See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Input Data Errors Dear Readers, I owe you an apology. I made a mistake. I am writing this letter in the first person, because I made the mistake. Let me explain what happened. I wrote software to calculate the gold basis and co-basis (and of course silver too). The app does not just calculate the near contract. It calculates the basis for many contracts out in the distance, so I can see the whole picture. I developed a model for the fundamental gold price, based on the basis. My software calculates this, too (spoiler alert: the reported fundamental prices were high). I have long since debugged it. It works reliably. So reliably, that every day I pored over the results, but I no longer checked the inputs and intermediate steps of the calculation. Now, in retrospect, I realize that I should have. The wrong stuff went into the funnel in the upper left-hand corner… - Click to enlarge The root cause is simple. For as far back as I have ever seen, the symbol for a future has been a two-letter code for the commodity + a one letter for the month and one digit for the year. For example, gold is GC. December is Z. And 2017 is 7. So the December gold contract is “GC Z7”.

Topics:

Keith Weiner considers the following as important: dollar price, Featured, Gold and its price, gold basis, Gold co-basis, gold price, gold silver ratio, Miscellaneous, newsletter, Precious Metals, silver basis, Silver co-basis, silver price

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

Input Data ErrorsDear Readers, I owe you an apology. I made a mistake. I am writing this letter in the first person, because I made the mistake. Let me explain what happened. I wrote software to calculate the gold basis and co-basis (and of course silver too). The app does not just calculate the near contract. It calculates the basis for many contracts out in the distance, so I can see the whole picture. I developed a model for the fundamental gold price, based on the basis. My software calculates this, too (spoiler alert: the reported fundamental prices were high). I have long since debugged it. It works reliably. So reliably, that every day I pored over the results, but I no longer checked the inputs and intermediate steps of the calculation. Now, in retrospect, I realize that I should have. |

|

| The root cause is simple. For as far back as I have ever seen, the symbol for a future has been a two-letter code for the commodity + a one letter for the month and one digit for the year. For example, gold is GC. December is Z. And 2017 is 7. So the December gold contract is “GC Z7”. Silver is SI, so December silver is “SI Z7”.

I did not expect my real-time quote provider to change year codes for contracts in 2018 and beyond. No longer is it one digit for year —8 in this case. Now it requires two digits. So the December 2018 gold contract is “GC Z18”. Even now that I have looked, I do not find any announcement of this change. I am not even sure if it is an official COMEX change, or just a quirk of one quote provider. This error was compounded because my software was not programmed to notify me of a problem. In software, the only thing worse than a failure in a system that is used in production is a silent failure that goes unnoticed, and hence goes uncorrected. This failure went unnoticed. |

|

System UpgradeBefore I get to the impact, I want to discuss how we will make sure this does not happen again. My team and I have been working hard on a new website, and the centerpiece will be our ongoing data science work in the precious metals markets. We will publish about 45 graphs, with daily updates. Obviously, this is driven by a much more sophisticated software system than my humble application. The new software is developed by one of the best coders in the world (not me, I’m rusty after not coding full-time in almost 15 years). Rudy Mathieu worked for my last company, a software company called DiamondWare. Rudy has built a hardened, enterprise-grade software system (now undergoing extensive testing), and when it encounters an error, it does not fail silently. It is constantly checking the status of all key components, and has a dashboard so we can monitor how the software and the server running it are doing. It emails us if anything goes wrong. It will instantly detect problems, such as a change in the year code or even the Spanish Inquisition, which nobody expects. For years, I have been publishing a unique view into the markets. Our new site takes it a thousand times further. I expect that it will become an essential tool for anyone who uses or trades gold. We need to ensure it is as reliable as clockwork. I promise to make it so. |

Nobody expects the Spanish Inquisition! |

Data Error ImpactBack to the question: what was the net effect? My software was not able to calculate a basis for gold or silver contracts maturing in 2018 or beyond. However, my fundamental price model relies on them. Its accuracy began to suffer starting around last August. This error continued to grow in magnitude. As of last week’s Report, the fundamental price of gold was overstated by about $175, and silver’s fundamental price by $2.30. The correct fundamental prices as of Friday March 31 were about $1,260 and $16.70. Interestingly — and this is important — the fundamental gold-silver ratio was robust to this error. The value stated in last week’s report, 75.75, was almost perfect. It was off from the revised estimated fundamentals by 0.2. I say revised and estimated, because I went back over the time period where I have incomplete data and derived what I need. The result is good enough for horseshoes and hand grenades, as we say in America (but it has higher uncertainty). There is a bigger lesson here. Monetary Metals focuses on the ratio (which we trade in our fund), because it is less error-prone, more accurate, and less risky than trading either metal against the dollar. The bottom line is that on March 31, the corrected fundamental gold price was above the market price, though not nearly so far above as I had reported it. It was about 1.4% over the market price (I reported 15.6% last week). As an aside, my friend Pater Tenebrarum at the Acting Man blog wrote about the disparity between the fundamental drivers that he monitors, and the fundamentals I reported. He is right in thinking that demand for physical is not going ballistic yet. Though as you will see in the graphs below, the fundamental price has indeed been rising since mid to late December (as I have been correctly reporting), from a low of around $1,115 to $1261 at the end of March. The correct silver fundamental price is below the market price. My commentary actually stands up pretty well, in light of the correct data. Even while I erroneously reported a silver fundamental price running up to about $19, I have not been enthusiastic about silver. I haven’t “trusted” it enough to encourage a big silver trade, nor called for a major price move. I think there were two reasons. One, obviously, the nearer-term contracts which I monitor are accurate. They did not show the kind of moves I would expect to see if the market for physical metal was getting so tight. The error only occurred for contracts in 2018. Two, the fundamental gold-silver ratio was correctly calling for a higher market ratio. Below, I include graphs of the fundamental prices for both metals. The correct values will be overlaid with the ones I have been calculating. So you can see where it went off the rails, and by how far it deviated. There is one last thing, which I am reluctant to discuss now, before we are ready to launch. Yet it is germane. Monetary Metals has licensed market data from Thomson Reuters. When the new charts go live, they will be based solely on this data. This data is of better quality than the data from the real-time quote provider I have been using. And we have developed some very sophisticated algorithms that allows us to extract the maximum signal with the least noise, far superior to what my little app does with the data from my current provider. The new basis and fundamental prices will not line up perfectly with the old data series. One reason is that the bid-ask spread is tighter. By the nature of the math to calculate the basis, a tighter spread means a higher basis and higher co-basis. That said, I am confident of two things. One, the new data is more accurate. And two, the old data set has served well in showing the big picture (notwithstanding the error I corrected this week). |

|

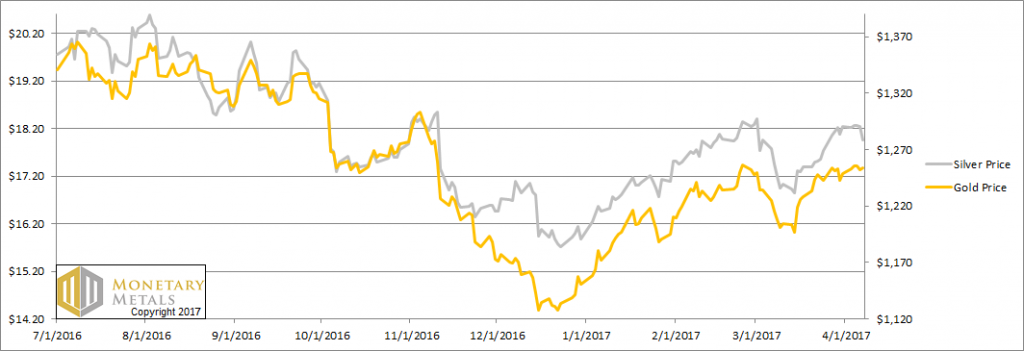

Fundamental DevelopmentsWe will look at the only true picture of supply and demand in the gold and silver markets. But first, the price and ratio charts. |

Prices of Gold and Silver(see more posts on gold price, silver price, ) |

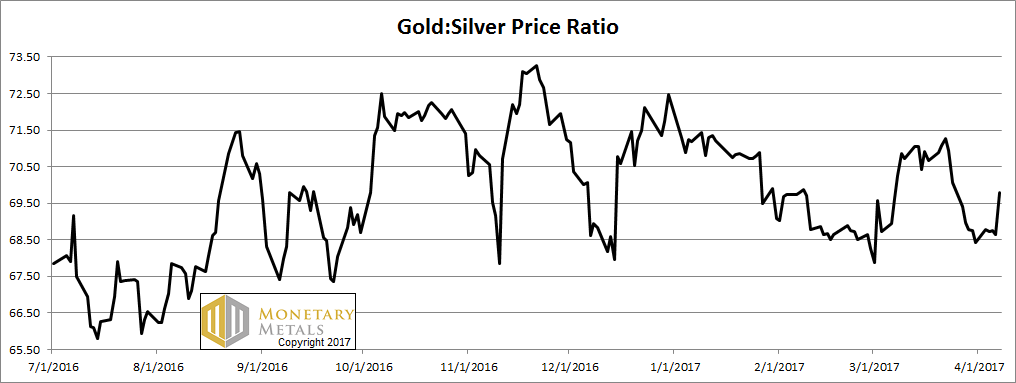

Gold:Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold-silver ratio. Last week, we asked if the downward-moving gold-silver ratio had hit a line of support. It seems it did, as it moved up sharply on Friday.

|

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

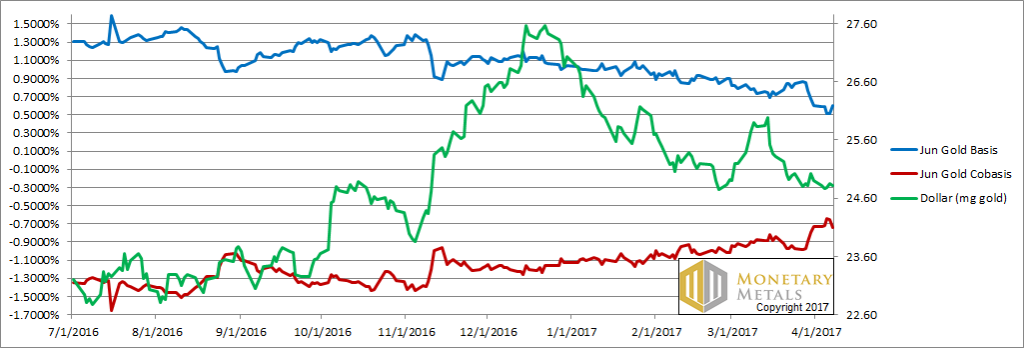

Gold Basis and Co-basis and the Dollar PriceHere is the gold graph. Not much change in the scarcity of gold (i.e. the red line, the cobasis) while the price moved up slightly. Our calculated fundamental price is up $30, to about $1,290. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

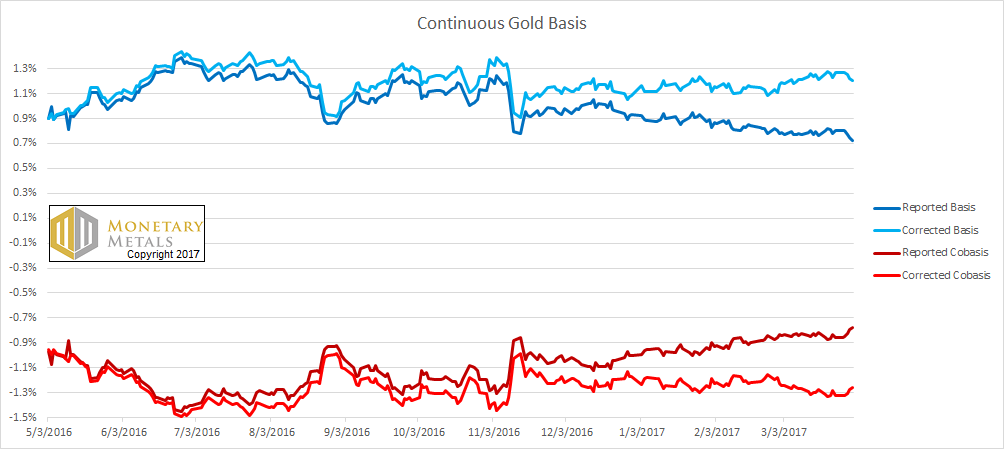

Gold Basis and Co-basis – CorrectedLet’s take a look at two graphs. Both show enough time to see where the error began to creep in, and where it ends. They are May 3, 2016 through March 31, 2017. The first is the continuous gold basis, with the erroneous line overlaid with the corrected line. As you can see, the erroneous basis was lower (indicating, falsely, lower abundance) and the erroneous co-basis was higher (indicated greater scarcity). |

Gold Basis and Co-basis - Corrected(see more posts on gold basis, Gold co-basis, ) |

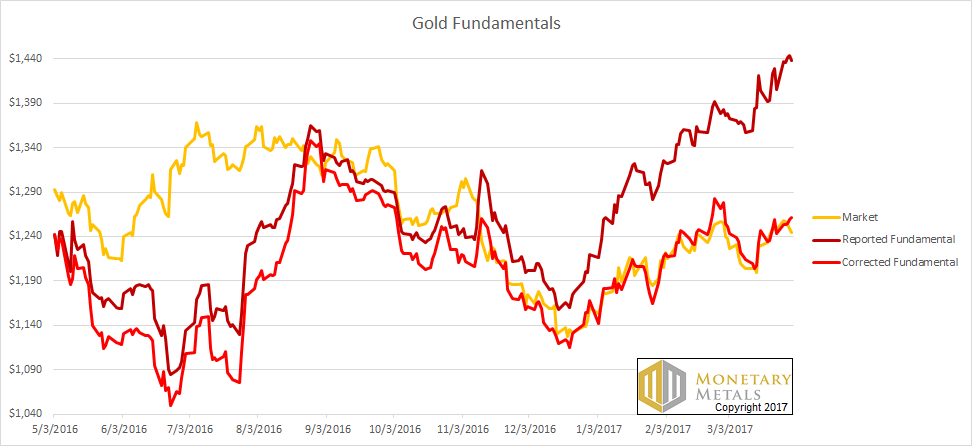

Gold Fundamental Reported and CorrectedThe second is the market price of gold, overlaid with the erroneous and corrected fundamental prices. The Reported and Corrected Gold Fundamental Prices |

Gold Fundamental Reported and Corrected(see more posts on Gold, ) |

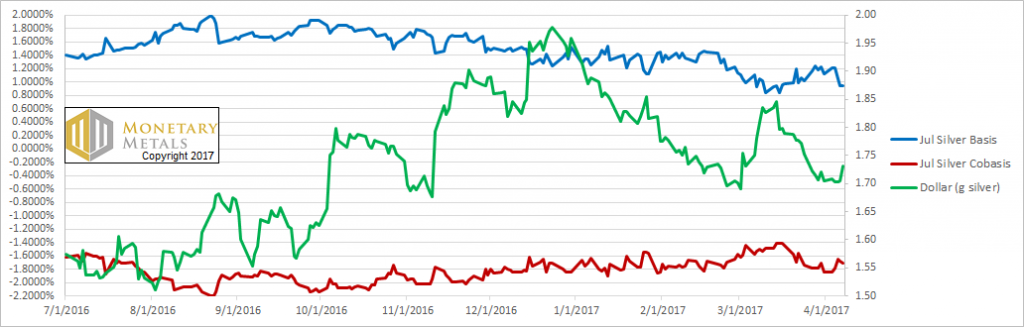

Silver Basis and Co-basis and the Dollar PriceThe erroneous one takes off for the stars. The corrected value is much closer to the market price, though a bit above. Now let’s look at silver. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

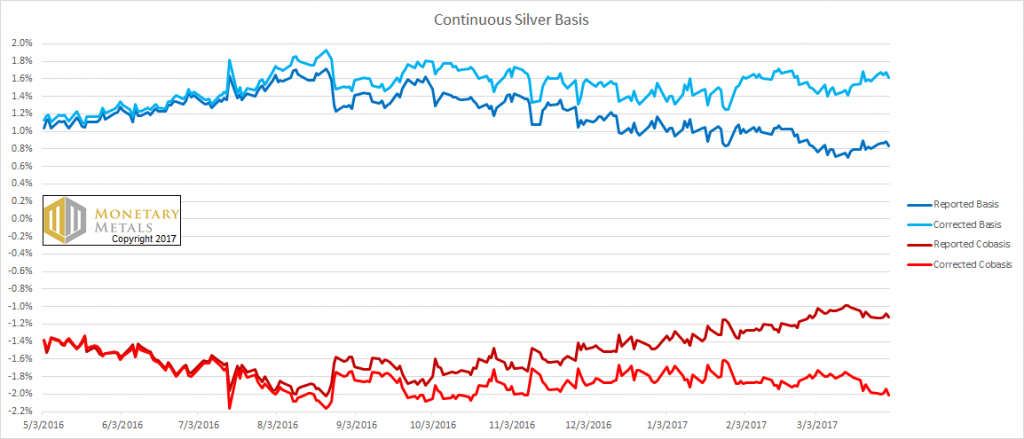

Silver Basis and Co-basis – CorrectedWe switched from the May to the July contract, as the May contract is in the process of being rolled (where traders must close positions in May and if they want to keep their positions, open a July or farther-out contract). There is a small decrease in the basis and increase in co-basis, along with a falling price this week. And our fundamental price is up 14 cents, to just under $16.85. Yes, alas, that is more than a buck under the market. Here are the same extra two graphs for silver. |

Silver Basis and Co-basis - Corrected(see more posts on silver basis, Silver co-basis, ) |

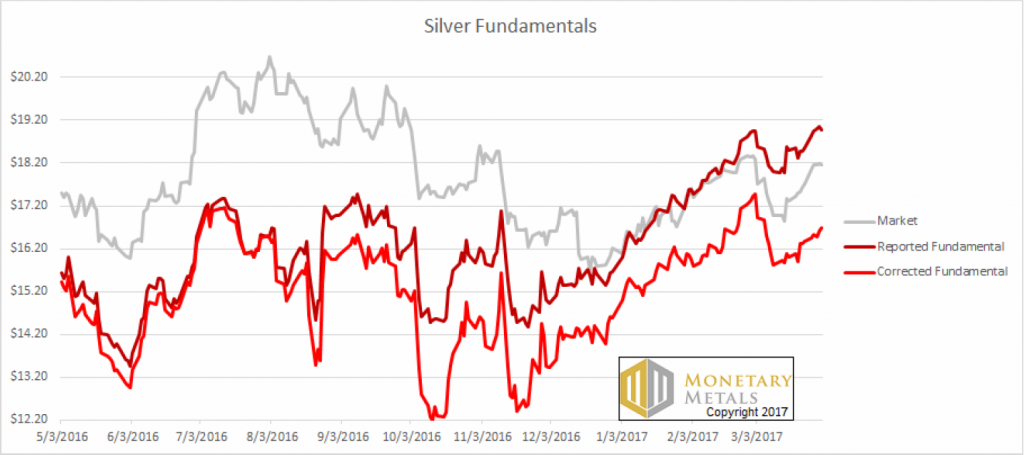

Silver Fundamentals Reported and Corrected |

Silver Fundamentals Reported and Corrected(see more posts on silver, ) |

You can see here that there are two salient features. One, the fundamental price has been rising for about a month longer than that of gold, although from a much more volatile bottom ($12.39). Two, the fundamental price is way below the market price.

© 2017 Monetary Metals

Image captions by PT

Tags: dollar price,Featured,gold basis,Gold co-basis,gold price,gold silver ratio,Miscellaneous,newsletter,Precious Metals,silver basis,Silver co-basis,silver price