Endangered Recovery As we noted in a recent corporate debt update on occasion of the troubles Neiman-Marcus finds itself in (see “Cracks in Ponzi Finance Land”), problems are set to emerge among high-yield borrowers in the US retail sector this year. This happens just as similar problems among low-rated borrowers in the oil sector were mitigated by the rally in oil prices since early 2016. The recovery in the oil...

Read More »Lackluster Trade

US imports rose 9% year-over-year (NSA) in March 2017, after being flat in February and up 12% in January. For the quarter overall, imports rose 7.3%, a rate that is slightly more than the 2013-14 comparison. The difference, however, is simply the price of oil. Removing petroleum, imports rose instead 6.3% in March and just 4% for the first quarter overall. The value of inbound crude oil expanded by more than 70% for...

Read More »How companies in Switzerland become best places to work

A warm welcome – the Google reception in Zurich A new ranking shows the best firms to work for in Switzerland – with Google topping the large companies for a third time in a row. Important to employees in all categories: a respectful and motivational work culture. In all, 29 companies were awarded Best Workplaces in Switzerland in the Great Place to Work® Award Ceremony in Zurich on Thursday evening. The results were...

Read More »Easyjet expands in Geneva adding a new aircraft

20 Minutes. On Friday, Easyjet added a 14th aircraft to its Geneva-based fleet. The new Airbus A320 will allow it to add new destinations. © Tommy Beattie | Dreamstime.com - Click to enlarge The new aircraft will create 36 new jobs on top of the current 500 at the airline’s Geneva base, Thomas Haagensen, Easyjet’s director of northern Europe, told Le Matin Dimanche. Last year, the airline flew 900,000 more people from...

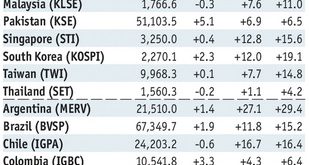

Read More »Emerging Markets: What Has Changed

Summary Moon Jae-in was elected president of South Korea Philippine President Duterte named Nestor Espenilla as central bank governor Nigerian President Buhari traveled to London for a follow-up to the initial medical visit earlier this year Market expectations for 2018 inflation in Brazil rose for the first time in more than a year Peru’s central bank unexpectedly started the easing cycle with a 25 bp cut to 4.0%...

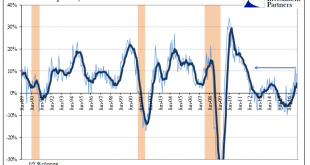

Read More »Great Graphic: Trade-Weighted Dollar

Summary: US TWI has appreciated a little since the end of Q1. The euro and sterling’s strength are exceptions to the rule. The dollar has edged up against the currencies of the US top four trading partners here in Q2. In early Asia today, the euro reached its highest level against the dollar since the US election last November. Sterling was near seven-month highs. It is primarily because of the strength of...

Read More »Will Gold or Silver Pay the Higher Interest Rate?

The Wrong Approach This question is no longer moot. As the world moves inexorably towards the use of metallic money, interest on gold and silver will return with it. This raises an important question. Which interest rate will be higher? It’s instructive to explore a wrong, but popular, view. I call it the purchasing power paradigm. In this view, the value of money — its purchasing power —is 1/P (where P is the price...

Read More »US-Vermögensverwalter expandiert in die Schweiz

Von Zürich aus soll künftig der Markt Schweiz/Österreich bearbeitet werden Der US-amerikanische Vermögensverwalter PineBridge Investments eröffnet 2017 in Zürich eine Niederlassung. Grund für die physische Präsenz in der Schweiz sei die "signifikant gewachsene" Kundenbasis in der Schweiz. Diese wolle man nun vor Ort adäquat betreuen können, lässt Klaus Schuster, Head of Business Development...

Read More »How The US Government Let A Giant Bank Pin A Scandal On A Former Employee

The following is an excerpt from David Enrich’s nonfiction financial and legal thriller The Spider Network: The Wild Story of a Math Genius, a Gang of Backstabbing Bankers, and One of the Greatest Scams in Financial History. (Read part of the prologue here; another excerpt can be found here) This excerpt takes place shortly after the accused mastermind of the Libor scandal, Tom Hayes, is fired from his job at...

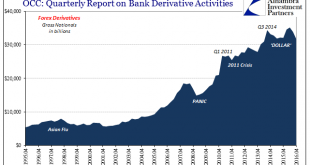

Read More »Noose Or Ratchet

Closing the book on Q4 2016 balance sheet capacity is to review essentially forex volumes. The eurodollar system over the last ten years has turned far more in this direction in addition to it becoming more Asian/Japanese. In fact, the two really go hand in hand given the native situation of Japanese banks. As expected, data compiled by the Office of Comptroller of the Currency (OCC) shows the same negative tendencies...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org