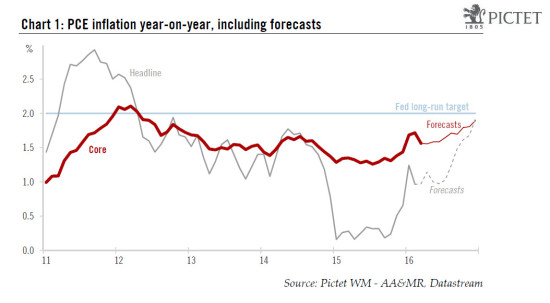

As widely expected, core personal consumer expenditure (PCE) inflation dropped back slightly in March in the US, while wage increases remained subdued in Q1. We now expect that the Federal Open Market Committee (FOMC) will hike rates only once in 2016, probably in September. Read the full report here In Friday's report on income and consumption, data were also published on the PCE deflator, the price measure targeted by the Fed in gauging inflation. The core PCE price index (excluding food and energy) increased by 0.1% month-on-month (m-o-m) in March, in line with consensus expectations. On a year-on-year (y-o-y) basis, core PCE inflation dropped back from 1.7% in February to 1.6% in March. The marked pick-up in y-o-y core PCE inflation between October 2015 (1.3%) and February 2016 (1.7%) thus eased off in March. The global economic backdrop is not conducive to more US inflation – quite the opposite in fact. Inflation remains pretty low worldwide, and deflationary forces are still present, limiting pricing power in the US. With regard to domestic inflation expectations, although they have bounced back recently, market’ inflation expectations remain extremely low. Housing inflation is likely to remain relatively high. However, we do not expect any further acceleration over the coming months.

Topics:

Bernard Lambert considers the following as important: FED, inflation, Interest rates, Macroview, US

This could be interesting, too:

investrends.ch writes US-Notenbank verschärft die Stresstests

investrends.ch writes Trump vs. Powell – «Zwei Züge rasen aufeinander zu»

investrends.ch writes Eine Zinspause der US-Notenbank ist wahrscheinlich

investrends.ch writes US-Notenbank weist auf neue Inflationsrisiken hin

As widely expected, core personal consumer expenditure (PCE) inflation dropped back slightly in March in the US, while wage increases remained subdued in Q1. We now expect that the Federal Open Market Committee (FOMC) will hike rates only once in 2016, probably in September.

In Friday's report on income and consumption, data were also published on the PCE deflator, the price measure targeted by the Fed in gauging inflation. The core PCE price index (excluding food and energy) increased by 0.1% month-on-month (m-o-m) in March, in line with consensus expectations. On a year-on-year (y-o-y) basis, core PCE inflation dropped back from 1.7% in February to 1.6% in March. The marked pick-up in y-o-y core PCE inflation between October 2015 (1.3%) and February 2016 (1.7%) thus eased off in March.

The global economic backdrop is not conducive to more US inflation – quite the opposite in fact. Inflation remains pretty low worldwide, and deflationary forces are still present, limiting pricing power in the US. With regard to domestic inflation expectations, although they have bounced back recently, market’ inflation expectations remain extremely low. Housing inflation is likely to remain relatively high. However, we do not expect any further acceleration over the coming months. Meanwhile, despite its recent sharp correction, the dollar’s past surge will continue to have a dampening impact on import prices.

Wage growth remained muted in Q1 2016

A key report on wage pressure – the quarterly Employment Cost Index (ECI) – was published on 29 April. The ECI rose by 0.6% q-o-q (2.63% annualised) in Q1 2016, in line with consensus estimates. This followed a 0.5% quarterly increase in Q4 2015 (revised down from +0.6%). As a result, the y-o-y rise in the ECI eased marginally from 2.0% in Q4 2015 to 1.9% in Q1 2016.

Overall, we don’t see any reason to modify our scenario on PCE inflation. We continue to believe that y-o-y PCE core inflation will end this year at a rate of around 1.9%, i.e. a rate not much higher than the average rate registered in Q1 (1.7%).

The Fed should remain on hold in June

With “additional strengthening in the labor market”, a marked easing in financial conditions, international risks receding and expectations of more robust growth over the coming months, there are certainly good reasons to forecast a rate hike in June, as we were until today. However, the US economy was surprisingly weak in Q1 and momentum entering Q2 seems to be soft. Moreover, the June FOMC meeting will happen just one week before the Brexit referendum of 23 June. Barring a sharp and rapid improvement in the economic dataflow, a hike in June seems now rather more unlikely in our opinion.

In conclusion, we now believe that the most likely scenario is that the FOMC will remain on hold in June and hike only once in 2016 (instead of twice), most probably in September. However, we continue to expect three additional 25bp hikes in 2017.