ECB policy rates will remain “at present or lower levels for an extended period of time”. Another deposit rate cut, to -0.40% or even lower, looks likely to be part of the ECB’s toolkit, especially if the Fed turns more cautious in the meantime. The ECB left all policy settings unchanged at today’s meeting, as widely expected. At the same time, the overall tone of the press conference reflected yet another significant dovish shift in the ECB’s communication – one that the Governing Council agreed on unanimously – strengthening our view that fresh easing measures are likely to be announced as soon as in March. Indeed the key sentence in the official statement reads: “it will be necessary to review and possibly reconsider the ECB’s monetary stance”. ECB President Mario Draghi described the December package as appropriate, immediately adding that the circumstances have changed dramatically since then. And when things change, the ECB’s Governing Council appears to be “willing and determined” to change its mind accordingly, with “no limits” as to how far their tools can be deployed “within their mandate”. In particular, the risk of inflation expectations dis-anchoring is one the ECB cannot afford to take, acting as a risk-manager from that perspective.

Topics:

Frederik Ducrozet considers the following as important: ECB, Euro, Interest rates, Macroview, Monetary Policy

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

Marc Chandler writes Ueda Lifts Yen, Leaving Euro and Sterling Pinned Near Lows

ECB policy rates will remain “at present or lower levels for an extended period of time”. Another deposit rate cut, to -0.40% or even lower, looks likely to be part of the ECB’s toolkit, especially if the Fed turns more cautious in the meantime.

The ECB left all policy settings unchanged at today’s meeting, as widely expected. At the same time, the overall tone of the press conference reflected yet another significant dovish shift in the ECB’s communication – one that the Governing Council agreed on unanimously – strengthening our view that fresh easing measures are likely to be announced as soon as in March. Indeed the key sentence in the official statement reads: “it will be necessary to review and possibly reconsider the ECB’s monetary stance”.

ECB President Mario Draghi described the December package as appropriate, immediately adding that the circumstances have changed dramatically since then. And when things change, the ECB’s Governing Council appears to be “willing and determined” to change its mind accordingly, with “no limits” as to how far their tools can be deployed “within their mandate”. In particular, the risk of inflation expectations dis-anchoring is one the ECB cannot afford to take, acting as a risk-manager from that perspective.

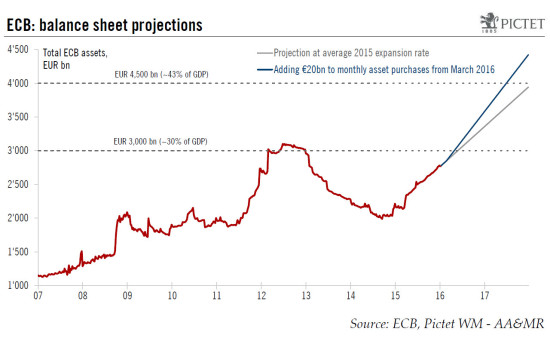

We believe that the balance of probabilities is now tilted towards a more significant policy response, including another deposit rate cut to at least -0.40% and an expansion in the QE programme, from EUR60bn to about EUR80bn, at the 10 March meeting. In order to ensure a smooth implementation of the asset purchase programme, any such expansion could well be accompanied by technical changes to QE modalities, including a further increase in issue/issuer limits as well as a broadening of the universe of eligible securities to corporate bonds and possibly more risky assets.

Another package should become the consensus for March…

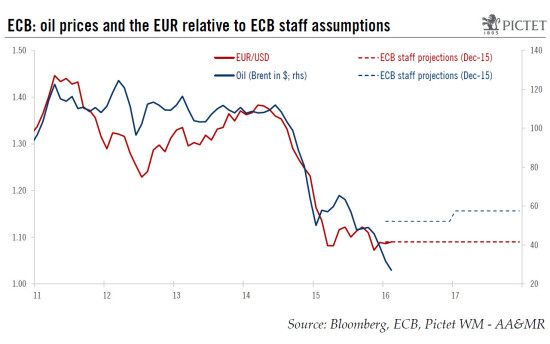

Laying the ground for an imminent move, Draghi hinted at yet another downward revision to the ECB staff projections in March (along with the first estimates for 2018), noting that inflation is likely to remain “very low, even negative” in the months ahead due to a 40% collapse in oil prices since the last cut-off date. Based on current oil futures contracts, we estimate that the median projection for 2016 HICP inflation would have to be lowered from 1.0% to 0.1%. Our best guess is that the 2018 projection would initially show inflation rising towards 1.7-1.8% over the medium-term. Other external risks were said to have increased as well since the last meeting on a combination of factors including China, equities, FX and global growth worries.

Positive developments in terms of domestic demand, especially the credit cycle *, were mentioned as well, but they are unlikely to compensate for the downside risks.

In the run-up to the March meeting, the key focus will be on the risk of second-round effects of lower oil prices on non-energy HICP components, most notably those affecting production costs, wage-setting behaviour and inflation expectations. Draghi indicated that the upcoming ECB staff projections will include an in-depth analysis on that topic. In an article from its December 2014 monthly bulletin, the ECB estimated that those indirect effects accounted for around one-third of the overall impact of oil on consumer prices. That was when oil prices were trading around USD50 per barrel.

Crucially, the longer headline HICP inflation remains at depressed levels, the higher the (hysteresis) risks to market-based inflation expectations. Draghi sounded particularly worried about recent developments, echoing recent comments by ECB’s Chief Economist Peter Praet who said that some effects from oil on inflation were “not negligible or temporary”. Draghi noted that most measures of inflation expectations were falling (not only the infamous 5y5y inflation swaps) and that those indicators were again more closely correlated to oil prices. Here again, the resilience of other survey-based indicators, such as the Survey of Professional Forecasters (next release due tomorrow), may not be sufficient.

…with “no limits” in terms of the tools that can be deployed

In terms of the policy tools the ECB is most likely to deploy, we see two main options which could be used in isolation or together.

Firstly, another deposit rate cut looks increasingly likely, facing little opposition from the hawks, as a response to an “unwarranted tightening” in financial conditions including through the appreciation of the trade-weighted currency. There is likely to be a limit as to how low the ECB can go, although Draghi made it clear that the ECB’s mandate was about price stability, not the preservation of banks’ profitability. A 10bp deposit rate cut to -0.40% would be a minimum, with a larger move not ruled out in the event of a further appreciation in the euro.

Secondly, the ECB’s asset purchase programme remains flexible enough to be expanded more significantly. A review of QE technical features was always due by the spring. We believe that an extension of the programme beyond March 2017 would be largely useless, if not counter-productive, reducing the room for an increase in the pace of QE. The latter option remains the most appropriate tool to address a deterioration in the outlook for price stability, as per all-important Draghi’s speech in Amsterdam in April 2014.

An increase in the monthly pace of QE, from EUR60bn currently to about EUR80bn, should be well received by the market provided that the technical features of the programme are adjusted to ensure a smooth implementation. With respect to this option, Draghi made it clear that there were “no limits” in principle. The ECB could decide to buy a larger share of individual securities, having raised the issue limits already last year. It could also broaden the scope of its interventions by adding new securities to the eligible universe (asked whether the ECB could buy stocks, Draghi did not rule it out), to corporate bonds and possibly more risky assets. Lastly, a more radical option would consist in an explicit deviation from the geographical breakdown of bond buying based on capital keys. Draghi did not rule it either, although it would be more politically challenging within the Council.

Finally, the ECB could surprise with other tools, including a cut in the main refinancing rate (currently at 0.05%) or new Targeted Long-Term Refinancing Operations (the last two operations will be announced on 22 March and 21 June 2016). The latter option looks more likely than the former, in our view, and would likely come with more favourable terms to make the TLTROs more attractive.

In the next six weeks ahead of the 10 March meeting, ECB officials will likely echo today’s statement and inevitably raise expectations for a more radical package of measures. The question is whether the market will view them as credible following recent disappointment. In our view, the option which has the greatest chances of success is an increase in the pace of QE, pushing the ECB’s balance sheet to new highs, above EUR 4 trillion by mid-2017.

* In this week’s Bank Lending Survey, banks reported a continued net easing of credit standards in Q4 15, a more pronounced increase in demand for loans as well as a further improvement in the transmission of the monetary stance to the real economy, including SMEs. This should provide the ECB with another argument to expand its QE programme as a large share of the cash finds its way to the real economy.