By Chris at www.CapitalistExploits.at Last week I jumped on a call with an old friend Thomas Hugger who I hadn’t spoken with in months. I recorded the call for your enjoyment but first a quick bit of background to Thomas. Thomas is a Swiss fund manager living and working in Asian frontier markets such as Vietnam, Bangladesh, and Cambodia, which is a bit like taking a Rolls Royce through the Gobi desert if you think...

Read More »Are Emerging Markets Still “A Thing”?

By Chris at www.CapitalistExploits.at Last week I jumped on a call with an old friend Thomas Hugger who I hadn't spoken with in months. I recorded the call for your enjoyment but first a quick bit of background to Thomas. Thomas is a Swiss fund manager living and working in Asian frontier markets such as Vietnam, Bangladesh, and Cambodia, which is a bit like taking a Rolls Royce through the Gobi desert if you think about it. The Swiss after all are everything that frontier markets...

Read More »Gold Surges Post-Trump, Nears Heaviest Volume Day Ever

Gold futures had their heaviest day of trading during April 2013 when a mysterious flash crash sent the precious metal collapsing with no clear fundamental/news catalyst. In June, Brexit sparked massive volume buying in the barbarous relic, but overnight, as a Trump victory became more and more of a reality, gold futures are approaching their busiest day ever. As Bloomberg notes, that’s triple the full-day average this...

Read More »Secular Stagnation Skepticism

I was asked to play devil’s advocate in a debate about “secular stagnation.” Here we go: Alvin Hansen, the “American Keynes” predicted the end of US growth in the late 1930s—just before the economy started to boom because of America’s entry into WWII. Soon, nobody talked about “secular stagnation” any more. 75 years later, Larry Summers has revived the argument. Many academics have reacted skeptically; at the 2015 ASSA meetings, Greg Mankiw predicted that nobody would talk about secular...

Read More »Investment Lessons

In the FT, looking back at ten years of The Long View, John Authers offers investment lessons that may be summarized in five points: Always worry about costs and don’t try to outsmart the market. That is, hold index funds. Rebalancing pays off. Since getting the timing right is very hard, being out of the market is as risky as being in it. To beat the market, buying at low prices is key. But know what you know and what you don’t. Public markets are efficient. Money isn’t everything; in...

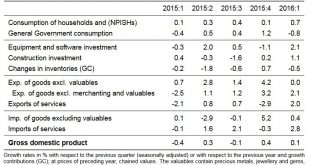

Read More »Swiss GDP Q1/2016, more Insights

Key points: Q/Q GDP growth: +0.1%, YoY GDP growth: +0.7% Until 2014, Swiss GDP was driven by net exports: Exports were rising more quickly than imports, which improved GDP. Positive change in the trade balance in goods: Recently only the trade balance of goods continued to increase (+8.1% YoY exports, +1.4% YoY imports in Q1/2016) Negative change in the trade balance for services (+6.7% YoY) increased more than the export of services (+2.0%). Exports of services are for example banking...

Read More »The Public Sector’s Portfolio Choice

In the NZZ, Michael Schaefer reports about a study that analyzes the portfolio composition of public sector entities and social security institutions. Cantons and the Federation mostly hold cash. The SNB’s portfolio is among the riskiest.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org