Swiss Franc As happened very often, traders expected more the SNB monetary assessment. And, as usually, the franc finally appreciated because the SNB did not act. Click to enlarge. FX Rates Looking at the diary, today is the most important day of the week. The Bank of England and the Swiss National Bank meet. The UK reports retail sales. EMU reports CPI figures. The US reports retail sales, industrial output, and...

Read More »Follow the Money

A Small and Lonely Group PARIS – It’s back to Europe. Back to school. Back to work. Let’s begin by bringing new readers into the discussion… and by reminding old readers (and ourselves) where we stand. US economic growth: average annual GDP growth over time spans ranging from 120 to 10 years (left hand side) and the 20 year moving average of annual GDP growth since 1967. Note that the bump in the 70 year average is...

Read More »The Mainstream Media Bet the Farm on Hillary–and Lost

The MSM has forsaken its duty in a democracy and is a disgrace to investigative, unbiased journalism. The mainstream media bet the farm on Hillary Clinton, confident that their dismissal of every skeptical inquiry as a “conspiracy” would guarantee her victory. It now appears they have lost their bet. Let’s do something radical and be honest for a moment: the mainstream media has smoothed the path to Hillary’s...

Read More »Cash Bans and the Next Crisis

Criminalizing Cash Money sometimes goes “full politics”. Take poor Kenneth Rogoff at Harvard. He wants a dollar with a voter registration card, a U.S. flag on its windshield, and a handgun in its belt – the kind of money that supports the Establishment and votes for Hillary. Writing last month in the Wall Street Journal under the headline “The Sinister Side of Cash”, he noted that: “Paper currency, especially large...

Read More »FX Daily, September 14: Precarious Stabilization

Swiss Franc Swiss ZEW expectations came in better than expected. The value was +2.7 instead of expected negative value. Switzerland ZEW Expectations (see more posts on Switzerland ZEW Expectations, )Switzerland ZEW Expectations. Click to enlarge. FX Rates The US dollar advanced yesterday and is in narrow ranges with a mostly softer bias today. The exception is the Japanese yen. Japanese press have reported that...

Read More »Great Graphic: Net Mexican Migration to the US–Not What You Might Think

Summary: Net migration of Mexicans into the US has fallen for a decade. The surge in Mexican migration into the US followed on the heels of NAFTA. Although Trump has bounced in the polls, and some see this as negative for the peso, rising US interest rates and the slide in oil price are more important drivers. There has been much discussion in the US presidential campaign about immigration, especially from...

Read More »Rogoff Warns “Cash Is Not Forever, It’s A Curse”

Submitted by Christoph Gisiger via Finanz und Wirtschaft, Kenneth Rogoff, Professor of Public Policy at Harvard University, postulates to get rid of cash. In his opinion, killing big bills would hamper organized crime and make negative interest more effective. Kenneth Rogoff makes a provocative proposal. One of the most influential economists on the planet, he wants to phase out cash. «Paper currency lies at...

Read More »Seven years of inaction on SNB rates day won’t end this week

Swiss National Bank, © Swisshippo | Dreamstime.com Anyone feeling let down that the European Central Bank didn’t do much last week might just want to skip the Swiss rate decision on Thursday to avoid more disappointment. While the Swiss National Bank may be infamous for some seismic policy changes in the last few years, those bombshells weren’t dropped at scheduled meetings. In fact, the last time the institution...

Read More »Thoughts on the Price Action

Summary: Global interest rates are rising. Something important is happening. It appears to be dollar positive. Price is Right – click to enlarge. The market has not changed its mind. Following Brainard’s comments yesterday the market had downgraded the chances, which were already modest, of a Fed hike next week. The September Fed funds futures is unchanged on the day. The implied yield of 41 bp matches the...

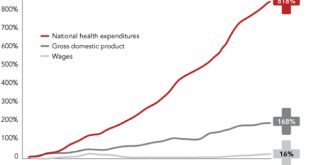

Read More »If Everything Is So Great, How Come I’m Not Doing So Great?

While the view might be great from the top of the wealth/income pyramid, it takes a special kind of self-serving myopia to ignore the reality that the bottom 95% are not doing so well. We’re ceaselessly told/sold that the U.S. economy is doing phenomenally well in our current slow-growth world — generating record corporate profits, record highs in the S&P 500 stock index, and historically low unemployment (4.9% in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org