Long Term Technical Backdrop Constructive After a challenging Q4 in 2016 in the context of rising bond yields and a stronger US dollar, gold seems to be getting its shine back in Q1. The technical picture is beginning to look a little more constructive and the “reflation trade”, spurred on further by expectations of higher infrastructure spending and tax cuts in the US, has thus far also benefited gold. From a technical perspective, there are indications that the low at 45.40, incidentally printed just ahead of the first Fed hike in December 2015, was significant and now provides medium-term support as indicated by the price channel in the chart below. The zone provided significant resistance in 2008 and throughout much of 2009, and following the upside breakout provided solid support on the pullback in early 2010. It also corresponds to the 50% retracement of the uptrend from the July 1999 low at 3.2 to the high at 23.7 in September 2011. Yet another reason why the low appears significant is the presence of a bullish RSI divergence, as depicted by the blue lines: RSI divergences are a very useful signal for technical analysts and contrarian investors, as they often indicate trend reversals.

Topics:

Helder Mello Guimares considers the following as important: Central Banks, Featured, Gold and its price, newsletter, Precious Metals

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Long Term Technical Backdrop ConstructiveAfter a challenging Q4 in 2016 in the context of rising bond yields and a stronger US dollar, gold seems to be getting its shine back in Q1. The technical picture is beginning to look a little more constructive and the “reflation trade”, spurred on further by expectations of higher infrastructure spending and tax cuts in the US, has thus far also benefited gold. From a technical perspective, there are indications that the low at $1045.40, incidentally printed just ahead of the first Fed hike in December 2015, was significant and now provides medium-term support as indicated by the price channel in the chart below. The zone provided significant resistance in 2008 and throughout much of 2009, and following the upside breakout provided solid support on the pullback in early 2010. It also corresponds to the 50% retracement of the uptrend from the July 1999 low at $253.2 to the high at $1923.7 in September 2011. Yet another reason why the low appears significant is the presence of a bullish RSI divergence, as depicted by the blue lines: RSI divergences are a very useful signal for technical analysts and contrarian investors, as they often indicate trend reversals. Another positive development in terms of price action is the bullish crossover signal of the 50- and 200-week simple moving averages, for the first time since 2002. This signal, however, is only a prerequisite for a new uptrend, and resistance levels at $1275/$1280 and especially $1377.5 must be breached to confirm an upside breakout from the current range. In the shorter-term, $1211 provides support, followed by $1177 and $1154. A break below the $1124.3 low would confirm a bigger correction to $1045.40, which as mentioned above currently represents medium-term support. |

Gold - Continuous Contract 1997-2017 |

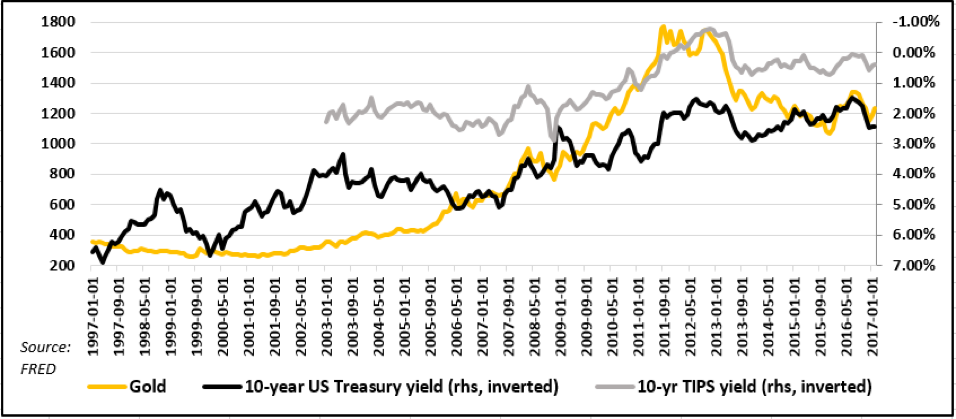

Rate Hike Not Necessarily Bad News for GoldIn terms of the Fed, as the probability of a March hike rose to nearly 80% as of last Friday’s close, some downward price pressure in the run-up to decision on March 15 was certainly not inconceivable and should be expected. As illustrated by dovish FOMC member Brainard’s recent speech, along with several speeches and comments by other members in the week before last (Kaplan, Harker, Williams, Lacker, Dudley, Mester, Powell, and Janet Yellen herself), jawboning has been hawkish lately, which has weighed on gold prices ahead of the decision, leading to a test of technical support levels. A potential hike by the Fed this month need not necessarily deter the resumption of the uptrend: since April 1968, for any given month in which the effective federal funds rate rose, gold rallied more than 50% of the time. Although the next hike may potentially indicate a quickening in the pace of tightening, the cycle as such need not necessarily spell carnage for gold prices. For instance, during the tightening cycle between June 2004 and June 2006, when Fed fund rates rose from 1% to 5.25%, gold prices rallied some 50%. Following the first hike of the current cycle on December 16th 2015, prices rose from $1071.5 to $1234.5 by the end of following quarter (Q1 2016), for a gain of more than 15%. Gold also rallied following the second Fed hike on December 14th 2017, when the metal closed at $1144.6, rising to nearly $1260 at its recent interim peak. An Unusual CycleComing off a zero-lower bound regime, this is an abnormal monetary tightening cycle. Money supply is at record highs after three rounds of QE, yields broadly remain close to their record lows and given potential trade wars and significant fiscal stimulus, the US dollar may well remain subdued under the Trump administration. Combining these three variables (M2, 10-year US Treasury yields, and the Fed’s broad US dollar index) yields an interesting metric with which to compare gold prices over the long-term. The negative relationship between gold and 10-yr nominal Treasury yields over the past 20 years is particularly interesting, as is the correlation between real yields and gold over the last 10 years. Currently, 10-yr real yields suggest gold prices may be slightly undervalued. |

Gold price vs. nominal 10 yr. treasury note yields 1997-2017 |

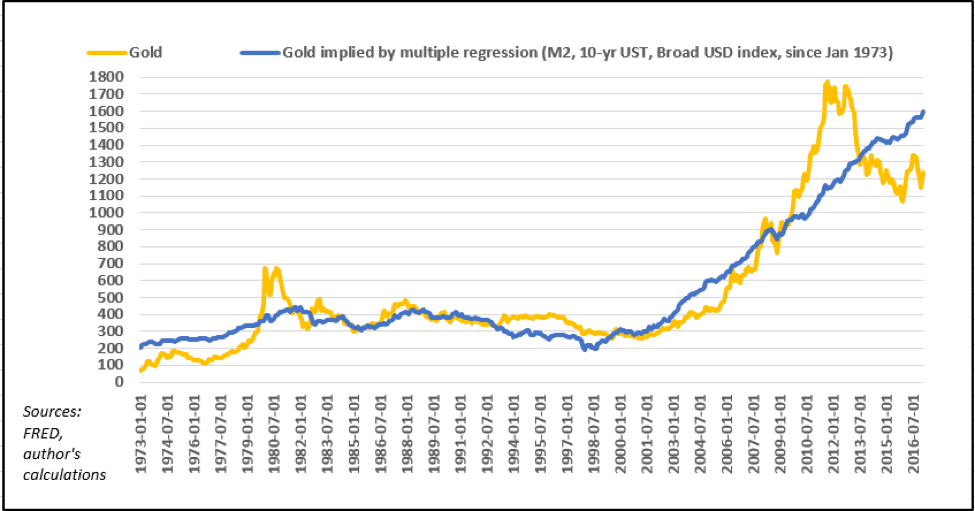

| Contemplating a longer period and using a metric combining M2, 10-yr nominal yields and the broad USD index as independent variables going back to January 1973, a statistically significant multiple regression currently implies gold prices of around $1600. |

Gold price vs. implied gold price yielded by multiple regression |

Conclusion

Perhaps most importantly, there are no signs of a trend reversal in this indicator yet, which suggests the environment for gold remains positive. In other words, short term selling pressure ahead of the Fed may actually provide an interesting entry opportunity for investors considering to buy gold for the long term.

Charts by stockcharts, FRED/ Helder Mello Guimaraes

Chart captions & editing by PT

Tags: central banks,Featured,newsletter,Precious Metals