© Pogonici | Dreamstime.com Tribune de Genève. Thousands of cross-border workers working in the canton of Geneva, who have not yet formally sorted out their health insurance situation, risk getting a big bill. This week the canton made a final call to those living in France and working in Geneva to make a formal choice between the French and Swiss health systems, something which must be done before the final deadline on...

Read More »Weekly Speculative Positions (as of May 02): Euro Shorts Covered, Yen Longs Liquidated

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »FX Weekly Preview: Dollar Drivers

Summary: US retail sales and CPI should help bolster confidence that the Fed was right about the transitory nature of Q1 slowdown. Bank of England meets; Forbes will likely continue with her dissent, but likely failed to convince her other colleagues of the merit of an immediate rate hike. French politics are center stage, but German state election and South Korea’s national election are also important....

Read More »Emerging Markets Preview

Stock Markets EM FX got some limited traction as the week closed, helped by stabilizing commodity prices. However, oil, copper, and iron ore have all broken important technical levels that suggest further weakness ahead. We also think the FOMC and jobs data support our view that the next Fed hike will be in June. This backdrop should keep EM on the defensive this week. Stock Markets Emerging Markets, May 06...

Read More »Swiss employees the best paid in Europe, according to study

© Kevkhiev Yury | Dreamstime.com Le Matin. According to a recent study, employees in certain roles in Switzerland are paid around 50% more than those second-placed Luxembourg. The premium applies to recent hires, middle managers and qualified professionals, says the study conducted by Willis Tower Watson. The report, entitled Global 50 Remuneration Planning Report 2016/2017, looks at pay across 50 roles and 60 countries...

Read More »Keiser Report Interview: Peak Gold, Silver On Small Finite Planet

Peak Gold and Silver On “Small Finite Planet” With Near Infinite CurrencyPeak gold and silver and the case for peak precious metals on “our small, finite planet” was the topic for discussion on the latest episode of the the Keiser Report. (Max Keiser interview of Mark O’Byrne of GoldCore in 2nd half of show at 13 min 15 seconds) [embedded content] Topics covered in the interview – Small planet with finite resources...

Read More »Emerging Markets: Buyer Beware – An Interview with Jayant Bhandari

Jayant on Emerging Markets, Precious Metals and Mining Companies Maurice Jackson of Proven & Probable has once again interviewed one of our friends, namely Jayant Bhandari, a frequent and highly valued contributor to Acting Man. Jayant is probably best known to our readers for his strong criticism of the economic and nationalist policies implemented by prime minister Narendra Modi in India since he decreed the...

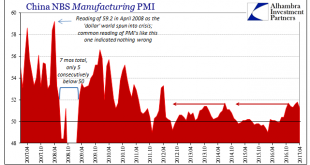

Read More »Blatant Similarities

Declines in several of the world’s PMI’s in April have furthered doubts about the global “reflation.” But while many disappointed, some sharply, it isn’t just this one month that has sown them. In China, for example, both the manufacturing and non-manufacturing sentiment indices declined to 6-month lows. While that might be erased next month as normal short run volatility, the indicators overall do seem to have stalled...

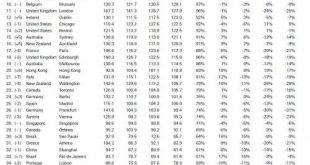

Read More »These Are The Most Expensive (And Best) Cities Around The World

Every year Deutsche Bank releases its fascinating index of real-time prices around the world which looks at the cost of goods and services from a purchase-price parity basis, to determine the most expensive – and in this year’s edition, best – cities. As have done on several occasions in the past, we traditionally focus on one specific subindex: the cost of “cheap dates” in the world’s top cities. The index consists of...

Read More »London Property Market Vulnerable To Crash

– London property market vulnerable to crash– House prices in London are falling – London property up 84% in 10 years (see chart) – House prices have risen over 450% in 20 years– Brexit tensions as seen over weekend and outlook for U.K. economy to impact property– Global property bubble fragile – Risks to global economy– Gold bullion a great hedge for property investors For the bargain price of 36 AED (£5) I can buy...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org