In our post on January 28, 2021 “Gold, The Tried-and-True Inflation Hedge for What’s Coming!” we outlined four reasons that we expect higher inflation over the next several years. The brief bullet points are: Money Supplies have risen dramatically Commodity Prices are rising again Reduced Globalization as ‘Made at Home’ policies are proliferating Pent up demand Headlines such as this one last week from Bloomberg “Inflation gauge Hits Highest Since 1991 as Americans Spend More” or this one from the Financial Times, “Inflation fears in the UK rocket as supply and staff shortages stymie recovery“, or The Australian Financial Review, “Soaring gas prices add to the energy, inflation crisis“, are becoming regular headlines in the mainstream media. . Why You Must Own

Topics:

Stephen Flood considers the following as important: 6a.) GoldCore, 6a) Gold & Monetary Metals, Business, Central Banks, central banks cryptocurrency, central banks explained, central banks gold, Commentary, Commodity inflation, currency, economy, Featured, Federal Reserve, Finance, forex trading, Gold, gold and silver, gold silver, inflation, inflation 2021, Inflation and gold, inflation explained, inflation stocks, inflation us, Investing, Investment, Markets, News, newsletter, Precious Metals, silver, silver and gold, silver market, silver news today, silver price, the inflation tide is turning, trading

This could be interesting, too:

finews.ch writes Führungswechsel bei der Global Lending Unit der UBS

finews.ch writes BPS (Suisse) überrascht mit gutem Zinsgeschäft

finews.ch writes Liechtenstein: Steht die Bank Frick zum Verkauf?

finews.ch writes KMU-Finanzierungs-Fintech expandiert in die Deutschschweiz

In our post on January 28, 2021 “Gold, The Tried-and-True Inflation Hedge for What’s Coming!” we outlined four reasons that we expect higher inflation over the next several years. The brief bullet points are:

Headlines such as this one last week from Bloomberg “Inflation gauge Hits Highest Since 1991 as Americans Spend More” or this one from the Financial Times, “Inflation fears in the UK rocket as supply and staff shortages stymie recovery“, or The Australian Financial Review, “Soaring gas prices add to the energy, inflation crisis“, are becoming regular headlines in the mainstream media. |

|

Why You Must Own Tangible Assets Now

|

|

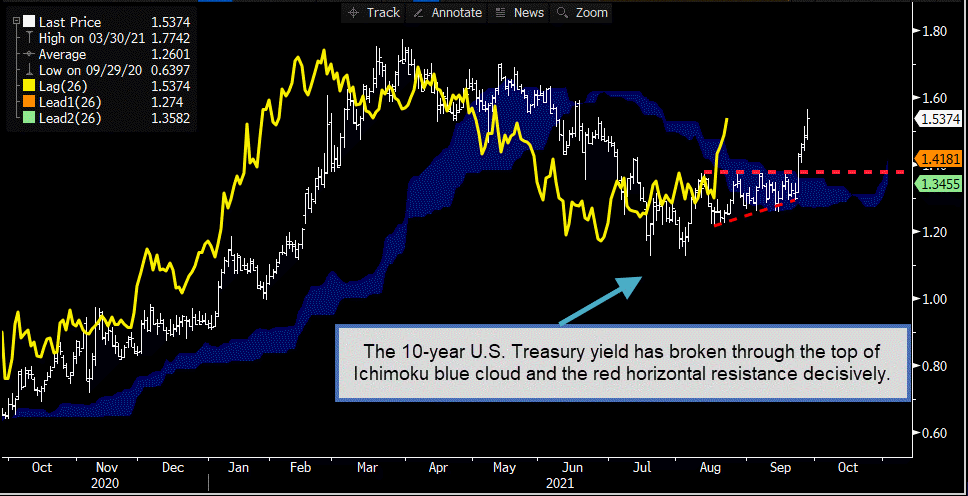

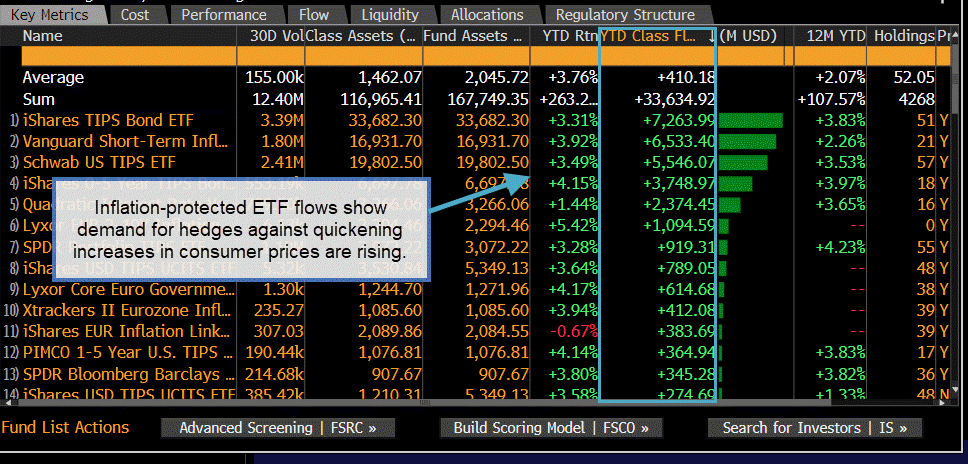

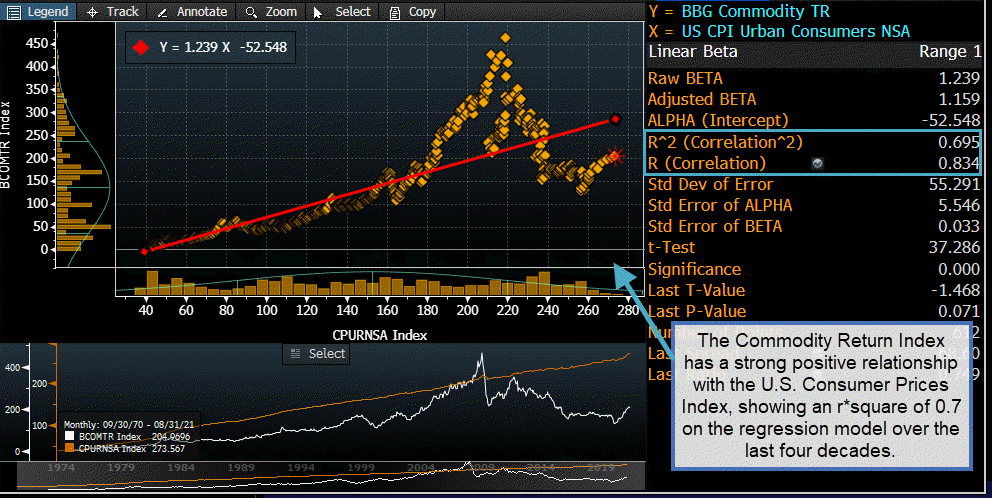

Inflation is NOT TransitoryAnd it seems that markets are finally catching up to the view that this inflation is not as ‘transitory’ as we have been told. A Bloomberg article title “Four Charts Suggest Inflation May Not Be So Transitory After All” the first line of the article warns “Before buying central bank assurances that inflation is transitory, here are four charts from various corners of the market suggestion otherwise.” Before going on to say that businesses are upset about the skyrocketing costs of raw materials and that these businesses are feeling pressure to raise their prices. The four inflation indicator charts are below: |

|

| So, here is the tricky part for Monetary Policy … | |

Central Banks are Trapped!We are reminded by the U.S. Debt Ceiling debate that is consuming Congress and the White house the last several days that the U.S. government debt has been growing exponentially for the last 30 years …. And has more than doubled in the last 10-years to more than $28 trillion. More than $6 trillion above US GDP. Even if inflation is here to stay, we are not going to see the Fed (or other advanced economies) central banks raise interest rates in the manner of the late 1970s. Why? Because central banks are trapped, if they raise interest rates quickly this means that the interest payment on this debt goes up quickly and the governments must choose between making their debt payments, cutting other services or raising taxes. Defaulting on the debt is not a good choice but remember that in this era voters don’t generally re-elect governments that cut services or raise taxes. Also, not to mention that equity markets quiver every time the central banks mention raising rates, and a large equity market decline is not within the ‘intestinal fortitude’ of the current regime of central bank officials. Moreover, on top of that, what about the rapidly rising housing prices and the large mortgages, at low interest rates that go along with the surging house prices. Think central bank officials are willing to have another housing crisis on their hands … Us neither! So, what does the central bank do … they continue to talk up the transitory nature of the inflation in the economy and they hold the course with slight adjustments along the way. |

|

| As we wrote in the March 4 post titled “Central Banks Will Still Do “Whatever It Takes”! ” Central bank options are limited, and not only are their options limited but the preferred option is to allow governments to inflate their way out of debt – which bottom line is that more inflation leads to more nominal GDP (actual GDP + inflation)! (The March 4 post discusses the formula for reducing debt to GDP ratios in detail.)

It is not at Tsunami speeds and may not look like it yet, but the tide is turning and so will the ratios of silver to equity markets as inflation takes hold and central banks deal with their limited options! Moreover, in the coming economic environment silver surpassing its all time high is being carried with the incoming tide. Gold will also rise with the tide and as it usually rallies first silver is the one to watch as although it lags at the beginning during bull rallies it historically usually outperforms gold. Such as in June 2020 when gold rallied a significant 20% in two months silver caught the wave and moved more than 65%. |

Tags: Business,central banks cryptocurrency,central banks explained,central banks gold,central-banks,Commentary,Commodity inflation,Currency,economy,Featured,Federal Reserve,federal-reserve,Finance,forex trading,Gold,gold and silver,gold silver,inflation,inflation 2021,Inflation and gold,inflation explained,inflation stocks,inflation us,Investing,investment,Markets,News,newsletter,Precious Metals,silver,silver and gold,silver market,silver news today,silver price,the inflation tide is turning,trading