There are three areas that we suspect that many investors are vulnerable to disappointment. NAFTA, trade talks with China, and Powell speech at Jackson Hole on Friday. With problems elsewhere, the Trump Administration has been playing up the likelihood of an agreement as early as today with Mexico, which would be used, apparently to deliver a fait accompli to Canada. It is not clear what a “handshake agreement” really...

Read More »Monthly Macro Monitor – August

[embedded content] Economic thoughts and analysis from Alhambra Investments CEO Joe Calhoun. Related posts: In Next Crisis, Gold Won’t Drop Like 2008, Report 19 August 2018 FX Daily, August 17: Dollar Limps into the Weekend Monthly Macro Monitor – August 2018 FX Daily, August 14: Brief Respite but Little Relief Global Asset Allocation Update –...

Read More »SNB banknote app updated for new 200-franc note

The Swiss National Bank’s ‘Swiss Banknotes’ app is designed to help the public familiarise themselves with the new banknotes. The popular app, which has been downloaded some 100,000 times, now also showcases the new 200-franc note. It can be downloaded free of charge from the Apple (itunes.apple.com) and Google Play (play.google.com) app stores. Anyone who has already downloaded the software can update it via the...

Read More »Or suisse: M Villiger a mené la politique nécessaire au bradage des années 2000. Vincent Held

Or suisse: M Villiger a mené la politique nécessaire au bradage des années 2000. Vincent Held Le 1er mai de l’an 2000, la Banque nationale suisse démarrait la vente de quelque 1’300 tonnes d’or à des prix historiquement bas. Le jour suivant le début de cette grande braderie, la BNS expliquera que tout ceci se déroulait dans le cadre d’un « accord sur l’or » conclu avec « 15 banques centrales européennes ». Sans plus de...

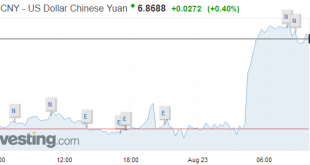

Read More »FX Daily, August 22: Markets Take US Political Developments in Stride

News that President Trump’s personal lawyer claimed he was instructed by the candidate to commit a federal crime and, separately, his the former campaign manager was found guilty on eight counts is hardly impacting the global capital markets. Swiss Franc The Euro has fallen by 0.11% to 1.1385. EUR/CHF and USD/CHF, August 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates...

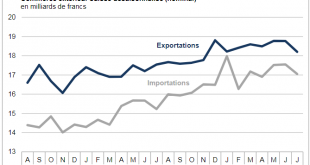

Read More »Swiss Trade Balance July 2018: Slowdown to a High Level

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

Read More »Submerged Lighthouse Syndrome – Precious Metals Supply and Demand

Fundamental Developments – The Gap Keeps Widening Last week, the lighthouse went down 24 meters (gold went down $24), or 50 inches (if you prefer, silver went down 50 cents). However, let’s take a look at the only true picture of supply and demand. Are the fundamentals dropping with the market price? They done whacked our lighthouse! [PT] Image credit: Skip Willits - Click to enlarge Gold and Silver...

Read More »Cool Video: Bloomberg TV Clip-Dollar Developments

- Click to enlarge The US dollar was sliding as I joined Vonnie Quinn and Shery Ahn on the Bloomberg Markets show. I tried making the case, as I have in recent posts, that the dollar’s rally in the first half of the month had left it over-extended. Most of the major currencies were outside of their Bollinger Bands a week ago and had begun correcting since August 15. Reports of President Trump’s criticism of the...

Read More »Great Graphic: Head and Shoulders Top in Dollar Index

This Great Graphic depicts what appears to be a head and shoulders top in the hourly bar chart of the Dollar Index. The neckline is found near 96.00 and rotating the pattern along it produces a measuring objective near 95.00. The bearish pattern was formed in the last few days, and the Dollar Index was resting near the neckline before Trump’s comments gave it the push. The low today is near 95.45, which corresponds to...

Read More »FX Daily, August 21: Trump Comments Hit Dollar, Little Impact on Rates

Swiss Franc The Euro has risen by 0.02% to 1.1378. EUR/CHF and USD/CHF, August 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is broadly lower following President Trump’s comments yesterday, criticising Fed policy and reiterating his previously made claim that China and the EU are manipulating their currencies. We suggested that last week’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org