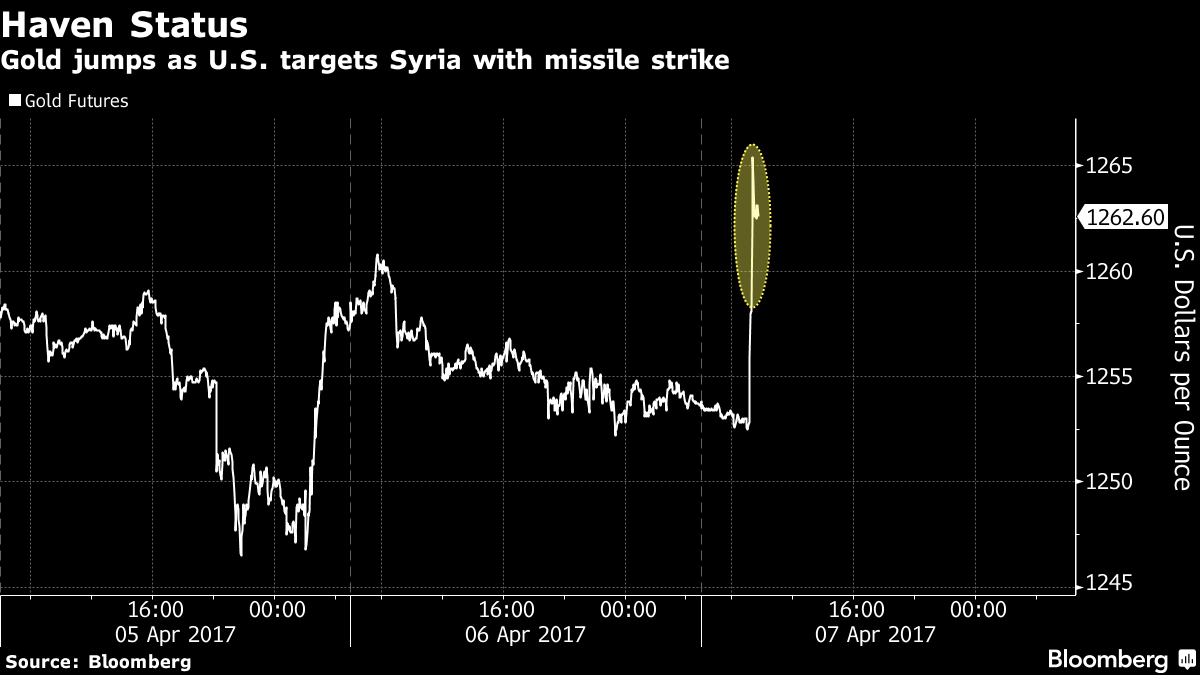

– Gold silver oil spike after U.S. bombs Syria– Gold and silver spike 1% as oil rises 1.4% – Gold breaks 200 day moving average, 4th week of gains– Stocks fall after U.S. strikes in Syria rattle markets – U.S. missiles hit airbase; Lavrov says no Russian casualties; Russia deploys cruise missile frigate to Syria – Russia denounces ‘aggression’ & warns of ‘considerable damage’ U.S. ties– “Aggression against a sovereign state in violation of international law” – Russia – Iran warns “destructive and dangerous” strike– China warns against “further deterioration” in Syria– Trump sending message to China and Russia– Concerns of wider war see World War III trend on Twitter – Brexit and French elections sees robust demand for gold and silver bullion Gold and silver prices spiked sharply higher today, as investors piled into the safe haven asset in the wake of U.S. bombing of Syria. Gold and silver bullion rose more than 1% and oil prices rose 1.4% after the bombings. Gold reached a 5-month high as risk aversion returned to markets leading to a sell off in stocks and oil prices rising. Brent crude futures surged more than 2% after the US attack and were last up 1.5% at .72 a barrel. Gold earlier climbed as much as 1.4 percent to its highest since Nov. 10 at ,269.30.

Topics:

Mark O'Byrne considers the following as important: Featured, GoldCore, newsletter, Weekly Market Update

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

– Gold silver oil spike after U.S. bombs Syria

– Gold and silver spike 1% as oil rises 1.4%

– Gold breaks 200 day moving average, 4th week of gains

– Stocks fall after U.S. strikes in Syria rattle markets

– U.S. missiles hit airbase; Lavrov says no Russian casualties; Russia deploys cruise missile frigate to Syria

– Russia denounces ‘aggression’ & warns of ‘considerable damage’ U.S. ties

– “Aggression against a sovereign state in violation of international law” – Russia

– Iran warns “destructive and dangerous” strike

– China warns against “further deterioration” in Syria

– Trump sending message to China and Russia

– Concerns of wider war see World War III trend on Twitter

– Brexit and French elections sees robust demand for gold and silver bullion

| Gold and silver prices spiked sharply higher today, as investors piled into the safe haven asset in the wake of U.S. bombing of Syria.

Gold and silver bullion rose more than 1% and oil prices rose 1.4% after the bombings. Gold reached a 5-month high as risk aversion returned to markets leading to a sell off in stocks and oil prices rising. Brent crude futures surged more than 2% after the US attack and were last up 1.5% at $55.72 a barrel. Gold earlier climbed as much as 1.4 percent to its highest since Nov. 10 at $1,269.30. Gold is now trading at levels not seen since the November election of Donald Trump as U.S. president. Gold is on track for a fourth straight week of gains and this in conjunction with the higher 2016 close and the higher Q1, 2017 close is bullish from a technical and a momentum perspective. Gold has not managed to close above the 200 day moving average – $1,257/oz – in recent days and a weekly close above that level today will be very bullish for gold. This is especially the case given the very uncertain geo-political backdrop. The unilateral action by President Trump and the use of cruise missiles against a Syrian air base, has escalated tensions with Syrian allies Russia and Iran. Russia has denounced the U.S. ‘aggression’ and warned of ‘considerable damage’ to ties with the U.S. The Kremlin warned that “aggression against a sovereign state is in violation of international law.” China warned against “further deterioration” in Syria and Iran said that the U.S. bombing was “destructive and dangerous.” Markets were already nervous as Trump met Chinese leader Xi Jinping for talks over flashpoints such as North Korea and the U.S. massive trade deficits with China and massive and continuously increasing national debt. Other geo-political concerns such as Brexit and the upcoming French elections is leading to ongoing robust demand for gold and silver bullion. |

Gold Jumps(see more posts on gold price, ) |

Tags: Featured,newsletter,Weekly Market Update