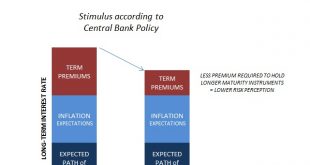

According to orthodox theory, if interest rates are falling because of term premiums then that equates to stimulus. Term premiums are what economists have invented so as to undertake Fisherian decomposition of interest rates (so that they can try to understand the bond market; as you might guess it doesn’t work any better). It is, they claim, the additional premium a bond investor demands so as to hold a security that...

Read More »Bi-Weekly Economic Review: Don’t Underestimate Gridlock

The economic reports released since the last update were slightly more upbeat than the previous period. The economic surprises have largely been on the positive side but there were some major disappointments as well. The economy has been doing this for several years now, one part of the economy waxing while another wanes and the overall trajectory not much changed. Indeed, the broad Chicago Fed National Activity index...

Read More »Global Asset Allocation Update: No Upside To Credit

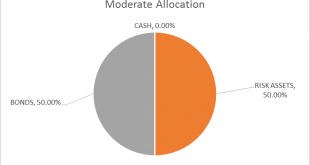

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are other changes to the portfolio though so please read on. As I write this the stock market is in the process of taking a dive (well if 1.4% is a “dive”) and one can’t help but wonder if the long awaited and anticipated correction is finally at hand. Which means,...

Read More »Bi-Weekly Economic Review: Attention Shoppers

The majority of the economic reports over the last two weeks have been disappointing, less than the consensus expectations. The minor rebound in activity we’ve been tracking since last summer appears to have stalled. Retail sales continue to disappoint and inventory/sales ratios are once again rising – from already elevated levels. Even the positive reports were clouded by negative undertones. So far though our market...

Read More »Great Graphic: Dollar Index Bottoming?

Summary Downside momentum is fading and technicals are showing a bullish divergence. The Dollar Index has not met the minimum corrective retracement target, meaning that it is premature to talk about bear market. We identify two pre-conditions to enter trade. The Dollar Index set the year’s high on January 3 a little above 103.20. Today it made a marginal new lows for the year at 95.464. The previous low, set at...

Read More »Bi-Weekly Economic Review: The Return of Economic Ennui

The economic reports released since the last of these updates was generally not all that bad but the reports considered more important were disappointing. And it should be noted that economic reports lately have generally been worse than expected which, if you believe the market to be fairly efficient, is what really matters. The disappointing employment report and the generally less than expected tone of the reports...

Read More »Great Graphic: US Curve and the Euro

This Great Graphic was created on Bloomberg. It shows two times series. The yellow line and the left-hand scale show the euro’s exchange rate against the dollar for the past year. The white line depicts the spread between the US two-year and 10-year yield. I show the curve this way to be more intuitive with the euro rather than the 10-2 yr curve. To be clear as the curve has flattened the white line rises. Despite me...

Read More »Great Graphic: US Rate Curve and the Euro

This Great Graphic was created on Bloomberg. It shows two times series. The yellow line and the left-hand scale show the euro’s exchange rate against the dollar for the past year. The white line depicts the spread between the US two-year and 10-year yield. I show the curve this way to be more intuitive with the euro rather than the 10-2 yr curve. To be clear as the curve has flattened the white line rises. Despite me...

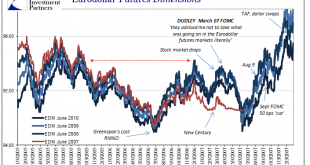

Read More »Less Than Nothing

As I so often write, we still talk about 2008 because we aren’t yet done with 2008. It doesn’t seem possible to be stuck in a time warp of such immense proportions, but such are the mistakes of the last decade carrying with them just these kinds of enormous costs. It has been this way from the beginning, even before the beginning as if that was possible. The Great Financial Crisis has no official start date, but we...

Read More »Four Numbers to Watch in FX

Summary: The dollar’s downside momentum faded today, but it has not shown that it has legs. Watch 96.45 in the DXY and $1.3055 in sterling. The US 2-year note yield is low, given expectations for overnight money. The US premium needs to widen. The US dollar’s downside momentum faded today. While one should not read much into it, it could be an early sign that the market has discounted the recent news stream,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org