Is recession coming? Well, yeah, of course, it is but whether it is now, six months from now or 2 years from now or even longer is impossible to say right now. Our Jeff Snider has been dutifully documenting all the negativity reflected in the bond and money markets and he is certainly right that things are not moving in the right direction. But moving in the wrong direction, even deeply, as we discovered in 2015/16,...

Read More »Monthly Macro Chart Review: April 2019

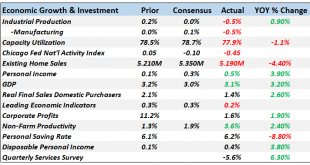

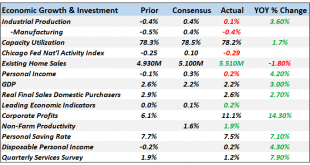

The economic data reported over the last month managed to confirm both that the economy is slowing and that there seems little reason to fear recession at this point. The slowdown is mostly a manufacturing affair – and some of that is actually a fracking slowdown – but consumption has also slowed. On a more positive note, housing seems to have found its footing with lower rates and employment is still fairly robust....

Read More »Commodities King Gartman Says Gold Soon Reach $1,400 As Drums of War Grow Louder

Commodities King Gartman Says Gold Soon Reach $1,400 As Drums of War Grow Louder - 'Commodities King' Gartman sees $1,400 gold surge in months- "Gold is the one currency that will do the best of all..."- Pullback below $1300 "is relatively inconsequential"- Use gold price weakness to be a buyer "no question"- Bullish on gold due to central banks and easy monetary policy and gold will be even higher in euro terms- Gold will be the best of all, as a result of QE and expansionary policies-...

Read More »Swiss Mystery: Someone Keeps Flushing €500 Bank Notes Down The Toilet

While there are several comments one can make here, “dirty money”, “flush with cash” and “flushing money down the toilet” certainly coming to mind, perhaps the ECB was on to something when it warned that €500 “Bin Laden” bills (which it has since discontinued to print) tend to be used by criminals. The reason for this is that in recent weeks, Swiss prosecutors have been gripped by a mystery, trying to figure out why...

Read More »Buy Gold Urges Dalio on Linkedin – “Militaristic Leaders Playing Chicken Risks Hellacious War”

Don’t let “traditional biases” stop you from diversifying into gold – Dalio on Linkedin “Risks are now rising and do not appear appropriately priced in” warns founder of world’s largest hedge fund Geo-political risk from North Korea & “risk of hellacious war” Risk that U.S. debt ceiling not raised; technical US default Safe haven gold likely to benefit by more than dollar, treasuries Investors should allocate at...

Read More »Silver Analysts Forecast $20 In Bloomberg Silver Price Survey

Silver Analysts Forecast $20 In Bloomberg Silver Price Survey - Bloomberg silver price survey - Large majority bullish on silver- Silver median "12 month-forecast" of $20- Precious metal analysts see silver "24 percent rally from current levels"- Investors are pouring money into silver ETFs- Speculative funds bearish even as ETF assets rise to record- Spec funds being bearish is bullish as frequently signals bottom- Important to focus not just on silver price but on silver...

Read More »Sources of Low Real Interest Rates

In a (December 2015) Bank of England Staff Working Paper, Lukasz Rachel and Thomas Smith dissect the global decline in long-term real interest rates over the last thirty years. A summary of their executive summary: Market measures of long-term risk-free real interest rates have declined by around 450bps. Absent signs of overheating this suggests that the global neutral rate fell. Expected trend growth as well as other factors affecting desired savings and investment determine the neutral...

Read More »Switzerland’s Gold Exports To China Surge To 158 Tons In December

Switzerland’s Gold Exports To China Surge To 158 Tonnes In December Switzerland’s gold bullion exports to China saw a huge jump in December, climbing to 158 tons versus a much lower 30.6 tons in November – a jump of 416%. According to Eddie van der Walt as reported on the Bloomberg terminal this morning, total Swiss gold exports surged to 287.6 tons in December (valued at CHF 10.8b) according to data on the website of...

Read More »The Psychological Impact Of Loss

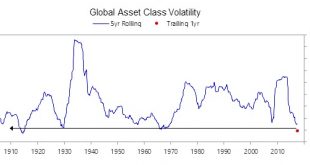

For the third time in four weeks, the market was closed on Monday due to a holiday. Not only is this week shortened by a holiday, it is also coinciding with the annual Billionaire’s convention in Davos, Switzerland and the Presidential inauguration on Friday. Increased volatility over the next couple of days will certainly not be surprising. In this past weekend’s missive, I discussed a variety of “extremes” being...

Read More »Declassified CIA Memos Reveal Probes Into Gold Market Manipulation

By Smaul gld The CIA recently released a series of declassified 1970s memos relating to the gold market and the newly created SDR. These memos give new insight how the CIA viewed the gold market, the perceived manipulation of gold and the potential for the SDR to become a gold substitute in the international monetary system. The classification of the documents is significant because “secret” is the CIA’s second-highest...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org