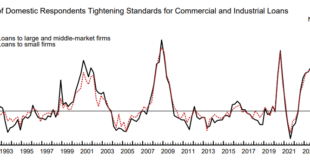

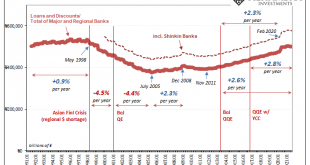

Banks continue to tighten lending standards across all sectors. This has eased a bit from the July survey. Banks continue to widen spreads across all sectors. The percentage of banks widening spreads has also eased a tad. Banks are not seeing increasing demand for loans. I’m just posting survey results for C&I loans, the graph is very similar for commercial real estate, residential real estate and consumer loans. Commercial and Industrial loan growth has...

Read More »“Money and Banking with Reserves and CBDC,” CEPR, 2023

CEPR Discussion Paper 18444, September 2023. HTML (local copy). Abstract: We analyze the role of retail central bank digital currency (CBDC) and reserves when banks exert deposit market power and liquidity transformation entails externalities. Optimal monetary architecture minimizes the social costs of liquidity provision and optimal monetary policy follows modified Friedman (1969) rules. Interest rates on reserves and CBDC should differ. Calibrations robustly suggest that CBDC provides...

Read More »Sam Bankman-Fried FTX’ed Up

You can listen to the audio version of this article here. Last week the cryptocurrency exchange FTX, which was recently valued at $32 billion, imploded. While the tragedy continues to play out, let’s summarize what has happened so far: FTX is a cryptocurrency exchange, co-founded by Sam “SBF” Bankman-Fried. FTX enables customers to make leveraged bets (as high as 20 to 1) on cryptocurrencies. More often than not, it takes loans to make loans. FTX would make these...

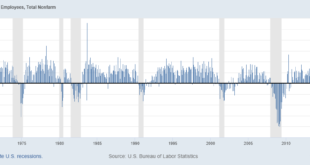

Read More »Weekly Market Pulse: A Most Unusual Economy

The employment report released last Friday was better than expected but the response by bulls and bears alike was exactly as expected. Both found things in the report to support their preconceived notions about the state of the economy. I do think the bulls had the better case on this particular report but there have been plenty of others recently to support the ursine side of the aisle too. My take is that everything about the economy right now, and really since...

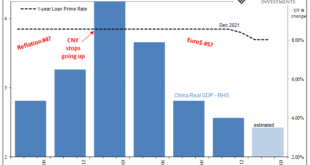

Read More »China’s Loan Results Back The PBOC Going The Opposite Way From The Fed

This week will almost certainly end up as a clash of competing interest rate policy views. Everyone knows about the Federal Reserve’s upcoming, the beginning of what is intended to be a determined inflation-fighting campaign for a US economy that American policymakers worry has been overheated. The FOMC will vote to raise the federal funds range (and IOER plus RRP) for the first time since December 2018 Over in China, however, it’s nearly certain to be the opposite....

Read More »The Hawks Circle Here, The Doves Win There

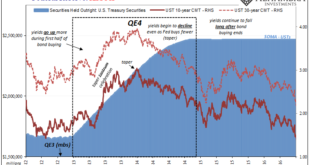

We’ve been here before, near exactly here. On this side of the Pacific Ocean, in the US particularly the situation was said to be just grand. The economy was responding nicely to QE’s 3 and 4 (yes, there were four of them by that point), Federal Reserve Chairman Ben Bernanke had said in the middle of 2013 it was becoming more than enough, creating for him and the FOMC coveted breathing space so as to begin tapering both of those ongoing programs.A full and complete...

Read More »The Real Tantrum Should Be Over The Disturbing Lack of Celebration (higher yields)

Bring on the tantrum. Forget this prevaricating, we should want and expect interest rates to get on with normalizing. It’s been a long time, verging to the insanity of a decade and a half already that keeps trending more downward through time. What’s the holdup? You can’t blame COVID at the tail end for a woeful string which actually dates back farther than the last pandemic (H1N1). Emil Kalinowski has it absolutely right; what happened in 2013 in the Treasury...

Read More »You Don’t Have To Take My Word For It About Eliminating QE

You don’t have to take my word for it. QE doesn’t work and it never has. That’s not just my assessment, pull out any chart of interest rates for wherever gets the misfortune of having been wasted with one of these LSAP’s. If none handy, then just read what officials and central bankers write about their own programs (or those of their close and affectionate counterparts). After nearly a decade of Abenomics in Japan, the latest Japanese Prime Minister Fumio Kishida...

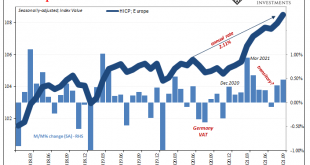

Read More »Tapering Or Calibrating, The Lady’s Not Inflating

We’ve got one central bank over here in America which appears as if its members can’t wait to “taper”, bringing up both the topic and using that particular word as much as possible. Jay Powell’s Federal Reserve obviously intends to buoy confidence by projecting as much when it does cut back on the pace of its (irrelevant) QE6. On the other side of the Atlantic, Europe’s central bank will be technically be doing the same thing likely at the same time. Except,...

Read More »Is Lending the Root of All Evil? Report 24 Feb

Ayn Rand famously defended money. In Atlas Shrugged, Francisco D’Anconia says: “So you think that money is the root of all evil? . . . Have you ever asked what is the root of money? Money is a tool of exchange, which can’t exist unless there are goods produced and men able to produce them. Money is the material shape of the principle that men who wish to deal with one another must deal by trade and give value for value....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org