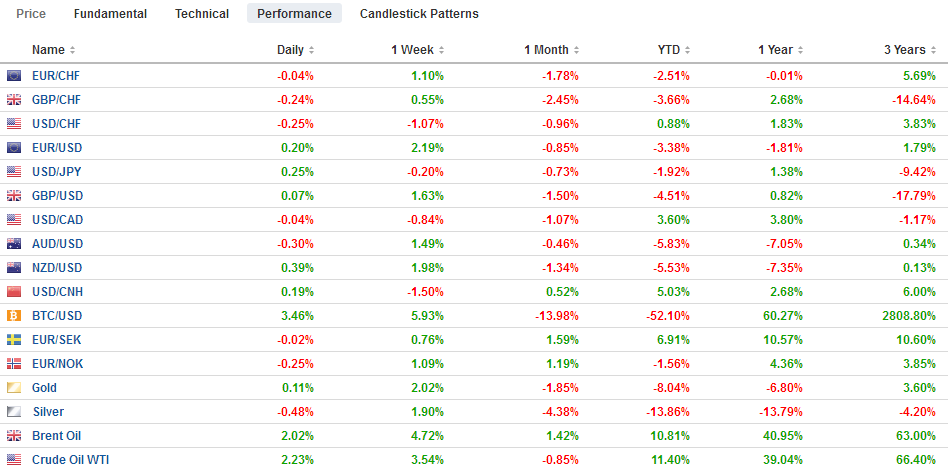

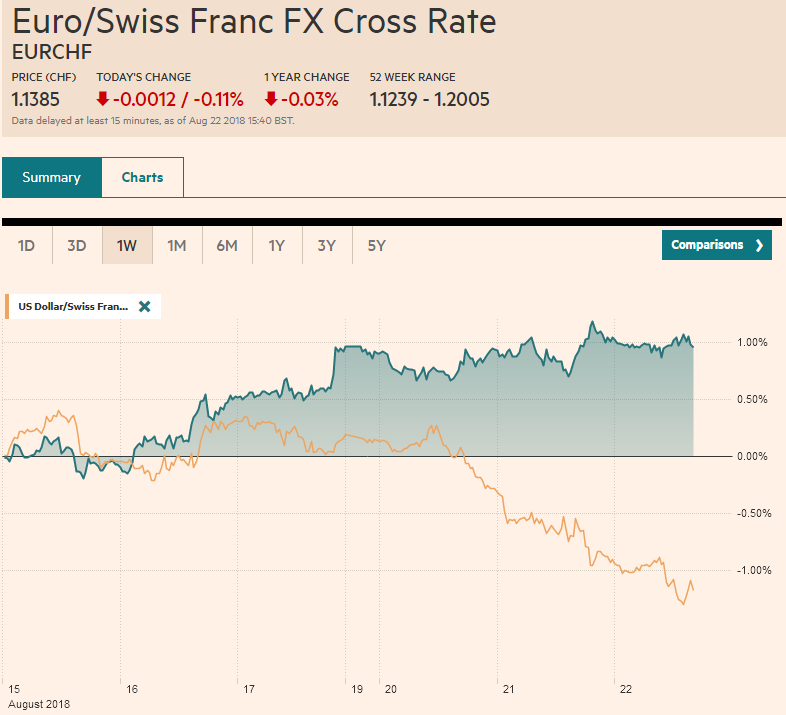

News that President Trump’s personal lawyer claimed he was instructed by the candidate to commit a federal crime and, separately, his the former campaign manager was found guilty on eight counts is hardly impacting the global capital markets. Swiss Franc The Euro has fallen by 0.11% to 1.1385. EUR/CHF and USD/CHF, August 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The dollar is narrowly mixed in consolidative trading after extending the correction that began last week. The Dollar Index held the small head and shoulders top objective near 95.00, but there has been little recovery, considering that last week’s low was a little shy of 97.00. Still, the dollar’s

Topics:

Marc Chandler considers the following as important: $CAD $GBP, 4) FX Trends, AUD, EUR, Featured, GBP, JPY, MXN, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

News that President Trump’s personal lawyer claimed he was instructed by the candidate to commit a federal crime and, separately, his the former campaign manager was found guilty on eight counts is hardly impacting the global capital markets.

Swiss FrancThe Euro has fallen by 0.11% to 1.1385. |

EUR/CHF and USD/CHF, August 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe dollar is narrowly mixed in consolidative trading after extending the correction that began last week. The Dollar Index held the small head and shoulders top objective near 95.00, but there has been little recovery, considering that last week’s low was a little shy of 97.00. Still, the dollar’s correction may not be complete. Asian equities got to react to the news first, and the MSCI Asia Pacific index rose 0.45% to extend its streak to four consecutive advances. Most markets in the region moved higher, with the noted exception of China and Australia. There are public holidays in several markets including Indonesia, Singapore, and Malaysia. The Shanghai Composite had advanced in the first two sessions of the week amid reports of encouragement by officials, which was not seen today, and the market gave back a little more than a third of the two-day gains. The S&P/ASX200 slipped 0.3% as it continued the pullback that began yesterday after reaching a 10-year high. Prime Minister Turnbull who turned back one leadership challenge yesterday faces additional pressure> No Australian Prime Minister has finished a complete term for more than a decade. While US politics do not seem to be weighing much on the US dollar, but the Australian dollar is the weakest of the majors, off about 0.25% (~$0.7350). There is an A$619 mln option struck there ($0.7250) that expires today. |

FX Performance, August 22 |

European shares are mixed, leaving the Dow Jones Stoxx 600 little changed. Most sectors are advancing, led by real estate, energy, and the financials. Utilities and consumer staples are the major offsets. The bond market is more interesting today, Of note, Italy’s bonds continue to recover. The 10-year yield rose from near 2.45% in mid-July to 3.20% last week amid renewed concern about the government’s fiscal plans. Today is the third consecutive decline, and the yield has returned to the 20-day average near 2.93%. The better performing sovereign bond market is helping steady the bank share index, which is extending yesterday’s recovery and is more than 3% above the lows set on at the end of last week. Peripheral European bonds markets are firmer. German Bunds are flat.

Oil prices are firm today. Brent is above $73 a barrel, and WTI for October delivery is establishing a foothold above $66 after hitting $64, a two-month low, last week. API reported a large (~5.2 mln barrel) draw down on US inventories and the preparation of sanctions on Iran has a cooling effect two-months before the implementation. There have been some reports noted a tightening of conditions. The EIA reports the government estimate of oil stocks and a 1.8 mln barrel draw is expected, Watch Cushing supplies, which have risen for the past two weeks. US exports are also believed to have picked up, while other supply may be diverted toward distillate production.

The Mexican peso is firm but within its recent ranges as the market awaits NAFTA developments. Signals from the US suggest a “handshake agreement” with Mexico is possible as early as today. It is not clear what a handshake agreement really entails, and there are several issues outstanding, leaving aside including Canada into the agreement. What were stumbling blocks earlier, like the US demand for a sunset clause, how to address government procurement, and how investment disputes are to be resolved, remain, according to press accounts. The Canadian dollar is firm with the greenback at two-week lows near CAD1.30.

There is risk that US participants take a dimmer view of Trump’s legal jeopardy than Asia or Europe. The next technical target in the euro is found near $1.1630 area, and a 2.2 bln euro option expires tomorrow struck at $1.1625. A trendline drawn off the mid-June high and catching several highs in July is found now a little below $1.17. Sterling is testing the 20-day moving average (~$1.2910) which coincides with the 50% retracement of this month’s drop (~$1.2915). A move above here could see some offers in the $1.2940 area with a stronger cap near $1.30.

The dollar recovered from JPY109.80 in the Asia session yesterday to JPY110.50 where ran out of steam. It was again sold in Asia, but today the JPY110 level held. However, the bounce again fizzled near JPY110.50. Cross rate adjustments, like euro-yen, seem to be playing impact the dollar-pairs. There are two maturing option strikes (JPY110 for $537 mln and JPY110.40 for $710 mln) that may help constrain activity for the next few hours.

The US reports existing home sales. This is both an interest rate and tax sensitive sector. Existing home sales edged lower each month in Q2. The seasonally adjusted pace slowed to 5.38 mln in June from 5.6 mln at the end of Q1. The pace in June 2017 was 5.50 mln, and it slowed to 5.42 mln in July. The small increase that is expected last month is unlikely to change the fact that the year-over-year pace is slower. Toward the end of the session, the minutes from the August 1 FOMC meeting will be released. Little will dissuade the investors from looking for a September hike, and whatever insight some observers will glean will be kept in check ahead of Powell’s speech on Friday at the Jackson Hole confab.

Canada reports June retail sales. After a heady 2.0% jump in May, the question is how much of a pullback. We suspect the risk is on the downside of the median forecast in the Bloomberg survey for a 0.2% decline.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD $GBP,$EUR,$JPY,Featured,MXN,newsletter