Ayn Rand famously defended money. In Atlas Shrugged, Francisco D’Anconia says: “So you think that money is the root of all evil? . . . Have you ever asked what is the root of money? Money is a tool of exchange, which can’t exist unless there are goods produced and men able to produce them. Money is the material shape of the principle that men who wish to deal with one another must deal by trade and give value for value. Money is not the tool of the moochers, who claim your product by tears, or of the looters, who take it from you by force. Money is made possible only by the men who produce. Is this what you consider evil?” There needs to be a similar defense of the loan. The Attack On the Loan As money has been

Topics:

Keith Weiner considers the following as important: 6a) Gold & Bitcoin, Aquinas, Aristotle, Basic Reports, Featured, Gold and its price, lending, Loan, moneylending, newsletter, Shakespeare, Shylock, usury

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Ayn Rand famously defended money. In Atlas Shrugged, Francisco D’Anconia says:

“So you think that money is the root of all evil? . . . Have you ever asked what is the root of money? Money is a tool of exchange, which can’t exist unless there are goods produced and men able to produce them. Money is the material shape of the principle that men who wish to deal with one another must deal by trade and give value for value. Money is not the tool of the moochers, who claim your product by tears, or of the looters, who take it from you by force. Money is made possible only by the men who produce. Is this what you consider evil?”

There needs to be a similar defense of the loan.

The Attack On the Loan

As money has been slandered—the root of all evil, etc.—the loan has been demonized as well. And not just because the loan involves money, which is already established as pure evil. The loan piles a whole new kind of evil on top of the root of money. And many who accept money are opposed to lending, or at least lending with interest. Even the good guys.

In Politics, Aristotle wrote:

“The most hated sort [of moneymaking], and with the greatest reason, is usury, which makes a gain out of money itself, and not from the natural use of it. For money was intended to be used in exchange, but not to increase at interest. And this term Usury which means the birth of money from money, is applied to the breeding of money, because the offspring resembles the parent. Wherefore of all modes of making money this is the most unnatural.”

This shows a pernicious idea. If you lend 20 at 5% interest, you get back 21. This extra one is “unnatural”, according to Aristotle. Many people reflexively feel that this is coming out of the flesh of the borrower. This view is missing something. We will look at it, below.

In Ethicus, Thomas Aquinas says:

“To take usury for the lending of money is in itself unjust, because it is a case of selling what is non-existent; and that is manifestly the setting up of an inequality contrary to justice. In evidence of this we must observe that there are certain things, the use of which is the consumption of the thing; as we consume wine by using it to drink, and we consume wheat by using it for food. Hence in such things the use of the thing ought not to be reckoned apart from the thing itself; but whosoever has the use granted to him, has thereby granted to him the thing; and therefore in such things lending means the transference of ownership. If therefore any vendor wanted to make two separate sales, one of the wine and the other of the use of the wine, he would be selling the same thing twice over, or selling the non-existent: hence clearly he would be committing the sin of injustice. And in like manner he commits injustice, who lends wine or wheat, asking a double recompense to be given him, one a return of an equal commodity, another a price for the use of the commodity, which price of use is called usury. But there are things the use of which is not the consuming of the thing: thus the use of a house is inhabiting it, not destroying it. In such things ownership and use may be made the matter of separate grants. Thus one may grant to another the ownership of a house, reserving to himself the use of it for a time; or grant the use and reserve the ownership. And therefore a man may lawfully take a price for the use of a house, and besides demand back the house which he has lent, as we see in the hiring and letting of houses. Now according to the Philosopher, money was invented principally for the effecting of exchanges; and thus the proper and principal use of money is the consumption or disbursal of it, according as it is expended on exchanges.”

This shows a different rotten idea. If you rent a house, it’s OK to charge a fee and get the house back at the end. This is because the house is not consumed in being used. Which is true, but leads Aquinas astray in assessing interest on money. Thomas Aquinas asserts that it is the selling of the non-existent. This sounds a lot like an allegation of fraud. Though it would be hard, at least in our modern thought process, to say someone is defrauded who knows what he is getting.

Aquinas is not saying the borrower does not know. He is saying that the use of money is to spend, that is the money is consumed in a sense by being used. And thus, there should not be a price charged for using it, above the price for obtaining it. His understanding is also missing something.

In The Merchant of Venice, Shakespeare gives us the character Shylock. He is a Jewish moneylender, and an unsavory character. Shylock makes a loan to someone, with collateral set at one pound of flesh. It is noteworthy that Shakespeare associated lending at interest with a disfavored religion and objectionable personality. And he portrays collecting collateral as a nasty little lust for revenge. The artist need not make a philosophical argument, he can paint a picture or tell a story.

The Defense of the Loan

Shakespeare’s picture is missing the same thing as the pictures of Aristotle and Aquinas. Lending is a win-win deal. It should be self-evident (though not obvious, obviously) that if it weren’t good for both sides, then the deal would not take place. No one forces the lender to lend (well, today the Fed does) and no one forces the borrower to borrow.

Aristotle argues that lending is unnatural, because money is to be used to trade for other goods. If you lend your money, you enable someone else to trade it for goods but then he has to return it to you plus interest. Where is he supposed to get the interest? Shakespeare showed us vividly: it comes from the flesh of the borrower. Aquinas agrees, asserting that the interest is non-existent.

If wealth were zero-sum, then this would be true. If all the wealth that could exist, exists, and the absolute quantity of wealth could neither increase nor decrease, then Aristotle would be correct. Indeed, any gain by any means would necessarily come from the loss suffered by someone else.

Aristotle may, perhaps, be forgiven that he did not realize wealth could be created. In his day, it was produced very slowly and by much hard labor. This same condition prevailed in the day of Aquinas. Things were not all that much different even at the time of Shakespeare, long before the Industrial Revolution.

But today, there is no excuse. If someone in 2019 insists that wealth cannot be created, that anyone who gets richer is stealing from or otherwise exploiting others, then he is deluded and/or dishonest. Not only do we have a whole body of economic theory going back to Adam Smith. We have innumerable examples.

Apple gave the world, the smartphone. We say “gave”, because this one little device enriches us in ways both small and large. It performs the functions which once required a whole room full of gadgets: still camera, video recorder, boom box, calculator, watch, alarm clock, telephone, computer, TV, GPS map, etc. The profit that Apple made in so doing, is a trifle compared to the gain of its customers.

Our lives are made better by ride sharing, cardiac stents, and even lithium ion batteries and smartphones. Just to name a few recent inventions. Before that, was the automobile and airplane, telephone, telegraph, steam engine, cotton gin, steel, and the printing press.

We really are richer today than people were 100 years ago, much less in Shakespeare’s time. We are richer because of the work of countless inventors and entrepreneurs.

We, the people, lend our savings to productive entrepreneurs. At interest. The interest does not come out of the flesh of the entrepreneur, it comes out of the added production financed by our savings.

No one would think of Andrew Carnegie, John D. Rockefeller, or Alexander Graham Bell as victims. Nor think of their financiers as Shylocks. That’s because they got rich, even while paying for the money they needed to build their steel, oil, and telephone enterprises. Those who lent them money also made money. Thus we say it’s a win-win deal.

If the law prohibited lending at interest, then there would be no lending at all. No one will take the risk of not being paid back, or even give up the use of his money for a year, without being compensated. And therefore, no large enterprise can be financed. Since efficient production requires large-scale enterprises, everything we take for granted in the modern world, would be impossible. We would regress back to the dark ages, with family farms and little blacksmith and cooper workshops.

Which, not incidentally, is the path that central banks are taking us on with their war on interest. They are not making it illegal to lend at interest, they are so flooding the market with currency that loans are being driven down towards zero interest.

Supply and Demand Fundamentals

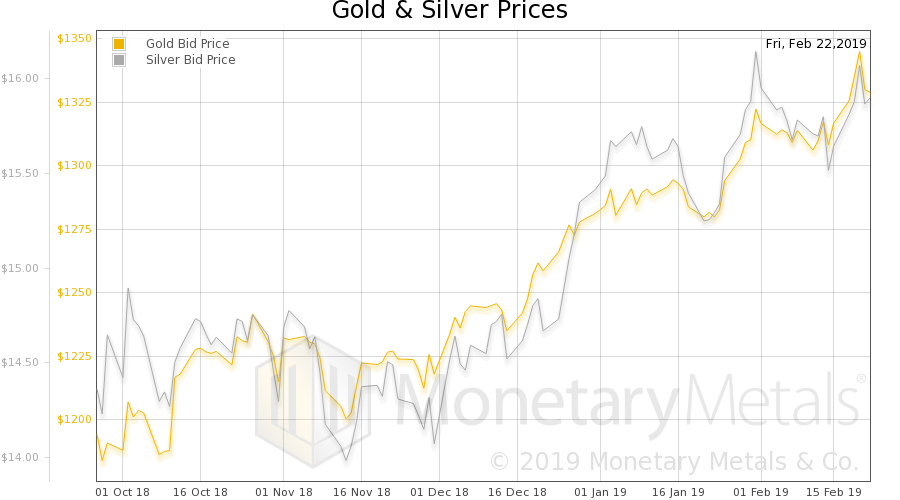

The prices of the metals were up somewhat, gold +$7 and silver + ¢13.

The price of the S&P 500 index was up, as was the price of oil and copper, and the price of the euro, pound, and yuan. And bitcoin. Even the Treasury bond had slight gains (i.e. slight drop in interest rate).

This is how the system is supposed to work. Institutions and traders are supposed to feel safe borrowing more dollars to buy every kind of risk asset. To arbitrage the yield differential and speculate for capital gains.

Of course, the yield differential between the dollar and the developed economy currencies is negative. But at least there’s capital gains.

So the central planners must feel good about the market moves this week.

There’s only one problem. These trades pile on more debt, in order to finance ownership of oil and copper. And the debt of other governments, which are themselves in the same pickle with no way out in the long term, if not short-term crises.

Businesses go on borrowing more and more, to consume copper and oil. They do this, in order to produce products. Which their customers borrow more and more to buy. When such borrowing can no longer be sustained, watch out. One will not want to be in debt to finance a hoard of copper or oil. And the stocks of companies whose debt is impaired, will certainly be no safe haven.

Gold and Silver PricePerhaps today is not that day. Let’s look at the only true picture of the supply and demand fundamentals of gold and silver. But, first, here is the chart of the prices of gold and silver. |

Gold and Silver Price(see more posts on gold price, silver price, ) |

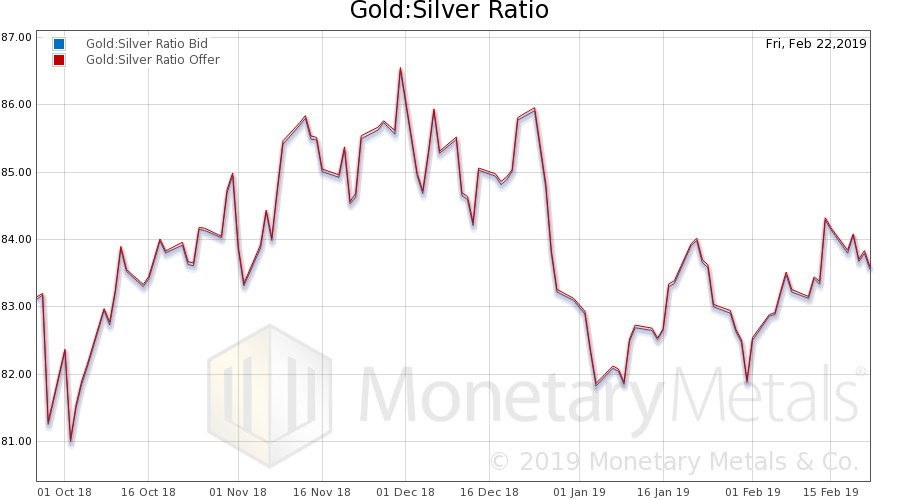

Gold:Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It was down a hair this week. |

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

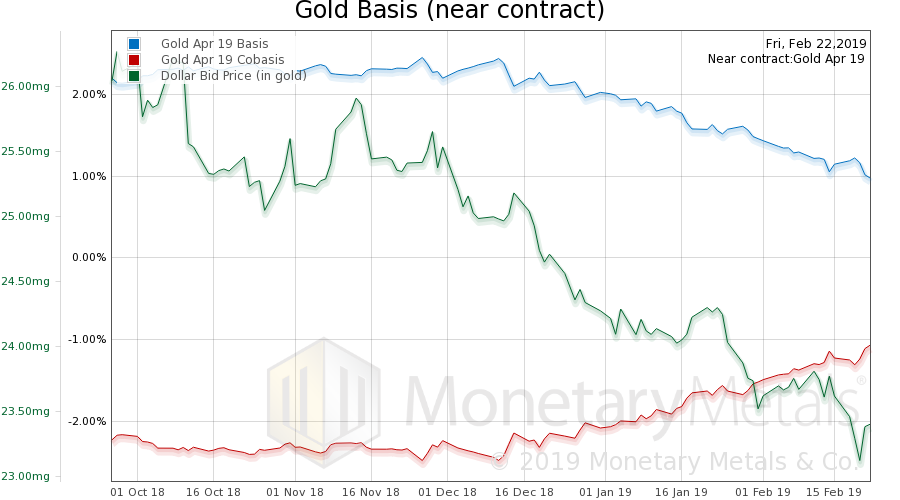

Gold Basis and Co-basis and the Dollar PriceHere is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. The price of gold is up, yet it is still scarcer (at least the near contract, the gold basis continuous is basically flat). We keep writing about this, not because gold is so scarce that we fear a bout of backwardation or worse yet, permanent backwardation. We write about it because it’s a change from the last several years. We now see price rising, and rising scarcity. That means the rising price is driven by buying of physical metal. It is not merely leveraged futures speculators front-running themselves. The Monetary Metals Gold Fundamental Price is up another $12, to $1,419. It is above its level from a year ago (which peaked over $1,500 while the market price peaked around $1,450). Very interesting indeed. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

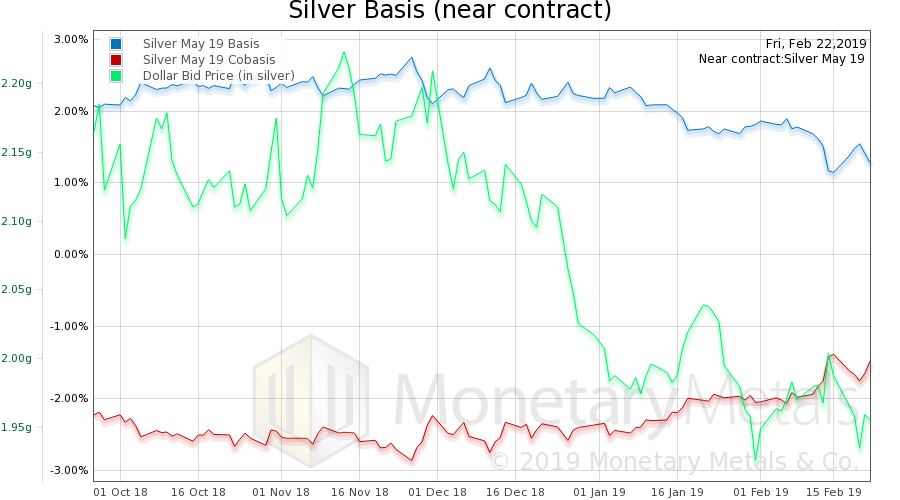

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. Unlike in gold, the scarcity of silver is down a bit. That means the rise in price is driven more by futures market speculation, and physical metal demand is a bit weaker. Still, the Monetary Metals Silver Fundamental Price is holding pretty steady, down 7 cents to $16.45 |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

© 2019 Monetary Metals

Tags: Aquinas,Aristotle,Basic Reports,Featured,lending,loan,moneylending,newsletter,Shakespeare,Shylock,usury