We’ve got one central bank over here in America which appears as if its members can’t wait to “taper”, bringing up both the topic and using that particular word as much as possible. Jay Powell’s Federal Reserve obviously intends to buoy confidence by projecting as much when it does cut back on the pace of its (irrelevant) QE6. On the other side of the Atlantic, Europe’s central bank will be technically be doing the same thing likely at the same time. Except, Christine Lagarde said early last month on behalf of her ECB, “The lady isn’t tapering.” It was a cringeworthy reference to former UK Prime Minister Margaret Thatcher’s “the lady’s not for turning” which back in 1980 was all about radiating self-assurance in the latter’s agenda. Make no mistake; Lagarde’s

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bank reserves, bonds, Christine Lagarde, currencies, ECB, economy, Europe, Featured, Federal Reserve/Monetary Policy, Interest rates, lending, loans, lsap, Margaret Thatcher, Markets, newsletter, QE, taper, taper tantrum

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| We’ve got one central bank over here in America which appears as if its members can’t wait to “taper”, bringing up both the topic and using that particular word as much as possible. Jay Powell’s Federal Reserve obviously intends to buoy confidence by projecting as much when it does cut back on the pace of its (irrelevant) QE6.

On the other side of the Atlantic, Europe’s central bank will be technically be doing the same thing likely at the same time. Except, Christine Lagarde said early last month on behalf of her ECB, “The lady isn’t tapering.” It was a cringeworthy reference to former UK Prime Minister Margaret Thatcher’s “the lady’s not for turning” which back in 1980 was all about radiating self-assurance in the latter’s agenda. Make no mistake; Lagarde’s agenda is clearly to cut back on the pace of its purchasing yet weirdly she doesn’t want anyone to refer to it as “tapering.” What’s to be afraid of in a single word?

|

|

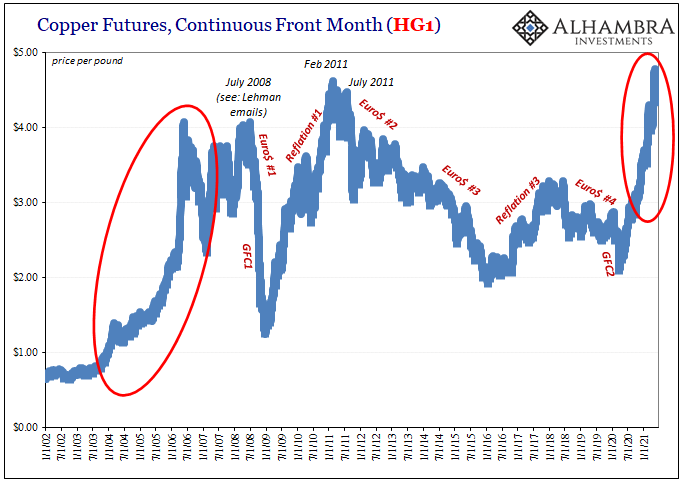

| We have not discussed what comes next.

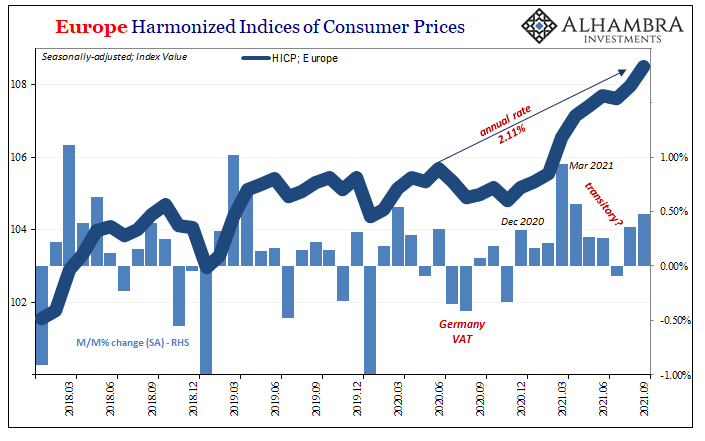

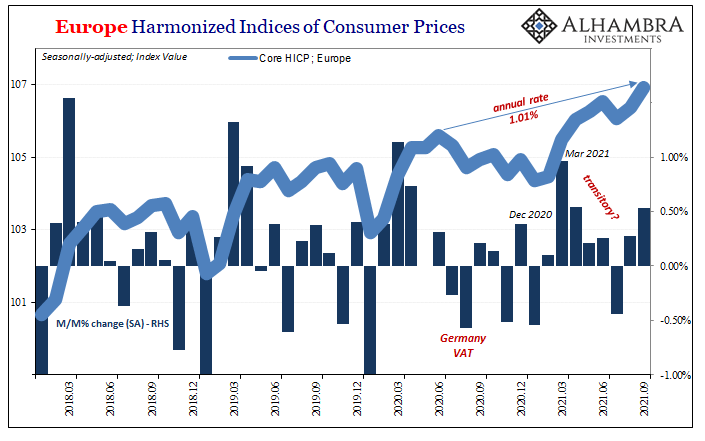

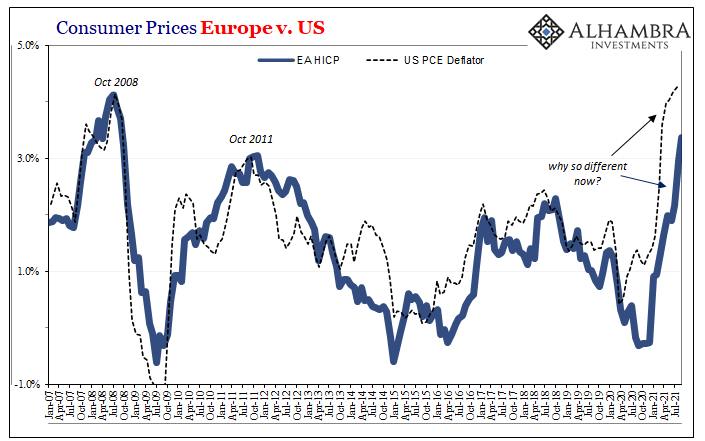

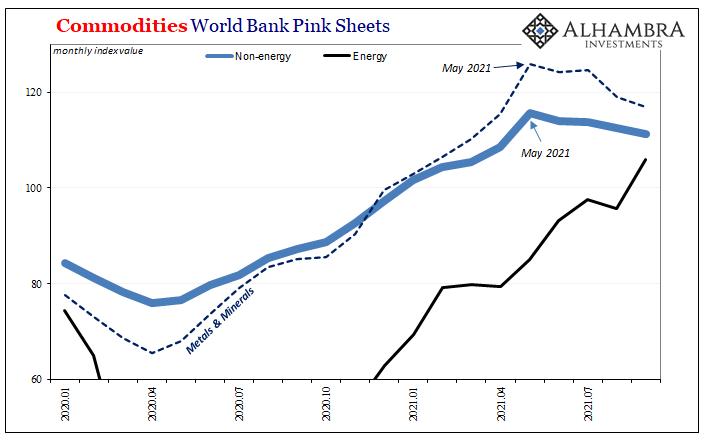

The oft-stated compatriot to “taper” is, of course, “tantrum.” Yet, nothing of the sort is in sight in European bond markets, just the same, typical Autumn meandering drift toward modest optimism being overly hyped by an aggressively supportive (of technocracy) global media. If Lagarde’s not nearly as outwardly sanguine about the shape of European affairs as her American counterparts are about theirs, it’s because there are more visible reasons to be. As usual, Europe lags the world and it has nothing to do with COVID. “At least” the US has its unemployment rate (and unacknowledged participation problem “somehow” worse than before 2020). The numbers for the ECB are truly staggering – and not in any good way. Start with European inflation which if only because of Germany’s VAT tax interference in July 2020 has begun to look more like the PCE Deflator in the US. But even with blasting energy prices recently and the huge base effects created by comparisons to the German tax holiday, Europe still falls way short (apparently no equivalent of Uncle Sam’s helicopter). The year-over-year increase in September 2021 HICP was 3.4%, highest since 2008 (not a good sign). Base effects, however, accounted for 130 bps of that rate, meaning without them the annualized gain was just more than 2%. For core prices, about half in each. |

|

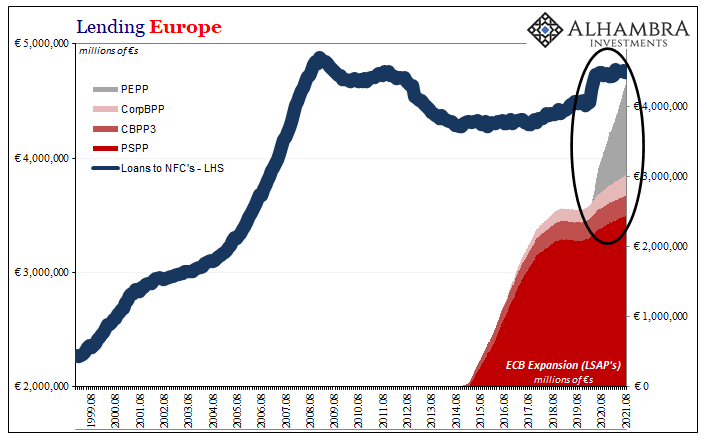

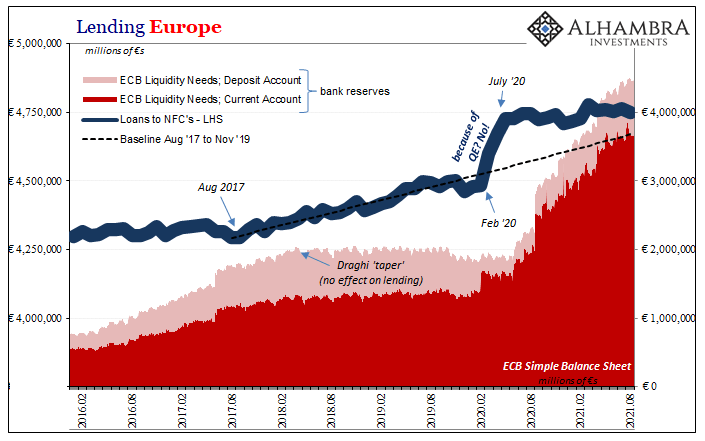

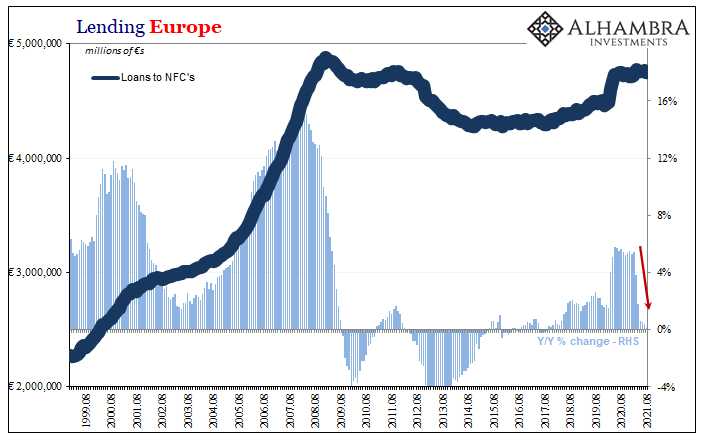

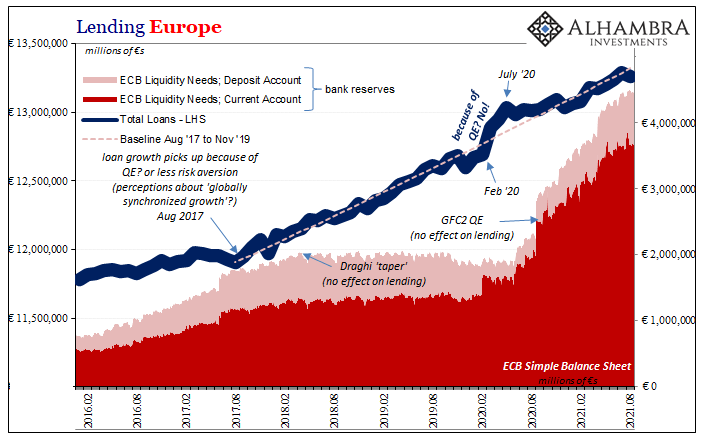

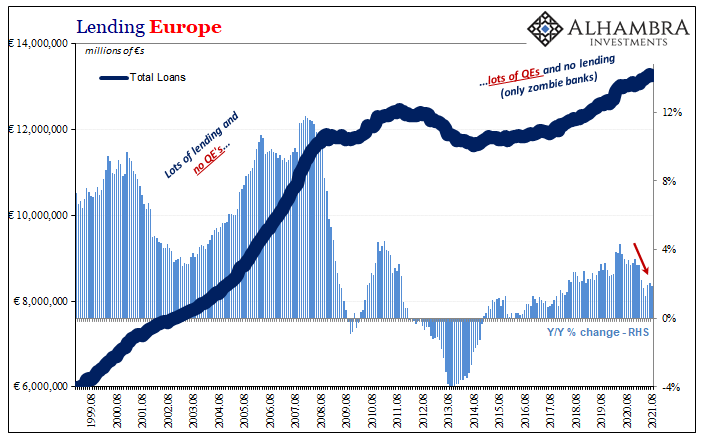

| How can this possible be given the pace, level, and determination of the ECB’s LSAP’s? This is where the numbers truly are astounding, in all the wrong ways: since March ’20, PSPP (the old QE) +€284.8 billion; Corporates +€95.3 billion; and PEPP (pandemic QE) +1.396 trillion.

Nearly €1.8 trillion added in various assets purchased, and inflation rates are all about oil, nat gas, and VAT. Where are these “favorable financing conditions?” Here’s where they are not, which just so happens to be the one place they should be: |

|

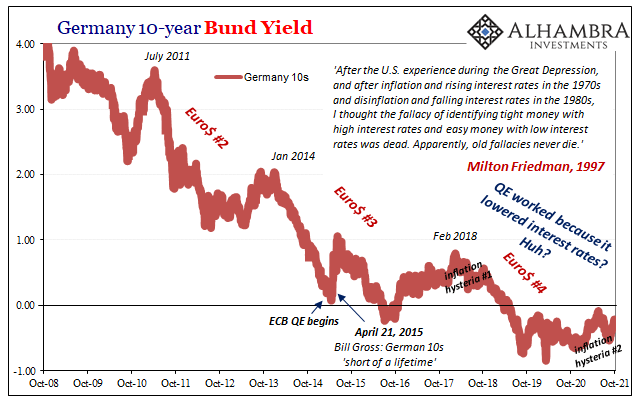

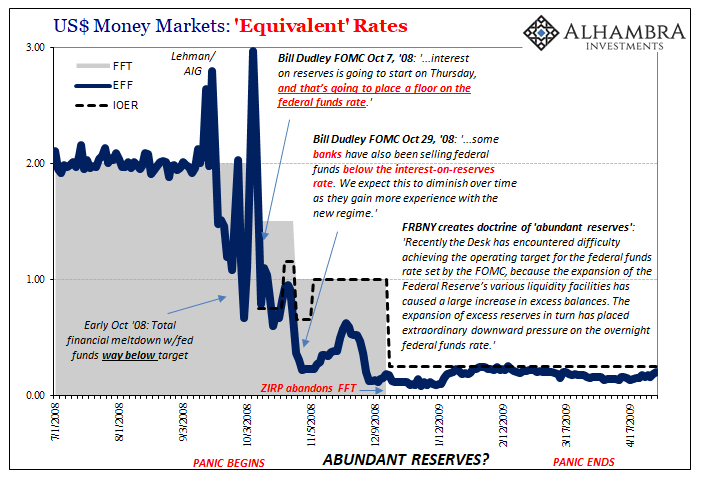

| QE in any form doesn’t actually work and never has (for more than twenty years). It has uniformly been unable to accomplish a single one of its goals through any of the three theorized channels: expectations, falling interest rates, and portfolio effects.

As to the latter of the trio, there’s absolutely no lending. Apart from panicked corporations desperate for liquidity during last year’s GFC2, loan activity to companies in Europe since has been more recessionary than inflationary. Even overall lending (mostly to consumers) has been lackluster and clearly unaffected by QE’s, tapering QE’s, more QE’s, and now a promise to reduce QE without calling it a taper. |

|

| Despite all of it, nada: | |

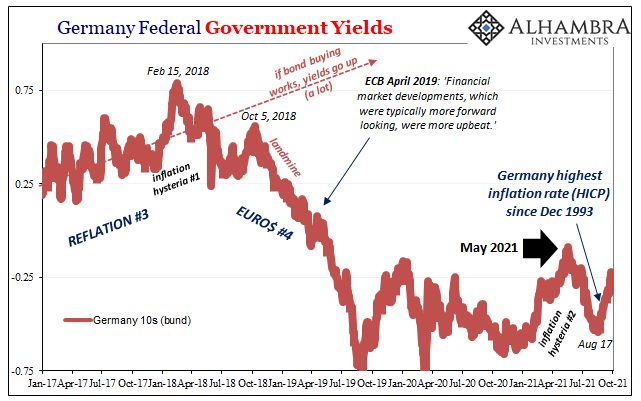

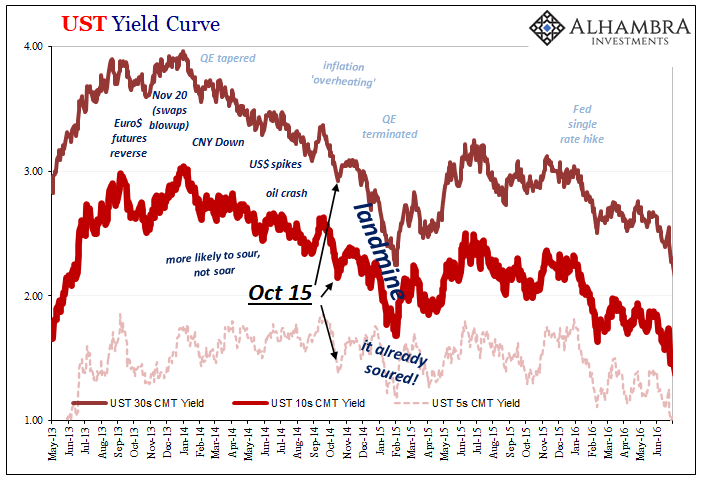

| Therefore, altogether, no tantrum regardless of the taper semantics. Again, Germany bund yields have moved a small amount higher since mid-August, like UST’s, but nowhere near the BOND ROUT!!!! if anything was close to working as designed, claimed, and reported. This despite Germany, in particular, because of its VAT actions, during August recording that country’s highest HICP inflation rate since 1993.

So far as QE’s second theorized channel, low rates, see for yourself how likewise zero effect: |

|

| Like Powell, policymakers everywhere have all simply got their fingers crossed just hoping this time it, meaning recovery, sticks. At the ECB, they appear to be a touch more concerned how using the specific word “taper” might rock the boat too much and spoil the low probability.

It’s not what you see that matters; you see tons of ECB action now an unrelated pickup in HICP. What you don’t see is the basis for actual inflation, and thus why you also won’t see Lagarde display much confidence in tapering. Calibrating indeed. |

Tags: bank reserves,Bonds,Christine Lagarde,currencies,ECB,economy,Europe,Featured,Federal Reserve/Monetary Policy,Interest rates,lending,Loans,lsap,Margaret Thatcher,Markets,newsletter,QE,taper,taper tantrum