Summary: The Canadian dollar’s link to oil has loosened. Its sensitivity to interest rates has increased. Lumber issue is coming to a head shortly. Of the majors, only sterling was weaker than the Canadian dollar in Q3. Sterling’s drop was a function of its decision to leave the EU and ease monetary policy. The Canadian dollar fell 1.6% compared with sterling’s 2.6% fall. The other dollar-bloc currencies...

Read More »A Longer Wait for the Fed

The Federal Reserve is expected to keep monetary policy unchanged over the next few months as the central bank continues to assess the underlying strength of the U.S. economy, especially after the Brexit vote raised concerns that a potential slowdown in the U.K. economy could have a significant spillover effect globally. Credit Suisse’s Global Markets team believes that the vote has, in fact, exacerbated some tendencies within the Fed that were in place long before Britain’s June 23...

Read More »The Fed is likely to wait until September before hiking rates

As widely expected, core personal consumer expenditure (PCE) inflation dropped back slightly in March in the US, while wage increases remained subdued in Q1. We now expect that the Federal Open Market Committee (FOMC) will hike rates only once in 2016, probably in September. Read the full report here In Friday's report on income and consumption, data were also published on the PCE deflator, the price measure targeted by the Fed in gauging inflation. The core PCE price index (excluding...

Read More »The dark side of negative interest rates

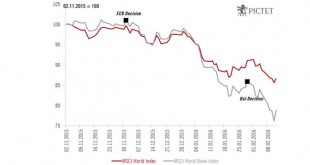

Recent equity market peaks coincided with the ECB and BoJ decisions to impose negative rates. From December 1st to last Friday, the MSCI World index declined by 14%. During the same period, the MSCI world banks index declined by 24%. Recent chronology of events Since 2009 and up until recently, central bank action has helped to stabilise equity markets. Looking at recent events, it now seems that the opposite is becoming true. The last two monetary decisions (ECB on 3 December 2015 and BoJ...

Read More »We expect the Fed to remain on hold in March and that it will hike ‘only’ twice this year

Macroview The Fed no longer considers that the risks to the outlook are ‘balanced’. However, yesterday's statement was not particularly dovish. After its meeting earlier this week, the Federal Open Market Committee (FOMC) published a statement where, as widely expected, it acknowledged that “economic growth slowed late last year”. It also added a comment that “the Committee is closely monitoring global economic and financial developments and is assessing their implications for the labor...

Read More »European monetary policy: new ECB easing package now likely to be announced in March

ECB policy rates will remain “at present or lower levels for an extended period of time”. Another deposit rate cut, to -0.40% or even lower, looks likely to be part of the ECB’s toolkit, especially if the Fed turns more cautious in the meantime. The ECB left all policy settings unchanged at today’s meeting, as widely expected. At the same time, the overall tone of the press conference reflected yet another significant dovish shift in the ECB’s communication – one that the Governing...

Read More »The Fed Raised Rates: Now What?

Enough talk already. The moment is finally here: The Federal Reserve raised interest rates today by 0.25 percent for the first time since June 2006. Credit Suisse doesn’t believe the small, well-anticipated hike will hurt the U.S. economy in and of itself. (What happens in rate-sensitive markets, especially high-yield bonds, is another story, and one that The Financialist will cover in the coming days.) More important to financial markets are the signals Federal Reserve Chair Janet Yellen...

Read More »Diverging Toward Europe and Switzerland

December could be a big month for central bankers. The Federal Reserve is expected to make its first rate hike in nine years on December 16, while the European Central Bank is expected to announce further easing measures on December 3. The Swiss National Bank is likely to follow the ECB’s footsteps, sending deposit rates in the country even further into negative territory. Those moves, particularly combined with the divergence from American monetary policy, should provide a boost to European...

Read More »Playing Defense: European High-Yield

It’s not an easy time to be a fixed-income investor, particularly for those seeking opportunities in the United States. The Federal Reserve’s stated intention to raise benchmark interest rates this year for the first time since 2006 hangs over the U.S. fixed-income market like a pall, threatening to drive bond prices down, introduce volatility, and even create a liquidity crunch. Investors who want (or need) to maintain exposure to fixed income through the rate hike might try looking across...

Read More »Falling Yields, Rising Asset Prices -Rising Yields,Falling Prices

Our monetary system is failing, but explaining that isn’t easy. The most popular argument is that the dollar has falling purchasing power and rising inflation. The problem with this argument is that consumer prices aren’t skyrocketing now. So, of course, people remain skeptical. Yields across all markets were falling worldwide. This causes the income generated from assets to fall. I wrote about this serious problem last time, introducing the concept of yield purchasing power—which is how...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org