she shares her assessment of the economy, I would expect to largely echo the broad sentiment expressed by NY Fed President Dudley. Click to enlarge. 2. Merkel has to protect both her flanks: She will be meeting EU leaders ahead of the summit, saying she wants the broadest possible debate about the future of the European Union. At the same time, many observers question whether she can be re-elected in a year’s time. The outcome of the state elections next month will be watched closely. The first one is September 4 in Mecklenburg-Vorpommern. Click to enlarge. 3. Flash eurozone PMI: The record of the recent ECB meeting was not very informative. In addition to playing down shortages of bonds that it must buy under its QE program, there were two points that seemed to be important for what to expect next month. First, there was broad agreement that the downside economic risks had increased, and second, it was noted with concern that the underlying trend of inflation was not rising.

Topics:

Marc Chandler considers the following as important: article50, Bank of Japan, Eurozone Manufacturing PMI, Featured, FX Trends, Jackson Hole, newsletter

This could be interesting, too:

Lastly, a brief word about next week. I will not post my usual piece on macro considerations on Sunday. Here, though, is a brief thumbnail sketch of the top five things I will be watching: 1. Yellen at Jackson Hole at the end of next week: To the extent that she shares her assessment of the economy, I would expect to largely echo the broad sentiment expressed by NY Fed President Dudley. Click to enlarge. 2. Merkel has to protect both her flanks: She will be meeting EU leaders ahead of the summit, saying she wants the broadest possible debate about the future of the European Union. At the same time, many observers question whether she can be re-elected in a year’s time. The outcome of the state elections next month will be watched closely. The first one is September 4 in Mecklenburg-Vorpommern. Click to enlarge. 3. Flash eurozone PMI: The record of the recent ECB meeting was not very informative. In addition to playing down shortages of bonds that it must buy under its QE program, there were two points that seemed to be important for what to expect next month. First, there was broad agreement that the downside economic risks had increased, and second, it was noted with concern that the underlying trend of inflation was not rising.

Topics:

Marc Chandler considers the following as important: article50, Bank of Japan, Eurozone Manufacturing PMI, Featured, FX Trends, Jackson Hole, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Lastly, a brief word about next week. I will not post my usual piece on macro considerations on Sunday. Here, though, is a brief thumbnail sketch of the top five things I will be watching:

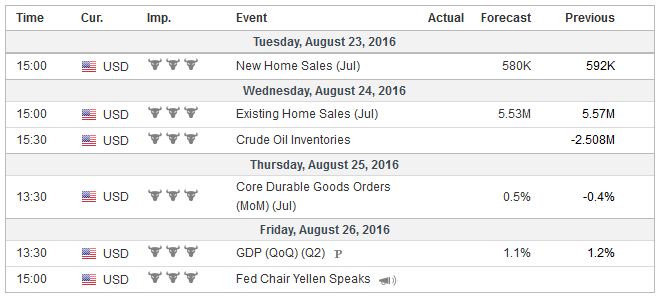

| 1. Yellen at Jackson Hole at the end of next week: To the extent that she shares her assessment of the economy, I would expect to largely echo the broad sentiment expressed by NY Fed President Dudley. | |

| 2. Merkel has to protect both her flanks: She will be meeting EU leaders ahead of the summit, saying she wants the broadest possible debate about the future of the European Union. At the same time, many observers question whether she can be re-elected in a year’s time. The outcome of the state elections next month will be watched closely. The first one is September 4 in Mecklenburg-Vorpommern. |

3. Flash eurozone PMI: The record of the recent ECB meeting was not very informative. In addition to playing down shortages of bonds that it must buy under its QE program, there were two points that seemed to be important for what to expect next month. First, there was broad agreement that the downside economic risks had increased, and second, it was noted with concern that the underlying trend of inflation was not rising. The eurozone composite PMI has been unusually steady. It has been between 53.0 and 53.2 since February. The July print was 53.2 but is expected remain within the range in August.

|

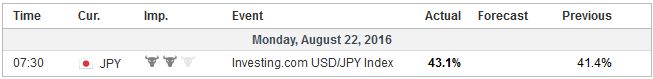

4. Japan: The market remains uncertain what the BOJ will do next month, and will closely listening to Kuroda when he speaks on August 23. At the end of the week, Japan will report July inflation figures. No progress is expected with the national headline and core (excluding fresh food) expected to remain at minus 0.4%. Excluding food and energy, the inflation rate is anticipated to edge down to 0.4% from 0.5% to match its lowest level since May 2015, which itself is the lowest since October 2013.

|

|

|

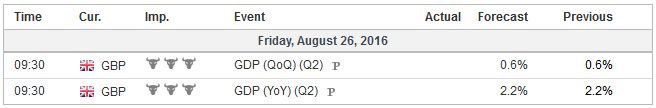

5. UK and Article 50: In the face of the enormity of the challenge and the complexity of the issue many observers have given up on ideas that Article 50, which formally begins the negotiations for the separation of the EU and the UK would be triggered anytime soon. However, comments by two UK officials may be the first indication that the many have misread the intent of the May government. Further clarification will be sought.

|