Real interest rates are nominal rates adjusted for inflation expectations. Inflation expectations are tricky to measure. The Federal Reserve identifies two broad metrics. There are surveys, like the University of Michigan’s consumer confidence survey, and the Fed conducts a regular survey of professional forecasters. There are also market-based measures, like the breakevens, which compare the conventional yield to the...

Read More »FX Weekly Preview: Politics Not Economics is Driving the Markets

Summary: The Fed is more confident this year of stable growth and rising inflation. The new US Administration’s economic agenda is beginning to take shape, though it is not clear that consumer interests will be pursued. There are several considerations, including politics in Europe, that are driving European rates higher. The RBA and RBNZ meet next week. Neither is expected to change policy. United States The...

Read More »Pressure on Greece Mounts, New Crisis Looms

Summary: Greece needs to implement its commitments in the next few weeks or it faces a new crisis. The more the government implements its commitments, the less public support it draws. New elections in Greece cannot be ruled out. The problem is uncomfortably familiar. Greece has a chunky payment due to its official creditors. Reports suggest that Greece has not completed much more than a third of the measures...

Read More »Are Interest Rates No Longer Driving the Dollar?

Summary: Many are concerned that the dollar and interest rates have become decoupled. We are not convinced. Correlations, not to be eyeballed, are still robust. The US 10-year yield is at its highs for the year, and yet the US dollar has been struggling to gain traction.Some suggest that this means that the dollar rally is over. Charts like this one are circulating among market participants. This Great...

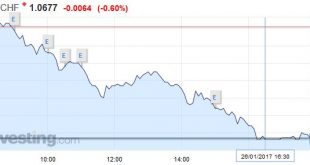

Read More »FX Daily, January 26: EUR/CHF collapses to 1.670

Swiss Franc The euro collapsed today, both against USD and CHF. One reason might be the new record for Swiss exports and for the Swiss trade balance. EUR/CHF - Euro Swiss Franc, January 26(see more posts on EUR/CHF, ) - Click to enlarge Sterling gains almost 2% against the Swiss Franc in 3 days, will the Pound continue to climb from here? The Pound has continued to climb throughout the week, after it was...

Read More »Cool Video: Bloomberg’s Daybreak–Trump and Rates

On what Trump’s first working day as POTUS, I had the privilege to be on Bloomberg’s Daybreak to talk about the wagers on US interest rates in the futures market. In the most recent CFTC reporting week, which ended on January 17, speculators in the 10-year note futures market reduced the record net short position. It is only the second week reduction since the end of November. Anchor Alix Steel noted that while the...

Read More »FX Weekly Preview: Twas the Week Before Christmas, Amidst Powerful Trends

Summary: The Nikkei, the dollar-yen and 10 yr US yield have risen nine of the past 11 weeks. The Dollar Index and 2 yr US yields have risen while gold has sold off in eight of past 11 weeks. Issue in next two weeks, profit-taking or trend extension? Spoiler alert: I expect some profit-taking. The capital markets have been buffeted by political developments and central bank policies. The direct influence of high...

Read More »FX Weekly Preview: Shifting Paradigms and the Market Adjustment

Summary: Perceptions of two trends shape the investment climate: reflation and nationalism. Fed rate hike set for next month, barring significant surprise. Japan’s trade surplus is growing even as imports and exports continue to contract. United States Around the middle of the year, St. Louis Federal Reserve President James Bullard revealed his new economic approach. He argued that during economic phases, or...

Read More »End Of The Bond Bull – Better Hope Not

It’s been really busy as of late to cover all of the topics I have wanted to address. One topic, in particular, is the bond market and the ongoing concerns of a “bond bubble” due to historically low interest rates in the U.S. and, by direct consequence, historically high bond prices. Bob Bryan, via Business Insider, recently penned the following note: “Bond yields are low. Historically low. Yields on government bonds...

Read More »Demographics and a New Old Paradigm

Summary: The hangover from the debt crisis and secular stagnation are the two main explanatory models for the low growth and low interest rates. Anew Fed paper brings the focus back to demographics. If true, warns of a protracted period of slow growth, low interest rates. There are two main interpretative frameworks that seek to explain the slow growth and low interest rates. The first is associated with...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org