It wasn’t a very good two weeks for economic data with the majority of reports disappointing. Most notable I think is that the so called “soft data” is starting to reflect reality rather than some fantasy land where President Trump enacts his entire agenda in the first 100 days of being in office. Politics is about the art of the possible and that is proving a short list for now. Republicans can’t agree among...

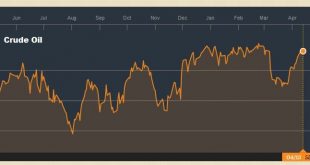

Read More »Decoupling of Oil and US Interest Rates

Summary: US yields have trended lower as oil prices have trended higher. The correlation between the 10-year breakeven and oil has also weakened considerably. Technicals readings are getting stretched, but no compelling sign of a top. Rising oil prices traditionally boost inflation expectations and US interest rates. The May futures contract for light sweet crude oil is up today for the sixth consecutive...

Read More »FX Daily, April 14: Holiday Markets Remain on Edge

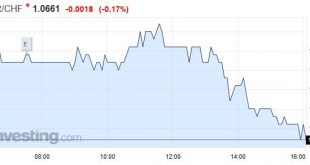

Swiss Franc EUR/CHF - Euro Swiss Franc, April 14(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge FX Rates The holiday-induced calm in the capital markets conceals a high degree of anxiety. The investment climate has been challenged by heightened geopolitical risk and unusual complaints about the US dollar’s strength from the sitting US President. While sending an “armada” toward the Korean...

Read More »FX Daily, April 11: Dollar Pushed Lower in Subdued Activity

Swiss Franc EUR/CHF - Euro Swiss Franc, April 11(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The Swiss Franc could be in for a particularly volatile with the recent developments in Syria and now North Korea. Both the Swiss Franc and US dollar generally perform very well in times of global economic and political uncertainty as their status as safe haven currencies becomes apparent once again. The...

Read More »US Jobs: Who Carries The Burden of Proof?

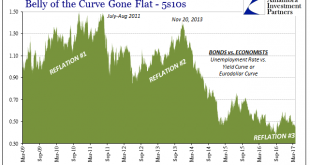

The idea that interest rates have nowhere to go but up is very much like saying the bond market has it all wrong. That is one reason why the rhetoric has been ratcheted that much higher of late, particularly since the Fed “raised rates” for a third time in March. Such “hawkishness” by convention should not go so unnoticed, and yet yields and curves are once more paying little attention to Janet Yellen. When Mohamed...

Read More »Systemic Depression Is A Clear Choice

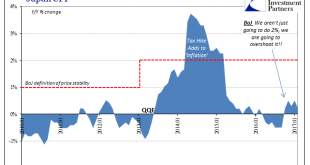

Looking back on late 2015, it is perfectly clear that policymakers had no idea what was going on. It’s always easy, of course, to reflect on such things with the benefit of hindsight, but even contemporarily it was somewhat shocking how complacent they had become as a global group. In the US, the Federal Reserve “raised rates” for the first time in a decade on the same day they released industrial production figures...

Read More »FX Weekly Preview: The Macro Backdrop at the Start of the Second Quarter

The macroeconomic fundamentals have not changed much in the first three months of the year. The US growth remains near trend, the labor market continues to improve gradually, both headline and core inflation remain firm, and the Federal Reserve remains on course to hike rates at least a couple more times this year, even though the market is skeptical. The uncertainty surrounding US fiscal has not been lifted, and it...

Read More »All In The Curves

If the mainstream is confused about exactly what rate hikes mean, then they are not alone. We know very well what they are supposed to, but the theoretical standards and assumptions of orthodox understanding haven’t worked out too well and for a very long time now. The benchmark 10-year US Treasury is today yielding less than it did when the FOMC announced their second rate hike in December. Thus, despite two rate...

Read More »Federal Reserve Hikes, but Changes Little Else

Summary: Fed made mostly minor changes in the statement as it hiked the Fed funds rate for the third time in the cycle. The average and median dot for Fed funds crept slightly higher. There was only one dissent to the decision. The Federal Reserve delivered the much-anticipated rate hike. There was one dissent, the Minneapolis Fed President Kashkari. In the first paragraph of the FOMC statement tweaked the...

Read More »Bi-Weekly Economic Review

Economic Reports Scorecard The Federal Reserve is widely expected to raise interest rates again at their meeting next week. They obviously view the recent cyclical upturn as being durable and the inflation data as pointing to the need for higher rates. Our market based indicators agree somewhat but nominal and real interest rates are still below their mid-December peaks so I don’t think a lot has changed. More...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org